- UNI is edging higher as the UNIfication vote approaches closure

- The proposal introduces protocol fees and a direct UNI burn mechanism

- Early results show overwhelming support, far above quorum

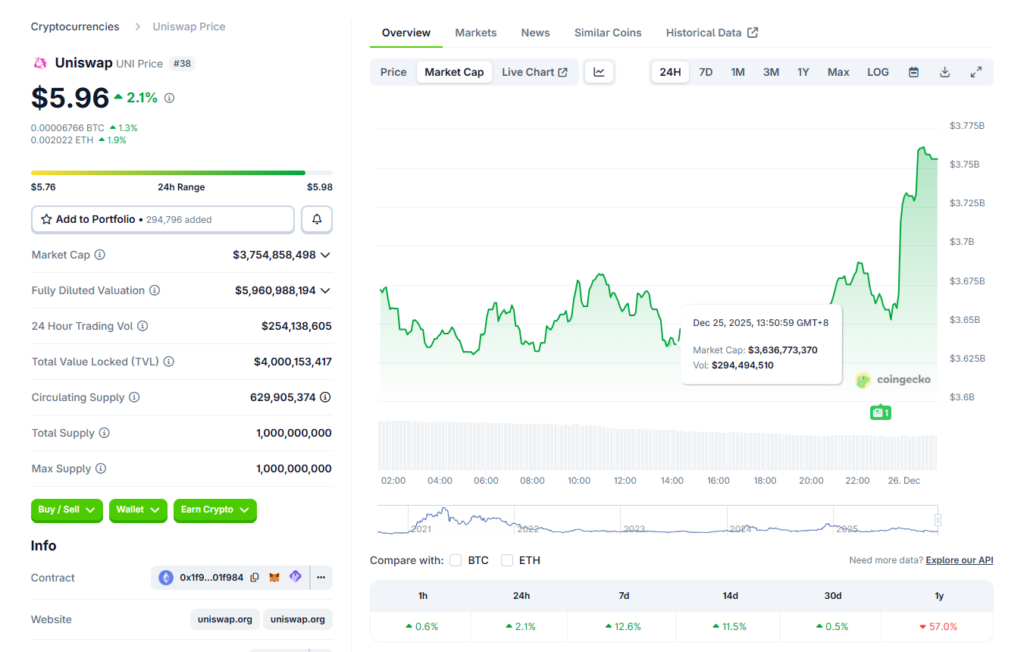

Uniswap’s UNI token is showing mild strength as the community votes on the high-impact “UNIfication” governance proposal. The vote opened on December 20 and is set to close in less than 20 hours, with early results already signaling overwhelming support. UNI briefly jumped from around $5.4 to $6.4 shortly after voting began before pulling back alongside the broader market, and is now trading near $6, up roughly 1.5% over the past 24 hours, according to CoinGecko data.

UNIfication Proposal Nears Decisive Approval

Voting data shows more than 120 million UNI tokens cast in favor of the proposal, compared to just 742 votes against, comfortably clearing the 40 million UNI quorum requirement. While the voting window has not officially closed, the margin strongly suggests the proposal will pass. The measure was introduced jointly by Uniswap Labs and the Uniswap Foundation as part of a broader effort to reshape Uniswap’s token economics and governance structure.

Fee Activation and Token Burn Take Center Stage

If approved, the proposal would activate Uniswap’s long-discussed protocol fees and route them into a mechanism that burns UNI, directly reducing token supply as usage grows. The rollout would happen gradually across pools and supported networks to limit disruption. In addition, the plan includes burning 100 million UNI from the treasury and consolidating ecosystem responsibilities under Uniswap Labs, while reducing product-level fees to prioritize protocol growth.

Why Supporters See This as a Long-Term Shift

Backers argue the proposal fundamentally strengthens UNI’s value proposition by directly linking protocol activity to token scarcity. By aligning Uniswap Labs’ incentives more closely with protocol usage, supporters believe the changes could create a more sustainable long-term model for Uniswap, where higher adoption translates into reduced circulating supply and stronger governance alignment.