- Bitcoin dropped 2.2% to $92,700 after stronger-than-expected U.S. job growth fueled inflation fears.

- Rising 10-year treasury yields, now at 4.78%, are pressuring Bitcoin and other risk assets.

- Bitcoin’s correlation with the S&P 500 and Nasdaq has grown as inflation concerns dominate market dynamics.

The U.S. economy added more jobs than expected in December, stoking inflation concerns that have weighed on Bitcoin’s price. Employers added 256,000 jobs last month, surpassing economists’ predictions of 160,000, according to the Bureau of Labor Statistics (BLS).

Bitcoin’s Volatility Intensifies Amid Economic Strength

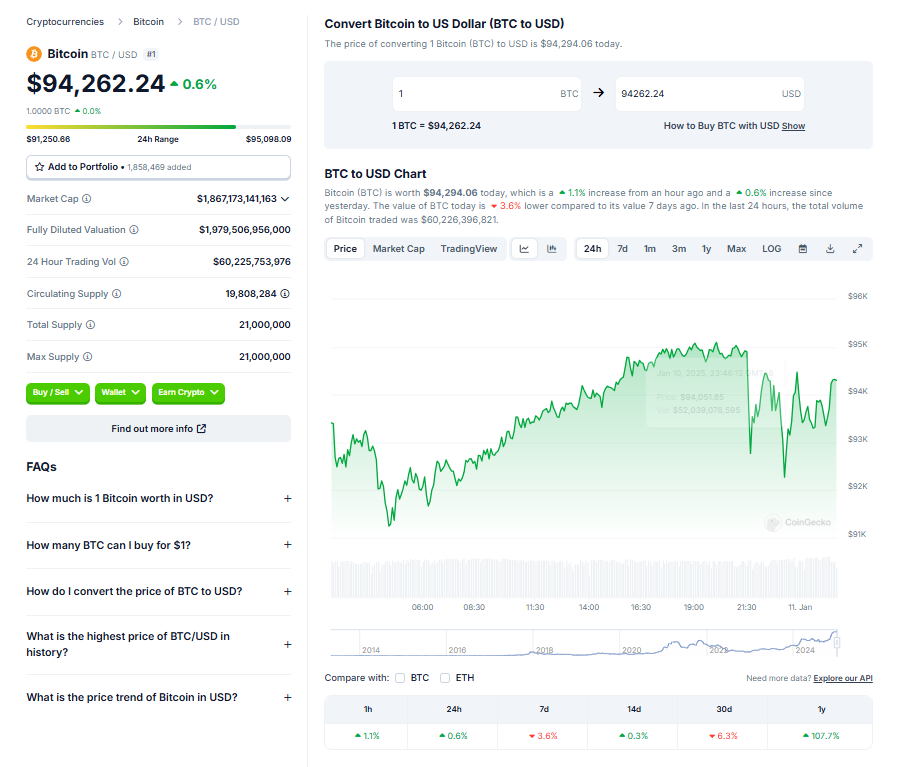

Bitcoin’s price took a sharp hit following Friday’s labor report, dropping 2.2% in just 10 minutes from $94,900 to $92,700. Over the past week, Bitcoin has been on a wild ride, fluctuating between highs of $102,300 and lows of $91,000, as strong economic signals fueled uncertainty.

The unemployment rate ticked down to 4.1% in December from 4.2% in November, reflecting a robust labor market. While good for the economy, lower unemployment can drive wage growth, intensifying inflation pressures—something that has already rattled investors.

Tom Dunleavy, a partner at MV Capital, summarized the sentiment: “Good news is bad news. A strong job market means more inflation risks and fewer chances of rate cuts.”

The Fed’s Cautious Stance and Rising Yields

The Federal Reserve signaled in its December meeting minutes that it plans to cut rates at a slower pace this year, citing concerns over potential shifts in trade and immigration policies. These factors could keep inflation above the Fed’s 2% target, complicating efforts to stabilize the economy.

Adding to the pressure, 10-year treasury yields climbed to 4.78% on Thursday—their highest level since 2023. Higher yields often lead investors to favor bonds over riskier assets like Bitcoin and stocks, further straining the crypto market.

Bitcoin’s Inflation Struggles and Correlation with Stocks

Bitcoin’s price briefly dipped below $93,000 on Wednesday before rebounding to around $93,900 by Friday. As inflation fears mount, Bitcoin’s correlation with traditional markets like the S&P 500 and Nasdaq has grown, marking a shift in market dynamics.

Analysts note that the Fed’s cautious approach, combined with broader economic uncertainty, has reduced traders’ confidence in near-term rate cuts. Jake Ostrovskis, an OTC trader at Wintermute, pointed out that Bitcoin’s movement now mirrors traditional assets more closely than ever.

Final Thoughts: Market Dynamics Shift

As Bitcoin faces mounting pressure from strong economic data and inflation concerns, its price movements are increasingly tied to broader market dynamics. While the labor market’s strength initially drove prices lower, Bitcoin’s modest recovery shows the resilience of crypto even in uncertain times. Traders and investors are keeping a close eye on the Fed’s next moves and how inflation trends evolve under the new administration.