- Someone turned $10,000 into $3 in seconds by buying the Pengu token before its official airdrop due to being routed to a low liquidity pool

- The trader placed an order using the Jupiter aggregator a few minutes before the official Pengu airdrop launch

- The trader’s order was executed at an inflated $14 trillion market cap for Pengu because of the low liquidity in the pool

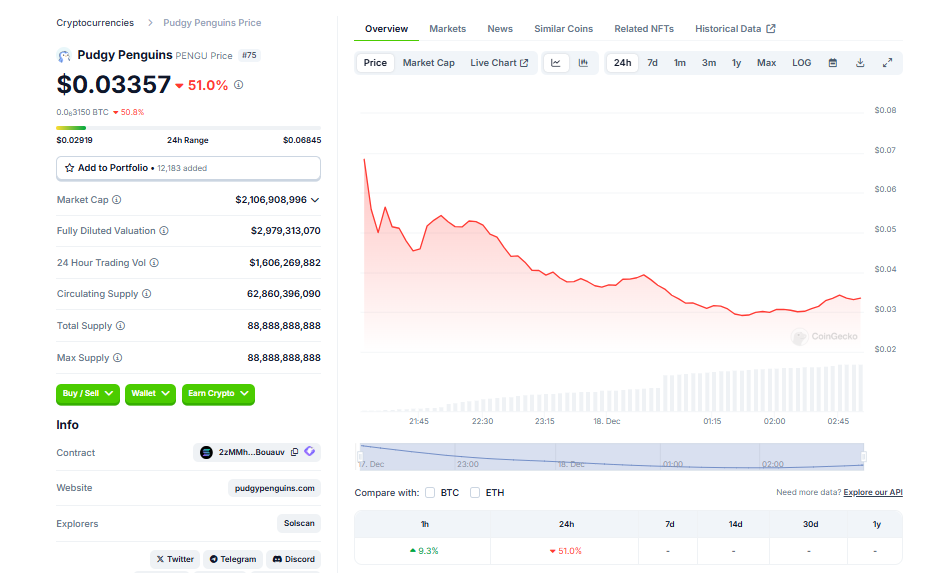

In a head-spinning turn of events, a trader turned $10,000 into a meager $3 within seconds by investing in Pengu, a token with an absurd $14 trillion market cap. This catastrophic financial mishap occurred due to a low liquidity pool that the trader was routed to via the Jupiter aggregator, right before the official airdrop.

The Pengu Trading Disaster

In the fast-paced world of crypto trading, one unfortunate trader experienced a devastating loss. Right before the official airdrop of the Pudgy Penguins Solana-based token, PENGU, the trader attempted to capitalize on the anticipated token boom. However, due to the low liquidity pool, the trader’s $10,000 investment swiftly dwindled to less than $5.

Behind The Unfortunate Trade

The trader, in an attempt to secure the lowest prices right after the airdrop, placed an order to swap over 45 wrapped Solana tokens for PENGU tokens. However, due to a quirk in the way the decentralized exchange aggregator, Jupiter, works, and the timing of the trade, the trader only received 78 PENGU tokens, worth less than $3 at the time.

The Risks of Low Liquidity

The trade, carried out before the official release of the token, was routed to an unofficial PENGU liquidity pool on Raydium. This resulted in an inflated price due to low liquidity. Moreover, at the time of the trade, PENGU had an artificially inflated market cap of $14 trillion due to the low circulating supply, further contributing to the disastrous outcome.

The Perils of Crypto Trading

While the unfortunate trader’s mishap offers a stark warning to others, it’s not the only way to lose out while trading new crypto tokens. Solana has several features and applications that make it easy to spin up counterfeit tokens, designed to trick unsuspecting traders. Additionally, other human errors like forgetting private keys or making a fat finger error can also lead to significant losses.

The Future of Pengu Token

Despite this incident, the PENGU token, owned by Igloo Inc., has a max supply of 8888 billion tokens and has a promising future with plans for listing on exchanges including Binance, Bybit, and OKX. However, eligible recipients must claim their PENGU tokens within 88 days, or they will be burned and removed from the circulating supply.

Conclusion

This incident serves as a reminder of the risks involved in crypto trading, especially in cases of low liquidity and unofficial pools. As PENGU continues to navigate the volatile crypto market, traders must exercise caution and thorough research before making their moves.