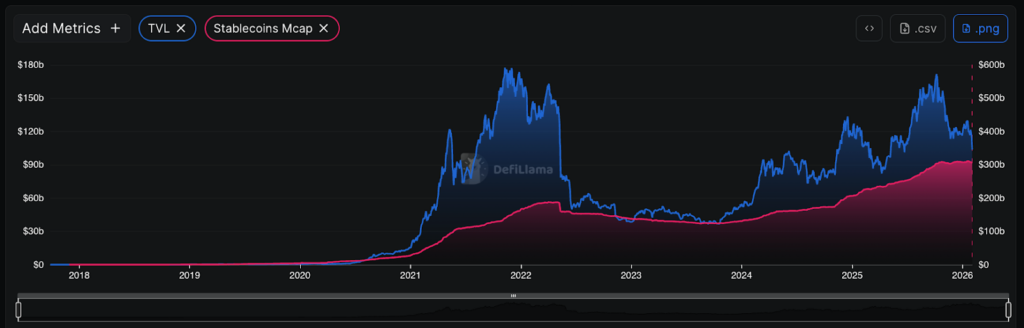

- DeFi TVL dropped sharply while total crypto market cap lost nearly $500B

- Stablecoin supply barely moved, signaling rotation instead of capital flight

- The next market move likely hinges on clarity, not panic or hype

Over a short stretch, DeFi TVL fell by roughly $16 billion while total crypto market cap shed close to half a trillion dollars. Those moves look dramatic on the surface, but context matters. This wasn’t triggered by a major protocol failure or a systemic shock. It resembled a coordinated step back, with participants reducing exposure as uncertainty piled up across macro and regulatory fronts.

Why Stablecoins Change the Read

The most important signal is what did not happen. Stablecoin supply remained largely flat after months of volatility. If capital were exiting crypto entirely, stablecoin market caps would be shrinking fast. Instead, funds appear to have rotated into cash-like positions on-chain. That suggests caution, not fear. Capital stayed in the system, waiting rather than running for the exits.

What This Behavior Signals

When prices fall but cash stays put, it usually points to indecision. Investors are not convinced enough to deploy risk, but they are also not convinced enough to leave. This kind of pause often follows sharp drawdowns and can last longer than traders expect. It reflects a market looking for confirmation, whether from policy clarity, macro stabilization, or simply time.

What to Watch Next

The real tell will not be a sudden TVL spike. It will be gradual redeployment into lending, liquidity pools, and productive DeFi use. That kind of move signals confidence returning. Until then, the market remains in a holding pattern, not broken, just undecided.

Conclusion

TVL and market cap falling show reduced risk appetite. Stablecoins holding firm show capital has not left. The market is not finished. It is waiting for a reason to move.