- Ethereum CEX spot trading volume hit $480B in August, surpassing Bitcoin’s $401B for the first time in 7 years.

- Corporate treasuries and U.S. spot ETH ETFs drove demand, with $3.95B in inflows compared to BTC’s $301M outflows.

- ETH is up 105% YTD vs BTC’s 18%, with whales rotating into ether as traders eye potential Q4 all-time highs.

Ondo Finance, a leading innovator in tokenized real-world assets, has officially launched Ondo Global Markets, a platform poised to redefine global access to U.S. financial markets. The initiative brings over 100 U.S. stocks and ETFs onchain, combining the liquidity and protections of traditional finance with the speed, transparency, and programmability of blockchain technology. So, let us take a closer look at what Ondo Finance has built, how it operates, and why it matters.

What Is Ondo Finance?

Founded in 2021 by Nathan Allman, a former Goldman Sachs executive, Ondo Finance is a decentralized finance platform built to bridge the gap between traditional finance and blockchain-based systems. Its mission is simple yet transformative – make high-quality, institutionally recognized financial products available to a global audience through tokenization.

Tokenization is at the heart of its model — the process of creating blockchain-based representations of real-world assets. By doing so, Ondo takes the stability and trust of established markets and injects them with the transparency, speed, and accessibility of decentralized systems.

Unlike many DeFi projects that focus purely on crypto-native products, Ondo’s offerings span regulated, real-world instruments such as U.S. Treasuries, mutual funds, and yield-bearing stablecoins. This dual approach positions it uniquely as a hybrid platform that can serve both everyday crypto users and large institutional players.

How Does It Work?

Ondo’s framework rests on three core pillars: tokenization, risk isolation, and purpose-built blockchain infrastructure — creating a system where real-world assets can be issued, traded 24/7, and transferred across chains without friction, all while meeting strict institutional requirements.

Here is how it works:

Tokenization Engine

Ondo works with regulated custodians and established investment vehicles to convert traditional assets like U.S. Treasuries, ETFs, and money market funds into blockchain-native tokens. Each token is fully backed, with transparent proof of reserves and legal structures ensuring holders have a direct claim on the underlying asset. This unlocks access to markets once restricted by geography, regulation, or high capital thresholds.

Risk-Isolated Vaults

Instead of pooling all investors into the same risk profile, Ondo separates capital into fixed-yield and variable-yield vaults. Fixed-yield vaults offer predictable returns, while variable-yield vaults deliver leveraged exposure for those seeking higher potential gains. This segmentation prevents risk from spilling across strategies, mirroring institutional-grade safeguards.

Ondo Chain

Launched in 2025, Ondo Chain is a Layer 1 network designed for tokenized financial markets. Optimized for compliance, high throughput, and interoperability, it integrates with both public DeFi and permissioned institutional systems.

Ondo Global Markets Goes Live

Ondo Global Markets is the most recent and ambitious development from Ondo Finance. The platform, dubbed Wall Street 2.0, went live on Ethereum, offering over 100 U.S. stocks and ETFs for non-U.S. investors, with plans to expand to more than 1,000 assets by the end of the year. This launch allows investors in Asia-Pacific, Europe, Africa, and Latin America to access major equities like Apple and Tesla and leading ETFs, all while maintaining traditional-market liquidity and institutional-grade protections.

