- Vitalik’s ETH sales were planned, transparent, and spread out over time

- The selling followed existing weakness rather than causing it

- Market reaction reflects trader psychology more than Ethereum fundamentals

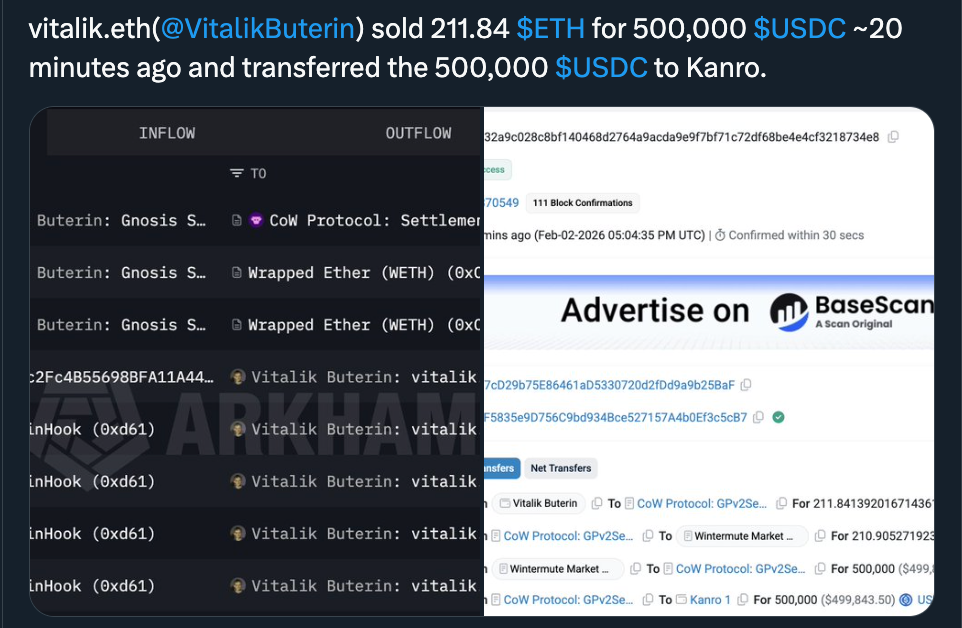

Recent on-chain activity shows Vitalik Buterin moving ETH in small, clearly visible batches over several days. Roughly 2,961 ETH changed hands using standard swap infrastructure, with no mixers, no routing tricks, and no urgency. That detail matters more than the headline number. When someone is trying to rush for the exits, the blockchain tells a very different story.

These transfers were clean, paced, and easy to follow in real time. Nothing about the flow suggested panic or reactive selling. It looked like execution, not escape, and the chain tends to be brutally honest about that distinction.

Context Explains the Motive Better Than Headlines

Vitalik has been open about why he periodically sells ETH. The proceeds fund long-term initiatives through his Kanro organization, including biotech research and open-source security work. This wasn’t a spur-of-the-moment decision triggered by market stress, it followed earlier transfers totaling more than 16,000 ETH.

Labeling that activity as “dumping” ignores both intent and scale. Ethereum trades billions of dollars in daily volume. These transactions didn’t drain liquidity or shock the system. They occurred after broader macro pressure had already pushed prices lower.

Fear Filled the Gap Before Facts Did

So why did traders still react so sharply. Founder activity introduces ambiguity, and markets tend to panic when clarity is thin. Even when the data is clean, optics take over, especially in fragile conditions. Short-term traders often react first and look for explanations later.

Long-term holders usually do the opposite. They check the flow, the structure, and the timing. The disconnect between those two groups is where most of the noise lives.

Transparency Isn’t a Warning Signal

Vitalik selling ETH isn’t a signal about market tops, bottoms, or confidence in Ethereum. It’s a reminder that neutral information often gets framed as negative when sentiment is already shaky. The blockchain didn’t change its story. Ethereum’s fundamentals didn’t move.

What shifted was perception. And in nervous markets, perception can travel faster than facts, at least for a while.