- 21Shares’ TSOL ETF launch expands Solana’s U.S. ETF lineup and signals growing institutional appetite.

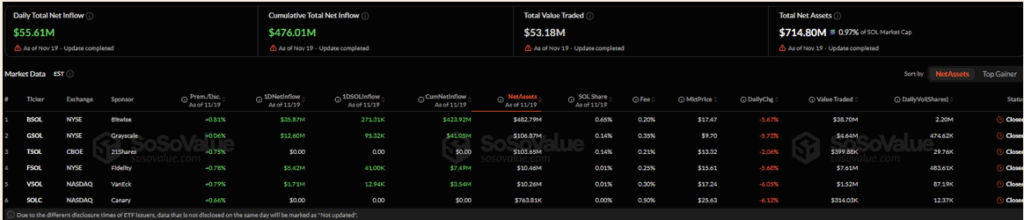

- Solana spot ETFs hit a daily record of $55M in inflows, with total cumulative inflows nearing $476M.

- SOL’s Open Interest surged 5.28% to $3.2B, reflecting rising volatility and stronger bullish positioning.

Solana’s ETF landscape is beginning to look a lot less experimental and a lot more… established. The launch of 21Shares’ TSOL arrived almost like a fresh spark in a market that was already heating up, sending a message that institutional demand for SOL exposure isn’t slowing down anytime soon. TSOL’s arrival expands Solana’s ETF lineup in the U.S., strengthening the chain’s footprint in a space once dominated almost entirely by Bitcoin and Ethereum products. For many observers, this felt like one of those quiet-but-important milestones—the kind that suggests Solana is settling into a new tier of legitimacy.

Inflows climb as institutions pour into Solana ETFs

Over the past week, Solana spot ETFs have kept printing positive inflows day after day, building real momentum behind the scenes. On 20 November, inflows even hit a fresh daily record of $55 million, pushing cumulative net inflows to around $476 million. Bitwise’s BSOL remained the biggest magnet for capital, pulling in $35.87 million, while Grayscale’s GSOL followed with $12 million. These numbers don’t just reflect trader excitement—they show steady institutional participation, the kind that usually doesn’t chase hype but instead builds long-term positions once confidence kicks in.

TSOL enters this mix at a moment when demand is already strong, making its timing feel almost intentional. Coming from 21Shares, one of the largest crypto ETP issuers globally, TSOL mirrors the company’s European Solana product, ASOL, which has been its biggest hit overseas. The firm described the launch as part of a broader shift in regulatory attitudes—one that finally allows U.S. investors to get cleaner, more transparent exposure to Solana.

TSOL launch arrives with rising volatility and surging Open Interest

New ETFs usually bring some noise with them, and TSOL’s debut seems no different. According to recent Open Interest data, Solana’s derivatives market has been heating up fast. In just the last 24 hours, SOL’s OI jumped 5.28%, climbing to about $3.2 billion—a level that reflects increasing volatility but also stronger confidence from leveraged traders. When OI rises this quickly, it usually hints at bullish positioning or a buildup ahead of a larger move.

Federico Brokate from 21Shares summed the moment up with a simple but telling line: “Crypto is here to stay.” It’s the kind of statement that would’ve sounded bold a few years ago, but now it feels almost obvious—especially when new ETFs like TSOL are rolling out while posting solid early interest.

Solana’s ETF ecosystem steps into a new phase

TSOL’s launch doesn’t just add another product to the list—it signals that Solana’s market presence is maturing. Institutional inflows look consistent, Open Interest is rising, and the appetite for regulated SOL exposure is becoming clearer week by week. Whether the market keeps this pace is still an open question, but the direction seems undeniable: Solana is becoming a staple in ETF conversations, not an exception.