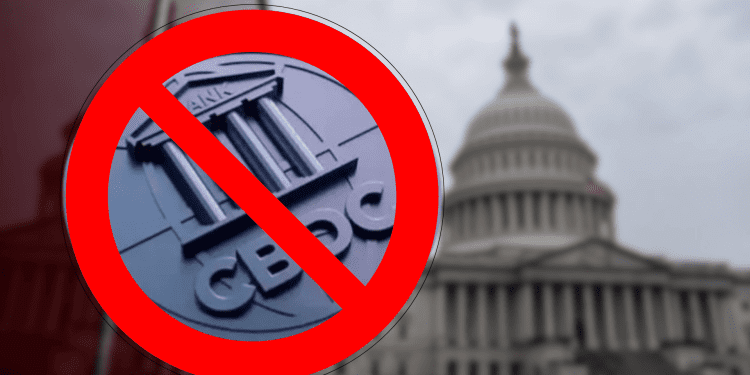

- The US House voted to pass the CBDC Anti-Surveillance State Act, banning the Federal Reserve from creating a central bank digital currency (CBDC).

- The bill prohibits the Fed from issuing a retail CBDC that could be used for citizen surveillance and bans any CBDC pilot programs before they’re proposed.

- The American Bankers Association supports the passage of the bill, citing risks associated with issuing a CBDC that could undermine the benefits and limit banks’ ability to make loans.

The US House of Representatives voted this week on a bill that would prohibit the Federal Reserve from launching its own central bank digital currency (CBDC). This controversial legislation has sparked heated debate around the future of digital currencies in the country.

Introducing the Anti-Surveillance Act

On May 23, 2024, the US House voted in favor of passing the CBDC Anti-Surveillance State Act, which was introduced by Congressman Tom Emmer. The bill aims to ban the Federal Reserve from piloting or issuing its own CBDC without Congressional approval.

According to the bill’s supporters, a Fed-backed digital currency could enable unwarranted government surveillance of citizens’ financial transactions. The bill text states that a CBDC must not be used “to implement monetary policy” or “for surveillance purposes.”

Backers Argue a CBDC Threatens Commercial Banking

Proponents of the legislation argue a CBDC could undermine the traditional banking system. In a letter of support, the American Bankers Association said a digital dollar would become an “advantaged competitor to retail bank deposits.” As a result, money would likely move out of private banks and into Federal Reserve accounts.

Majority Whip Emmer contends the bill “halts the efforts of this administrative state under President Biden from issuing a financial surveillance tool.” Meanwhile, the Biden administration has remained relatively quiet on the issue of a digital dollar.

Global CBDC Race Continues as US Stalls

While the US debates the idea of a CBDC, many other countries are racing ahead to launch their own digital currencies. China has already begun piloting the digital yuan in various cities. The European Union, UK, India and others are also exploring CBDCs.

But in the US, the future remains uncertain. The bipartisan anti-surveillance bill passed the Democrat-controlled House. It now heads to the Senate for consideration. If it becomes law, it could set back any plans the Fed had to experiment with digital currency.