- VeChain (VET) rallies modestly but is down 2.1% monthly, with eyes on $0.032 by Nov. 2.

- Bitcoin’s rebound above $113K and potential Fed rate cuts could fuel further upside.

- Seasonal weakness and volatility remain key risks for VET’s short-term outlook.

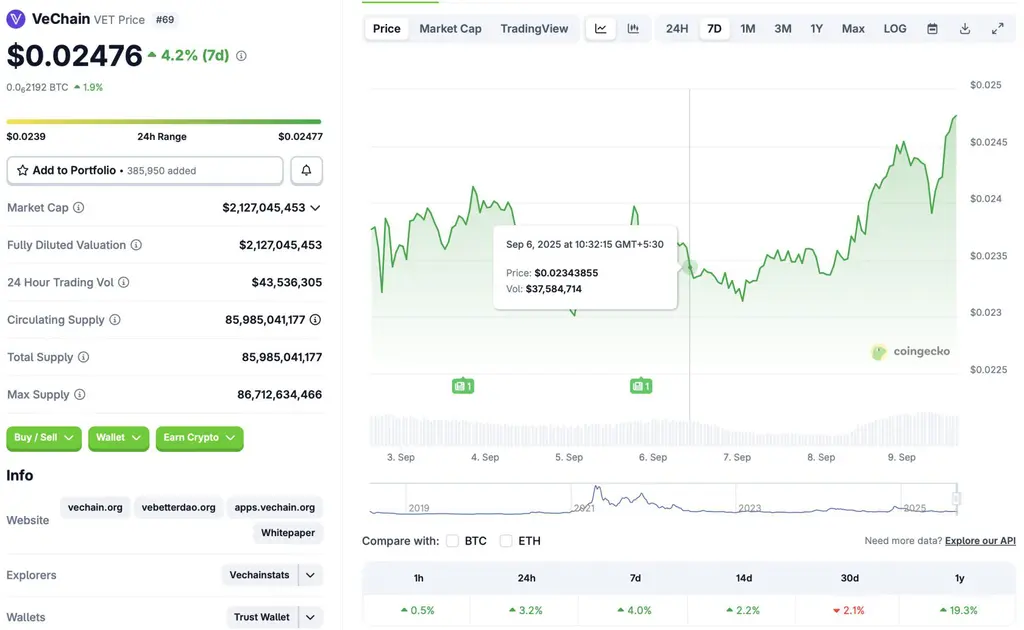

VeChain (VET) is slowly climbing back with the market’s latest rebound, adding 3.2% in the daily charts, 4% in the weekly, and 2.2% in the 14-day timeframe. Still, zoom out and the picture isn’t as rosy—CoinGecko data shows VET is down 2.1% over the past month. The question now: can VeChain keep its upswing going, or will it stall out before hitting the $0.032 target?

Bitcoin’s Recovery Could Pull VET Higher

The broader crypto market is flashing signs of strength again. Bitcoin reclaimed the $113,000 level, and global market cap surged back to $4 trillion. Historically, VeChain tends to follow BTC’s momentum, meaning if the king holds its ground, VET could benefit directly. CoinCodex forecasts that VET could hit $0.032 by Nov. 2, 2025—representing a potential 33.33% rally from current prices.

The Fed Factor: Rate Cuts on the Horizon

Another catalyst is looming on the macro side. The Federal Reserve is widely expected to cut interest rates at its September meeting—most likely 25 basis points, with a smaller chance of 50. Lower borrowing costs often drive liquidity into risk assets like crypto, which could help fuel VeChain’s next leg up.

Risks: Volatility and Seasonal Weakness

Despite the optimism, investors shouldn’t ignore the risks. September has historically been one of the weakest months for crypto. Add in ongoing volatility and unpredictable macro headlines, and VET could just as easily stall or consolidate around current levels. Much will depend on Bitcoin’s ability to sustain its recovery momentum. If BTC dips, VET will almost certainly feel the weight.