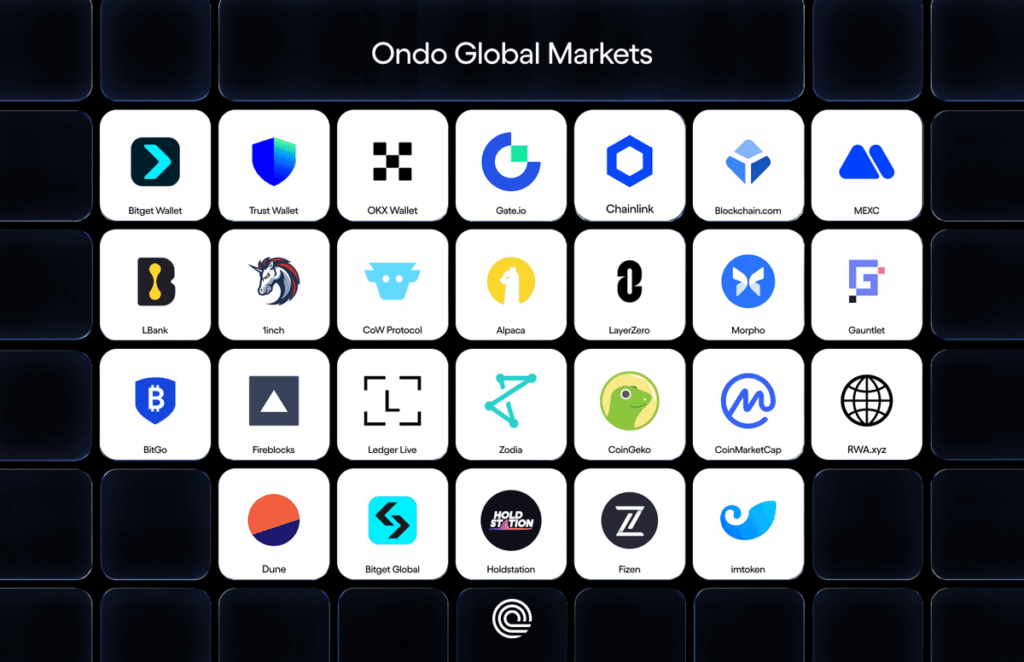

Partnerships and Infrastructure

To achieve this, Ondo has formed strategic partnerships across the financial and crypto ecosystems:

- Alpaca – Provides self-clearing brokerage infrastructure, regulatory compliance, and access to underlying U.S. equities.

- Block Street – Institutional-grade liquidity provider enabling borrowing, shorting, and hedging of tokenized stocks. Supported by firms like Citadel, Point72, and Jane Street.

- Wallet & Exchange Integration – Major wallets including Trust Wallet, Ledger, BitGo, Bitget, and OKX Wallet support tokenized assets, allowing retail investors seamless access.

- Oracles & Cross-Chain Support – Chainlink provides accurate pricing data, while LayerZero ensures cross-chain interoperability to Ethereum, Solana, BNB Chain, and Ondo Chain.

- DeFi Integration – Platforms like Morpho and Gauntlet support lending, collateralization, and risk monitoring of tokenized stocks, allowing investors to deploy assets in automated strategies.

How It Works in Practice?

When a user acquires a tokenized share:

- Ondo purchases the underlying stock through the U.S.-registered broker-dealer.

- Shares are held securely with a regulated custodian.

- The user receives a fully backed token reflecting the total economic return of the underlying asset, including dividends and corporate actions.

- Tokens can be minted or redeemed during trading hours and freely transferred onchain 24/7.

- Investors can use the tokens in DeFi protocols, as collateral, or for automated trading strategies, bridging the gap between traditional markets and decentralized finance.

Key Features of This Development

Ondo Global Markets sets a new standard in tokenized finance by combining speed, scale, and security. Its core features include:

- Scalability – Wrapped tokenization enables rapid onboarding of hundreds of assets, with thousands more in the pipeline.

- Liquidity – Ondo tokens inherit the liquidity of their underlying securities, reducing slippage and enabling efficient trading.

- Price Stability – Instant mint and redeem functionality allows arbitrageurs to keep token prices in line with real asset values.

- DeFi Compatibility – Tokens are fully transferable and usable in DeFi protocols for lending, staking, and automated strategies.

- Institutional Protections – Daily third-party reserve verification, bankruptcy remoteness, and security agent oversight ensure asset safety.

- Developer-Friendly APIs – Simplified integration for wallets, exchanges, and apps.

Plans Ahead

Looking ahead, Ondo is expanding the ecosystem to fully realize the potential of tokenized financial markets. The roadmap includes:

- Prime Brokerage Services – Borrow against tokenized securities, cross-collateralize positions, and access competitive institutional lending rates.

- Staking and Collateralization – Tokenized RWAs can be staked to secure networks and generate rewards.

- Onchain Wealth Management – Automated portfolio rebalancing and integrated strategies across tokenized equities, bonds, ETFs, and crypto.

- Multi-Chain Token Issuance – Seamless bridging and management of tokenized assets across Ethereum, Solana, BNB Chain, and future networks.

- Stablecoin Yield Products – Distribute stablecoins backed by tokenized securities with transparent yield attribution.

- Bootstrapping Protocols – Use staked tokenized RWAs to secure new chains or protocols while networks mature.

Final Thoughts

In conclusion, by integrating DeFi functionality, cross-chain interoperability, and institutional safeguards, Ondo Finance has created a scalable and secure ecosystem that bridges traditional markets with blockchain innovation. All in all, this launch marks a transformative step in democratizing access to U.S. equities and ETFs for global investors. So, as tokenized financial markets continue to evolve, it will be interesting to see how this platform reshapes liquidity, accessibility, and the future of global investing.