- Judge Failla questioned if SEC’s definition of security is too broad, concerned it could sweep up collectibles

- Failla pushed back on SEC’s argument that Coinbase’s staking services are unregistered securities offerings

- Core issue is if Coinbase operates unregistered exchange by allowing trading of tokens SEC deems securities

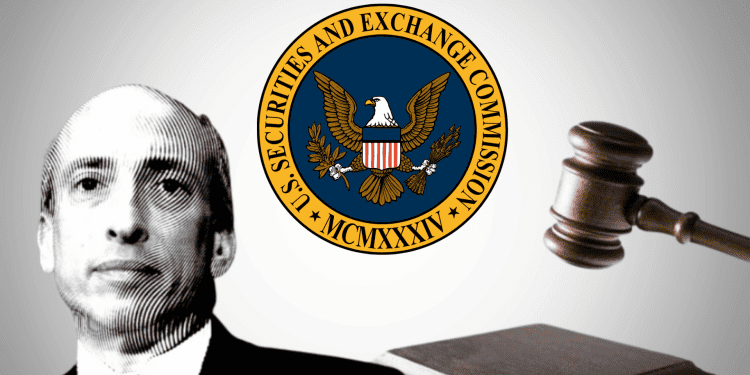

New York District Judge Katherine Polk Failla grilled the Securities and Exchange Commission (SEC) in court on Wednesday, asking pointed questions about what constitutes a security and how that applies to cryptocurrencies. This comes as the SEC sued Coinbase in June, accusing it of operating an unregistered exchange.

What is a Security?

In court, Judge Failla questioned the SEC’s definition of security, asking if it was too broad. She expressed concern that the SEC’s arguments could potentially sweep up things like collectibles as securities. The SEC maintained they were not arguing collectibles are securities.

Failla also asked if the tokens listed in the SEC’s complaint against Coinbase – like SOL, ADA and MATIC – violated securities laws. The SEC admitted those tokens are just computer code and did not violate laws.

Staking Services

Additionally, Failla pushed back on the SEC’s allegations that Coinbase’s staking services constitute an unregistered securities offering. She said she found staking to be the least securities-like activity Coinbase engages in.

Unregistered Exchange?

The core issue is whether Coinbase operates as an unregistered exchange by allowing trading of tokens the SEC deems securities. Coinbase argues the SEC is overstepping its bounds.

If the judge sides with the SEC, the case will likely go to trial in 2025. Other judges have taken varying stances on whether specific cryptocurrencies are securities.

Conclusion

This court battle represents a broader debate over how cryptocurrencies should be regulated. Judge Failla grilled both sides with tough questions, showing the complexities involved in applying decades-old securities laws to digital assets. Her eventual ruling could have major implications for Coinbase and the wider crypto industry.