- TRON price consolidates at $0.355 after rallying above $0.365, with futures data showing a neutral, non-overheated market.

- July 19 saw $1.1B worth of TRX transfers, mostly linked to exchange wallet movements, not organic retail demand.

- Broader network growth continues, but analysts caution against mistaking operational spikes for genuine adoption.

TRON’s momentum cooled off a bit after its recent climb, with TRX slipping 1.7% in the last 24 hours to trade around $0.355. This comes right after the coin broke above $0.365, marking one of its stronger runs in months. The pause looks more like consolidation than a breakdown, as analysts point out the futures market hasn’t tipped into overheated territory yet.

Futures Market Still Neutral

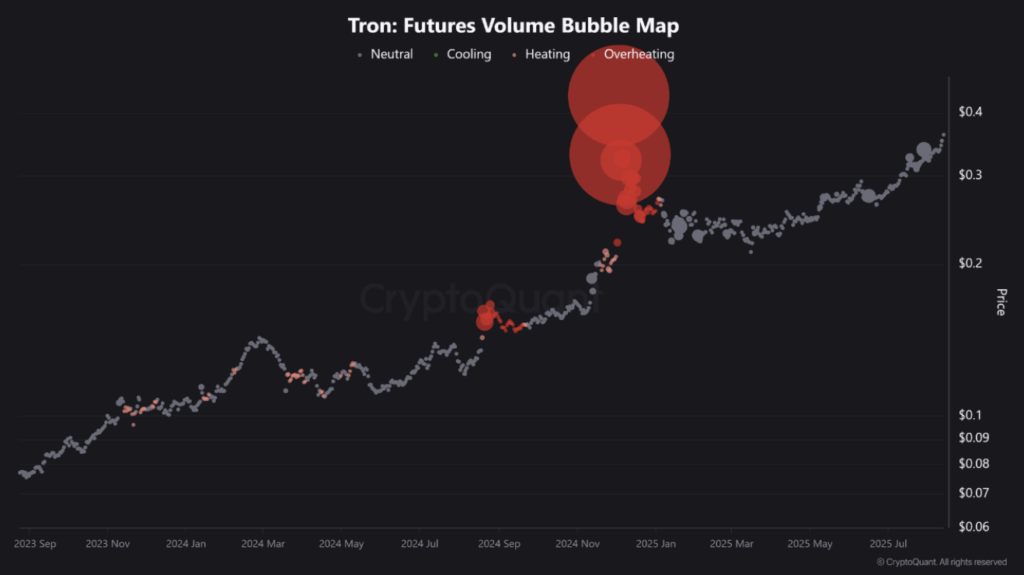

CryptoQuant contributor Burak Kesmeci highlighted TRON’s Futures Volume Bubble Map, a tool that tracks speculative excess in leveraged markets. When big red “bubbles” appear, it usually signals traders are piling in too heavily, raising risk of a pullback. The last major warning flashed in December 2024, right before TRX topped out at $0.45. Right now, the indicator is neutral, suggesting the rally has been mostly fueled by steady demand rather than short-term speculation. That balance gives TRX some room to keep pushing higher, though futures markets can flip quickly if open interest starts spiking.

On-Chain Transfers Spark Curiosity

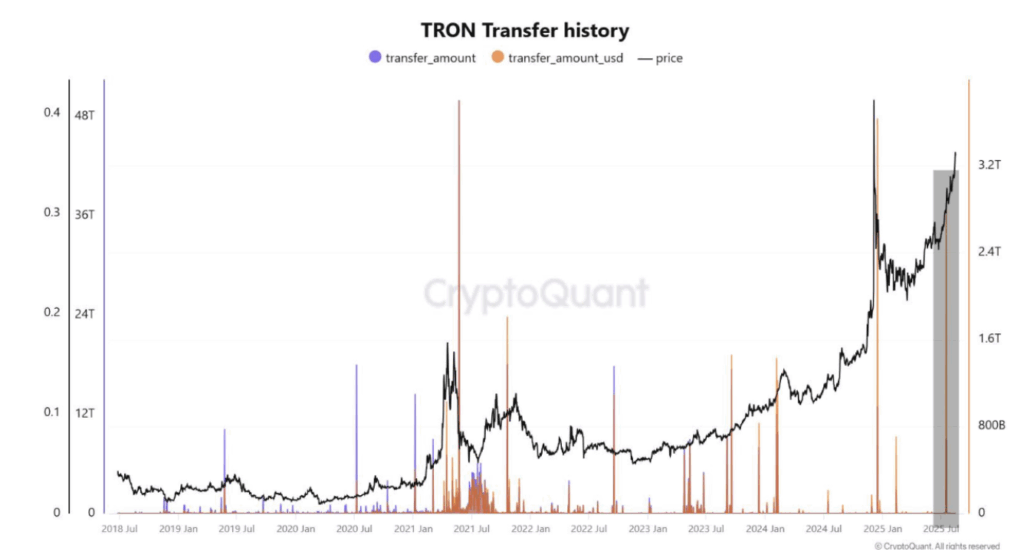

Meanwhile, analysts flagged unusual network activity on July 19, when over 3.4 billion TRX — worth about $1.1 billion — shuffled across the chain in a single day. At first glance it looked like whale activity, but a closer look revealed structured transfers between a small group of wallets. Two giant back-and-forth transfers alone accounted for more than a third of the total volume, fitting the pattern of exchange hot-to-cold wallet rebalancing. Smaller transfers in fixed amounts further reinforced that this wasn’t organic retail demand but more likely centralized custody operations.

Bigger Picture for TRON

Even with these operational spikes, TRON’s broader metrics keep expanding in 2025, from transactions per second to overall network throughput. That said, analysts warn not to confuse these exchange-linked flows with genuine user adoption. Still, with futures markets steady, whales quietly active, and its network continuing to scale, TRON looks set up for incremental gains — though traders need to watch for sudden speculative swings.