- Tron expanded its treasury by acquiring 177,587 TRX, reinforcing long-term confidence amid broader market uncertainty.

- TRX is holding near the $0.27 support zone, a level that previously triggered a 15% rally toward $0.30.

- Rising TVL above $4 billion and steady liquidity could set the stage for a breakout if $0.30 resistance is cleared.

As crypto becomes more mainstream, bear-market tremors don’t stay contained anymore. They ripple outward — into corporate treasuries, public portfolios, even traditional investor sentiment. When digital assets are woven into balance sheets, a modest pullback isn’t just a chart event. It’s a trust event.

That’s why supply control and treasury strategy suddenly matter a lot more than they used to.

Tron Buys the Dip While Liquidity Climbs

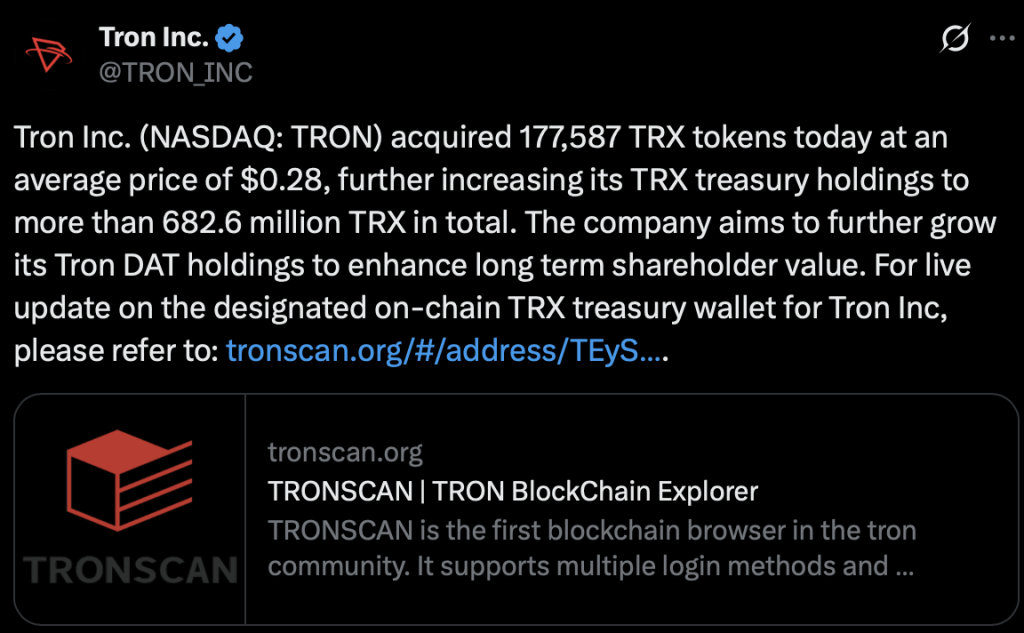

In that context, Tron made a deliberate move. The network acquired 177,587 TRX, pushing its treasury holdings above 682.6 million TRX. The stated goal? Enhancing long-term shareholder value. But strategically, it looks like something more familiar: buy into weakness, stabilize perception, reinforce confidence.

It’s a classic playbook.

At the same time, Tron’s on-chain liquidity is flashing constructive signals. Total Value Locked has risen nearly 2% in the past 24 hours, crossing the $4 billion mark. In a risk-off market, that kind of DeFi resilience isn’t trivial. It suggests capital isn’t fleeing as aggressively as headlines might imply.

Strong liquidity plus treasury accumulation sends a message — we’re not retreating. We’re reinforcing.

TRX Tests a Historically Important Floor

Technically, the timing isn’t random.

TRX is hovering near a critical support zone that, back in mid-December 2025, sparked a roughly 15% rally toward $0.30. That rally eventually got erased during the broader market crash, but the level itself hasn’t lost its memory. Markets remember floors. Traders do too.

Now, with TRX circling that same region again, Tron’s acquisitions look like a defensive maneuver designed to protect it. Combined with healthy TVL, the structure begins to resemble a “buy the fear” setup — the kind that quietly builds a base before a risk-on shift reignites momentum.

None of this guarantees upside. But it creates the conditions for it.

The $0.27–$0.30 Decision Zone

Right now, $0.27 appears to be acting as a psychological and technical floor. Treasury expansion reinforces that perception. So does on-chain engagement. When supply tightens and liquidity holds steady, it becomes harder for panic to spiral unchecked.

The real inflection point, though, sits higher.

A decisive break above $0.30 would signal that buyers are no longer just defending — they’re advancing. That’s when the narrative shifts from stabilization to expansion. In that scenario, the groundwork Tron is laying now could look less like damage control and more like positioning.

In volatile markets, confidence is currency. Tron seems intent on protecting both its token and its story. Whether that translates into a sustained breakout depends on broader risk appetite. But structurally? The pieces are being put into place.