- TRON Dominates USDT Transactions: TRON (TRX) now hosts $70 billion in USDT, solidifying its position as the leading network for stablecoin transfers, supported by whale activity and institutional inflows.

- Whales Anchor TRX Amid Volatility: Whales hold 72.49 billion TRX, accounting for 85.27% of profitable positions, creating strong price support and reducing downside volatility risk.

- Potential Breakout and Key Levels: With Open Interest up 16.60% to $273.44 million and bullish technicals flashing, TRX is eyeing a breakout above $0.2580–$0.2590. A successful push could target $0.286, while failure could trigger a pullback to $0.2400.

TRON (TRX) has cemented itself as the top network for USDT transactions, outpacing USDC and TUSD in terms of volume. As of 2025, TRON is hosting around $70 billion in USDT — a staggering figure that underscores its growing role in cross-border payments and emerging markets.

But it’s not just the stablecoin dominance that’s catching eyes. TRX is currently trading at $0.2560, up 2.47% in the last 24 hours, fueled by whale activity and strong institutional backing.

Whales Anchor TRX Amid Volatility

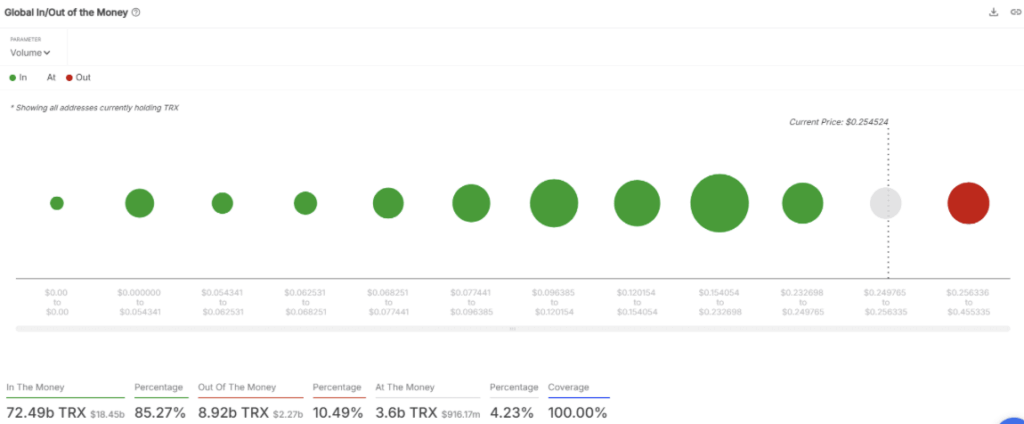

Whales are making their presence felt. According to the Global In/Out of Money chart, 85.27% of TRX holders are sitting on profits, with whales controlling a hefty 72.49 billion TRX. This concentration of whale holdings provides TRON with a solid support base, particularly during volatile market phases.

The implication? Less volatility and higher resistance to downside moves, as whales are less likely to panic sell during market dips. Essentially, their holdings could act as a price floor, stabilizing TRX in uncertain market conditions.

Investor Participation Up, Retail Interest Slips

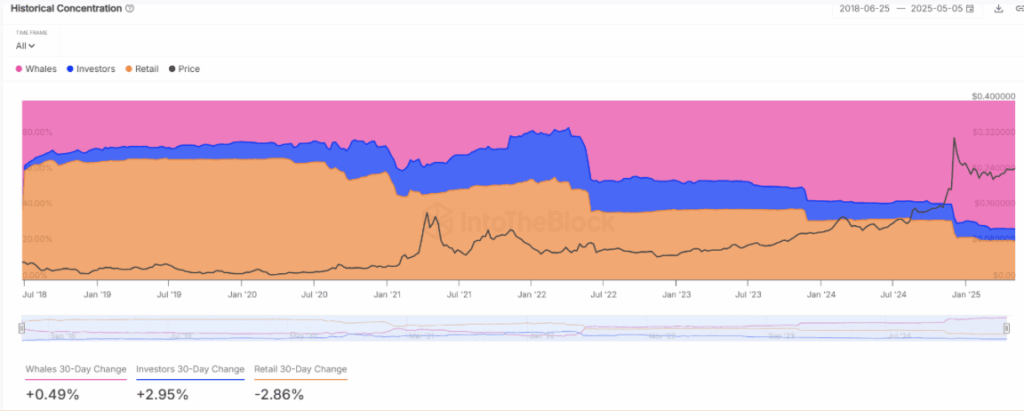

The Historical Concentration chart tells another story — one of shifting market dynamics. Whales have upped their holdings by 0.49%, while investor participation climbed by 2.95%, signaling a rise in long-term positions. Meanwhile, retail activity dipped by 2.86%, suggesting that short-term speculators are pulling back.

As a result, the market is leaning more toward a long-term, institutional-driven narrative rather than retail-driven speculation. That could mean more stability but also less explosive price action.

Open Interest and Liquidation Map Signal Potential Breakout

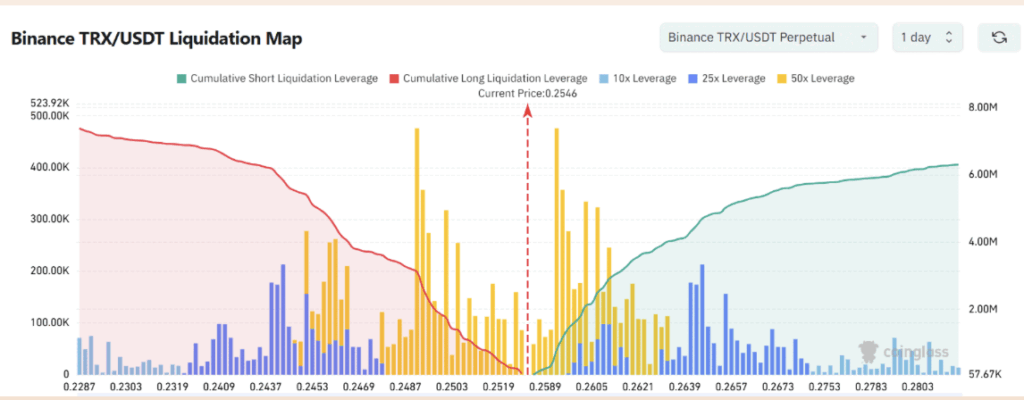

Open Interest for TRX jumped 16.60% to $273.44 million, signaling a wave of speculative bets. Typically, such spikes indicate that traders are positioning for a major price move — either through hedging or directional plays.

On the technical side, the Alligator Indicator is flashing bullish. The green line (lips) has crossed above the red and blue lines, suggesting upward momentum. Meanwhile, the DMI indicator shows buying pressure increasing as the DI+ line rises.

But the real wildcard here is the Binance TRX/USDT Liquidation Map. There’s significant short liquidation pressure near the $0.2580–$0.2590 range. If those shorts get squeezed, TRX could see a rapid spike. Conversely, if longs get liquidated, it could fuel a bearish reversal. Either way, the $0.2580 level is a critical inflection point.

Is TRX Poised for a Breakout?

With whales holding strong, Open Interest climbing, and technicals flashing bullish signals, TRON is positioned for a potential breakout. However, market dynamics remain fluid, and the liquidation map suggests that both short and long positions are vulnerable.

If TRX can clear the $0.2580–$0.2590 resistance zone, it could set the stage for a run toward $0.286. But if the price falters, a retest of support near $0.2400 could be in the cards. Stay tuned — the next move could be pivotal for TRON’s short-term trend.