- The U.S. government plans to return $11.87 billion worth of Bitcoin seized in the 2016 Bitfinex hack to rightful owners.

- Ilya Lichtenstein, the hacker behind the attack, was sentenced to five years in prison last year.

- The U.S. holds over $20 billion in Bitcoin, mostly seized from cases like the Bitfinex hack and Silk Road.

The U.S. government recently made waves with its announcement that more than $11 billion worth of Bitcoin seized in connection to the 2016 Bitfinex hack will be returned to its rightful owners. This decision marks a pivotal moment in the ongoing saga of one of the cryptocurrency industry’s largest thefts.

Massive Bitcoin Restitution in the Works

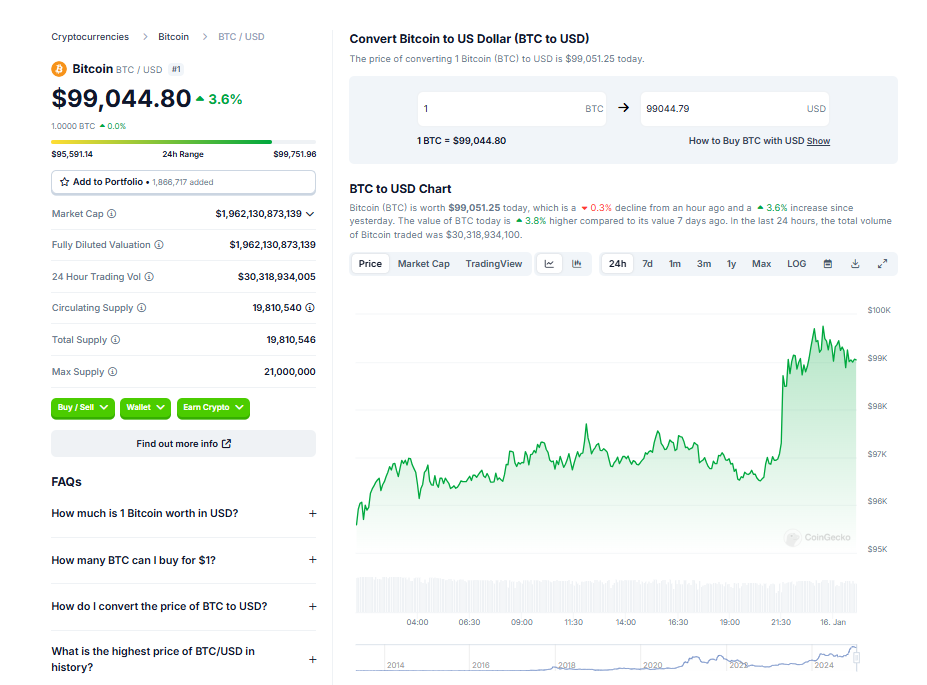

In a new court filing, officials confirmed that 120,000 BTC, valued at $11.87 billion today, will be returned to Bitfinex as “in-kind restitution.” Back in 2016, the stolen Bitcoin was worth around $70 million—a fraction of its current value after years of price surges. The move comes after Ilya Lichtenstein, the mastermind behind the hack, was sentenced to five years in prison last November.

Bitfinex Hack: A Lingering Scandal

The 2016 attack on Bitfinex remains one of the largest crypto heists to date. Nearly nine years later, this historic breach still casts a long shadow over the industry. While the U.S. government aims to rectify the damages with restitution, it highlights how far cryptocurrency regulation and security have evolved in response to such tragedies.

U.S. Government: A Silent Bitcoin Giant

Interestingly, the U.S. government has become one of the largest Bitcoin holders globally, controlling more than $20 billion in crypto assets. Most of this was confiscated from high-profile cases, including the Silk Road Marketplace and the Bitfinex hack. While the decision to return funds underscores their commitment to justice, it also sheds light on the growing intersection of law enforcement and cryptocurrency.

This development marks a win for the crypto space, emphasizing accountability and justice even in the face of colossal breaches. Yet, it also raises questions about how such events might shape the future of crypto regulation and restitution efforts.