• VeChain fell nearly 20% this month to around $0.01 but retains key enterprise partnerships.

• Analysts see the decline as a buying opportunity backed by strong fundamentals.

• Long-term outlook remains bullish if market conditions and adoption improve — here is why VET’s crash may be a blessing in disguise.

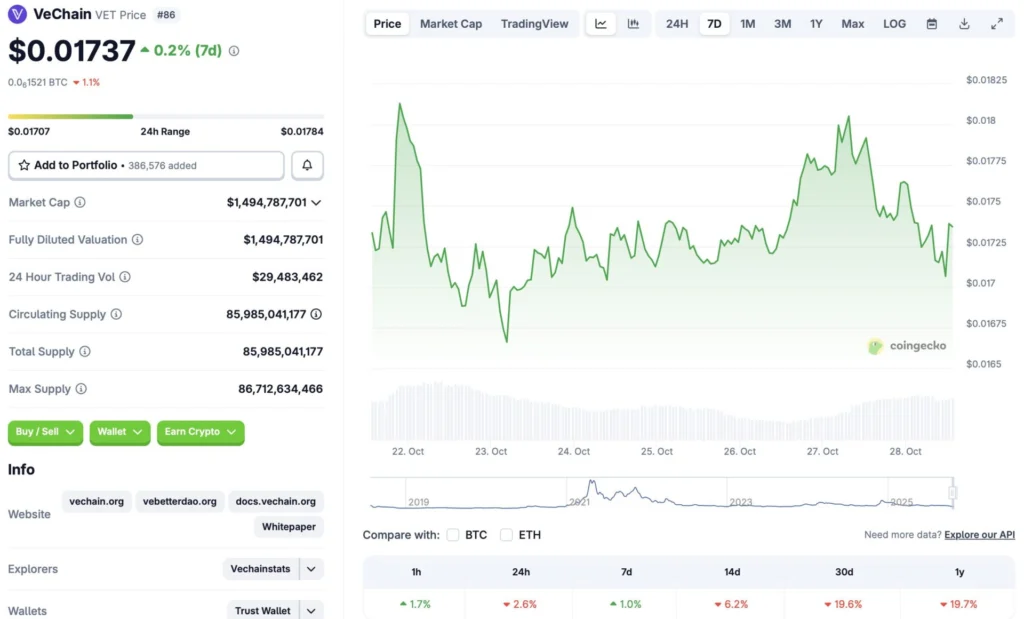

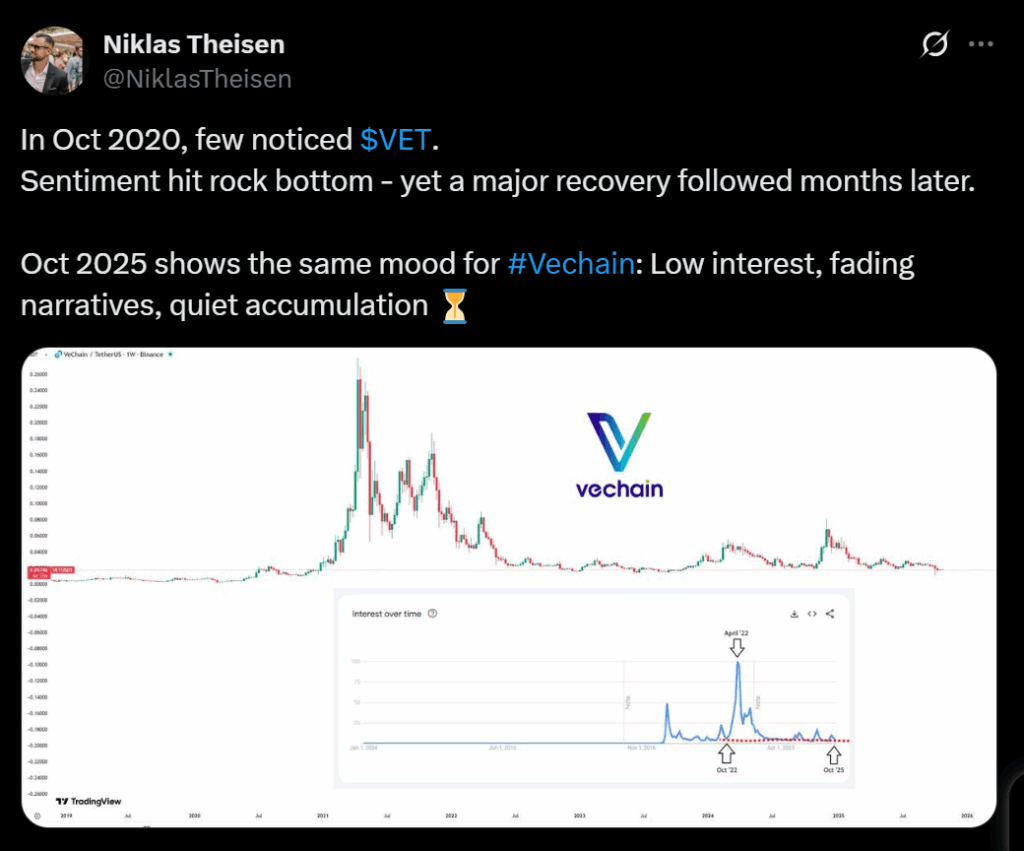

VeChain (VET) has been under pressure amid the ongoing market correction, dropping 2.6% in 24 hours and nearly 20% over the past month, according to CoinGecko. The token now trades near $0.01, marking a 93% fall from its all-time high of $0.281 set in April 2021. Despite the steep decline, VET did manage a modest 1% weekly gain, hinting that accumulation may be quietly taking place among long-term investors.

Why the Price Crash May Be a Blessing

Analysts argue that VeChain’s pullback could represent a strategic entry point for patient investors. The project’s focus on supply chain transparency, enterprise-grade blockchain solutions, and eco-friendly innovation gives it strong fundamentals compared to many speculative altcoins. Its technology has already been adopted by Walmart China, BMW Group, LVMH, Bayer, and even the UFC, underscoring real-world use cases that could drive future demand once macro conditions improve.

Fundamentals Remain Strong Despite Market Weakness

VeChain’s infrastructure continues to expand through corporate integrations and sustainability partnerships. The project’s dual-token model, which separates governance (VET) from gas fees (VTHO), remains a favorite among enterprise adopters seeking scalable blockchain tools. Many analysts believe that once inflation pressures ease and risk appetite returns to crypto markets, VeChain could emerge as a top contender in the next growth phase — benefiting from both its utility and green technology credentials.

Long-Term Outlook: Positioning for the Next Cycle

If Bitcoin moves toward its projected $1 million mark by 2030, analysts expect high-utility projects like VeChain to follow the trend. With its token price at multiyear lows, the current market phase could offer asymmetric upside for long-term believers. While short-term volatility may persist, VeChain’s ongoing partnerships and strong fundamentals make this dip look less like a collapse — and more like an early accumulation window.