- Congress remains deadlocked with no viable bipartisan stopgap deal.

- Prediction markets show 40–45% odds of the shutdown lasting beyond Nov. 16.

- Procedural delays make a quick reopening increasingly unlikely.

Prediction markets and Beltway signals are converging on the same takeaway: the federal shutdown looks poised to stretch beyond mid-November. Here are three concrete reasons—rooted in today’s numbers and Hill dynamics—why odds favor a longer grind.

Congress is dug in, and the floor math isn’t moving

Both chambers keep failing procedural votes while leadership remains split on what a stopgap should include. The Senate has now rejected GOP funding measures a dozen times, and even a “pay essential workers during the shutdown” bill fell short of the 60-vote bar—an indicator that there isn’t a bipartisan framework to pivot around yet. The chamber also adjourned until Monday, locking in more idle days with no deal. On the House side, Republican leaders have tied a short-term fix to security funding add-ons after a spate of threats and violence—an approach Democrats oppose unless paired with health-care provisions—leaving the two sides trading the same offers rather than narrowing differences.

Zoom out and the stalemate looks structural: appropriators warn the extended lapse is freezing conference work on full-year bills, while leadership messages harden blame rather than soften positions. When both the policy scope (security, health care, foreign aid rescissions) and the vehicle (clean CR vs. riders) are contested, time works against a quick resolution.

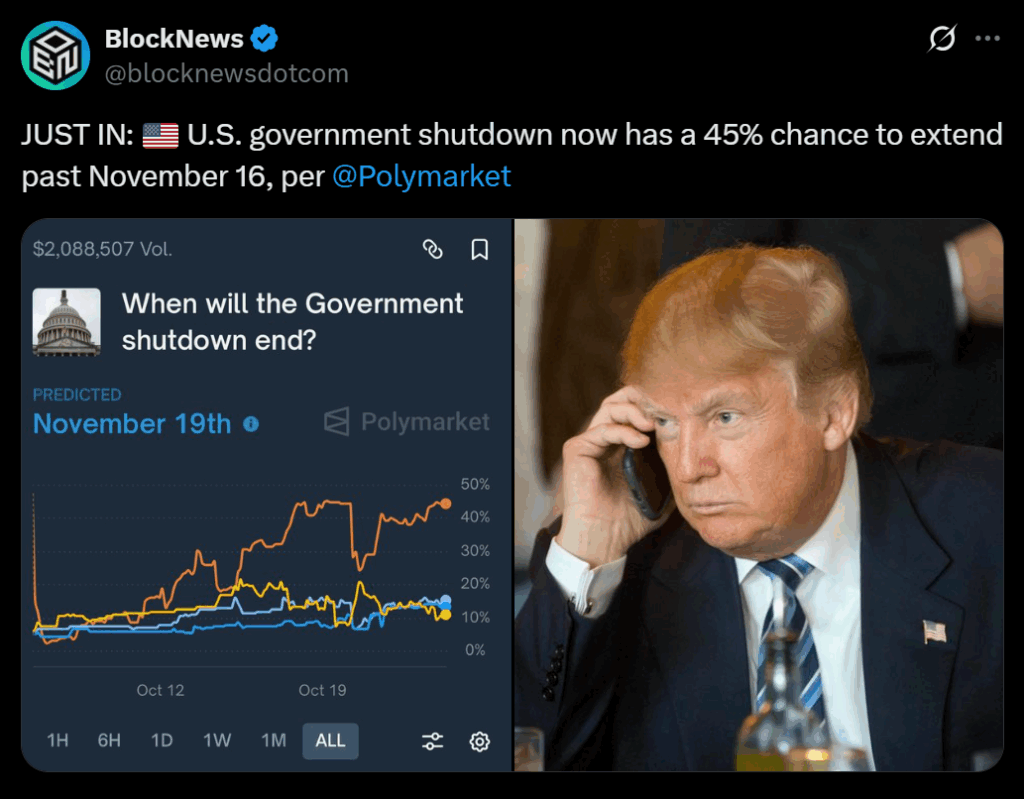

Markets are pricing a longer shutdown—mid-November (or later) is a live base case

Prediction markets have shifted decisively toward a mid-to-late November reopening. On Polymarket, the contract tracking when OPM declares the government re-open shows rising probability the lapse extends to at least Nov. 16; other markets imply ~40–45% odds it lasts into mid-November and ~⅓ odds it goes past Nov. 20. Kalshi pricing likewise leans to a 35-plus-day shutdown with elevated chances of 40+ days—i.e., a historically long event. These are real-money signals reflecting traders’ read of vote counts and the calendar, not just vibes.

The key here is direction: over the last week, odds for an early-November resolution fell, while mid-month buckets gained. That repricing lines up with each failed Senate cloture vote and the absence of a viable “clean CR” path emerging from leadership meetings.

The calendar—and procedure—favor drift, not speed

Even if a compromise outline surfaced, the Hill still needs text, scoring, procedural time, and a path through both chambers. With the shutdown already in Week 4 and the Senate not in constant session, the mechanics (drafting a CR, whipping votes, clearing holds, running debate time) stretch timelines. States are also warning that programs like SNAP could be disrupted in November, which raises stakes but doesn’t create floor votes where the math isn’t there. Translation: the nearer we get to mid-month without a bipartisan vehicle, the more likely Nov. 16 comes and goes before final passage.

Add that full-year appropriations are frozen during the lapse—and public posturing from both sides continues—and it’s hard to find the catalyst that compresses all the steps into the next two weeks. Historically, shutdowns end when a single, consensus vehicle emerges; right now, the process is still oscillating between clean CR and policy-rider CR, with neither commanding 60 Senate votes.

Bottom line

Until one side abandons riders—or both sides accept a stripped-down CR—probabilities favor duration. The latest trading odds, repeated failed votes, and the procedural calendar all point to a shutdown that outlasts Nov. 16 unless a genuinely bipartisan bill materializes fast.