• Federal investigators are probing cryptocurrency firm Tether for possible violations of anti-money-laundering and sanctions rules

• The criminal investigation is run by prosecutors at the Manhattan U.S. attorney’s office

• Authorities are looking at whether Tether has been used by third parties to fund illegal activities such as drug trade, terrorism, hacking, or money laundering

WSJ claims the federal government is investigating cryptocurrency company Tether for possible violations of sanctions and anti-money-laundering rules, according to people familiar with the matter. The criminal investigation, run by prosecutors at the Manhattan U.S. attorney’s office, is looking at whether the cryptocurrency has been used by third parties to fund illegal activities such as the drug trade, terrorism and hacking, or launder the proceeds generated by them.

Details on the Investigation

The investigation is allegedly focused on whether Tether concealed from banks that transactions were linked to crypto trading, the people said. Tether issued digital coins pegged to the U.S. dollar called tethers that trade like regular currency and are widely used in crypto markets. The company has long said it has sufficient dollar reserves to back all tethers in circulation.

Tether executives are reportedly cooperating with the Justice Department investigation, some of the people said. The company has no plans to cease operations and has been discussing whether to get a federal banking charter, some of the people said.

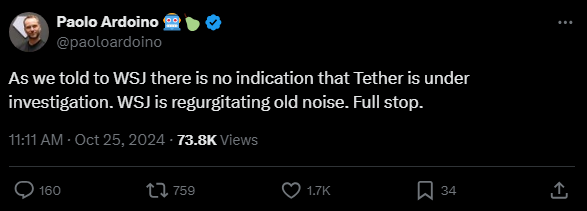

Despite the noise, Tether CEO Paolo Ardonio firmly stated the firm has not received any notice of an investigation, and that WSJ is “regurgitating old noise.”

Tether’s History

Tether was founded in 2014 and is incorporated in the British Virgin Islands, with main offices in Hong Kong. For years it has been dogged by allegations that its currency isn’t fully backed by dollars. New York’s attorney general said in a February 2021 settlement with Tether that the company had loaned billions of dollars to an affiliated crypto trading firm, Bitfinex, and concealed the loans for some time.

Tether remains important to the operation of many cryptocurrency exchanges and has only grown in influence as digital assets have attracted more mainstream investors. Tethers outstanding climbed above $68 billion as of September, from less than $5 billion at the beginning of 2020.

Industry Impact

The investigation threatens to destabilize the broader cryptocurrency industry, which has benefited from Tether’s ability to facilitate trading by serving as a widely accepted substitute for traditional, government-issued currencies.

Tether is also integral to the functioning of some crypto lending platforms and exchanges. Crypto firms sometimes hold customer deposits in tethers rather than traditional currencies to avoid onerous know-your-customer and anti-money-laundering checks. Some offshore crypto exchanges even use tethers as a stand-in for the U.S. dollar when providing banking services to clients.

A loss of confidence in tethers could prompt holders to redeem them en masse for dollars and might also reduce demand from traders who use them as a medium of exchange. Some investors already are shifting funds into alternatives. The market capitalization of tether rivals USD Coin and Binance USD has climbed to around $50 billion from less than $10 billion at the start of 2020.

Conclusion

The investigation into Tether is the latest example of U.S. authorities ramping up oversight of the crypto industry. Earlier this month, the Securities and Exchange Commission charged crypto lending platform BitConnect with running a $2 billion fraud.