- A $200B liquidity injection sounds big but is modest in crypto market context.

- Lower mortgage rates don’t translate directly into speculative buying.

- Long-term institutional participation matters far more than one headline number.

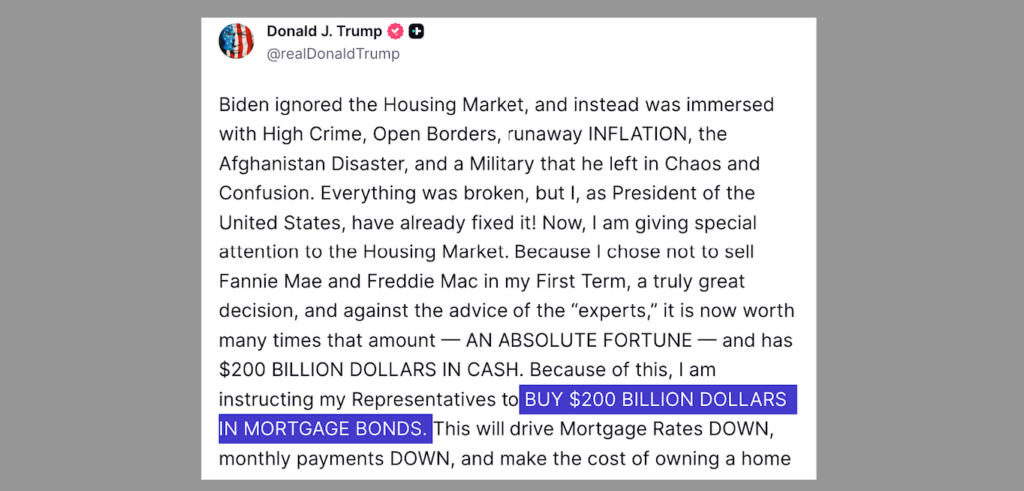

Yes, a $200 billion injection into mortgage-backed securities adds liquidity. No, it is not a magic switch for markets, and it definitely isn’t some hidden crypto catalyst waiting to explode. The number sounds dramatic until you put it in context. Against a roughly $3 trillion crypto market, $200 billion is not overwhelming, even in a best-case fantasy where every dollar somehow rotated into digital assets. That is not how capital moves, and it never has been.

Scale Kills the Hype

Liquidity stories fall apart when scale enters the conversation. Even if a fraction of that $200 billion eventually finds its way into risk assets, it gets diluted across equities, credit, real estate, and everything else competing for capital. The idea that mortgage bond liquidity turns into instant crypto bids assumes investors are sitting idle, waiting to speculate. They’re not. Capital allocators operate with mandates, timelines, and risk controls that don’t respond to one headline.

Liquidity Helps, It Just Doesn’t Flip a Switch

Buying mortgage-backed securities can lower mortgage rates and ease household pressure. That’s real and generally constructive for the economy. But freed-up cash doesn’t automatically become speculative capital. Most of it goes toward debt reduction, savings, or basic expenses. The leap from lower mortgage payments to crypto rallies skips several steps and ignores how people and institutions actually behave.

The Signals That Actually Matter

If you’re looking for meaningful indicators, ignore the one-off numbers. Focus on behavior over time. Pension funds slowly adjusting allocations. Asset managers expanding custody exposure. ETFs seeing consistent, not explosive, inflows. Corporate balance sheets adding digital assets without fanfare. These changes don’t come with fireworks, which is exactly why they matter. Real adoption shows up quietly and compounds.

Why This Framing Matters

Markets aren’t driven by theatrical moments. They’re driven by sustained participation. Treating every liquidity headline as a defining event leads to bad expectations and worse positioning. Crypto doesn’t need a savior number. It needs patience, infrastructure, and institutions showing up month after month. That process is slow, boring, and already underway.