- Stablecoin activity on TRON surged by $396M in 7 days, pushing its total stablecoin market cap to $66.91B and signaling rising network usage and confidence.

- TRON outpaced Ethereum and Solana in daily fees, collecting $1.3M—highlighting increased real usage and on-chain engagement.

- TRX price is holding key support at $0.21, with potential to rally toward $0.27 if it breaks above $0.24; RSI momentum is climbing but not yet fully bullish.

TRON’s been making some quiet moves lately — but if you’re paying attention to the data, the signs are starting to stack up.

In just the last 7 days, stablecoins on the TRON network jumped by $396 million, according to Lookonchain. That’s not pocket change. It’s a solid signal that more folks are using the chain — and trusting it.

And it doesn’t stop there.

Stablecoin Activity on TRON Is Heating Up

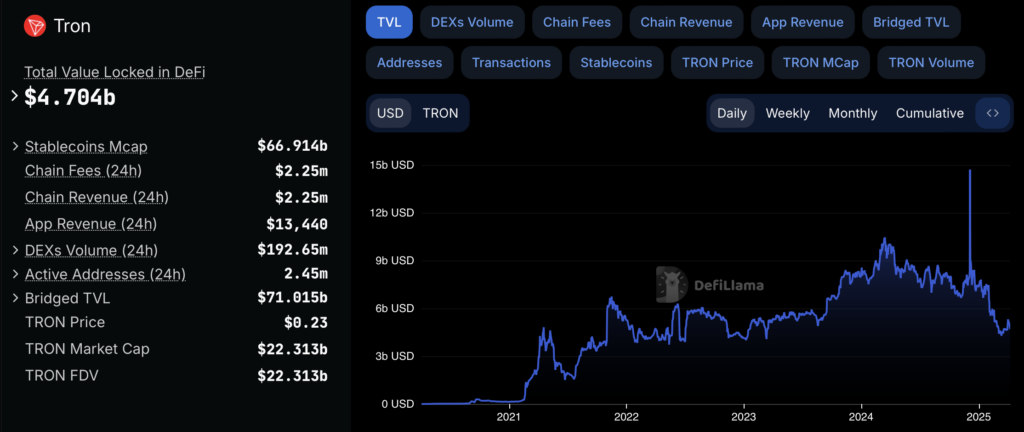

The total value of USDT and USDC on TRON has seen a steady climb since January, and that momentum isn’t slowing. As of now, the stablecoin market cap on TRON sits at $66.91 billion, per DefiLlama.

Why the growth? Probably a mix of low fees, fast transaction speeds, and — let’s be real — people chasing cheaper ways to move stablecoins. Whatever the reason, this kind of stablecoin volume boosts network usage and feeds into things like USDD’s burn mechanism. And when activity picks up like this, it often pulls more users into the ecosystem.

TRON Tops Fee Leaderboards — Seriously

In an unexpected twist, TRON actually collected more fees in the last 24 hours than Ethereum or Solana. Yep, you read that right. Data from Artemis shows TRON pulled in $1.3 million in fees, putting it at the top of the heap.

That’s not just impressive — it’s a strong sign that people aren’t just holding tokens on TRON, they’re using the chain.

Meme Season on TRON? It Might Be Coming

There’s also this wild card: the TRON meme wave. It might sound silly, but community-driven events like the TRON Meme King Challenge are stirring up activity — and memes have a track record of driving massive attention (and on-chain traffic).

Adding fuel to the fire, TRX is set to go live on Solana, according to a March 18 announcement. That cross-chain expansion could open the door to even more use cases and visibility — which only makes the current excitement that much more interesting.

TRX Price Outlook: Support Holding at $0.21

On the price front, TRX recently retested the 200-day EMA at $0.21 and found support — a good sign for bulls. As of Tuesday, it’s trading a bit higher, hovering around $0.23.

If it can break above that $0.24 weekly resistance, we might see a run toward the next major level at $0.27.

The RSI is sitting at 49, just below the neutral 50 line, but trending upward. A push above 50 would suggest that bullish momentum is picking up again. Still needs confirmation, though.

But… Watch the Downside Too

If TRX slips back below that 200-day EMA and closes under $0.21, things could turn bearish. In that case, a drop back to $0.20, the December 2 low, becomes the next likely target.

Bottom line? TRON is showing serious signs of growth — on-chain activity, fees, community engagement, and a strong price setup. If momentum holds, TRX might not stay under the radar for much longer.