The decentralized finance (DeFi) space continues to entice many investors worldwide, even in the face of the crypto winter. The sector is set for a rebound as the cryptocurrency industry readies for the next bull run. As of October 5, 2022, the DeFi sector boasts over $60 billion in capital across the different ecosystem protocols.

The values of crypto and DeFi projects have fallen sharply this year, and many projects have been shattered in the process, making 2022 one of the worst years for cryptocurrency and decentralized finance sectors ever. However, popular perception indicates that the market is due to make its way up. The perception comes as industry pundits say crypto prices may have bottomed out, making a bounce back imminent.

As has always been the case in the history of digital assets, whenever the crypto market bounces back, a subsequent wave of investment also hits the DeFi sector, causing a surge in prices for decentralized finance projects.

Projections by conservatives suggest that the overall market size of the DeFi sectors is poised to grow at a stable 43.8% compound annual growth rate (CAGR) by 2028, which translates to a $508 billion valuation. DeFi platforms add value by eliminating the need for intermediaries such as brokers and banks, courtesy of using self-executing smart contracts that allow users to automate financial transactions such as loans and interest payments, among others.

The DeFi sector features many players, each with its potential. Among the ones investors must watch in 2023 include the following:

AllianceBlock

Founded in August 2018 by Rachid Ajaja and Matthijs de Vries, AllianceBlock is a blockchain-agnostic Layer 2 that links traditional and decentralized finance by automating converting any digital or cryptocurrency asset into a bankable product. The DeFi end-to-end infrastructure leverages decentralized technology for the accelerated growth of individuals, businesses, and projects.

Seamlessly bridging DeFi and TradeFi, AllianceBlock represents the future of finance, featuring an integrated system wherein the best of both worlds can join efforts to maximize capital flows and technological innovation. To do so, the DeFi project provides financial infrastructure made up of ready-to-deploy applications and DeFi protocols atop which projects can build and get direct access to fundamental financial mechanisms within the digital asset space.

It connects them to any project that wants to integrate decentralized tech in their business processes to reduce development complexities. This allows them to concentrate on their objectives, reducing time-2-market while enhancing relevancy.

The DeFi infrastructure platform caters to the needs of borrowers, stakers, investors looking to stake crypto, and DeFi project developers. Apart from its decentralized investment services, AllianceBlock provides trustless KYC/AML and identity verification, compliant P2P and NFT services, cross-border regulatory compliance, and an on-chain and off-chain investment data API, among other offerings.

While the DeFi industry is famous for benefits like cost efficiency and accessibility, AllianceBlock is committed to taking DeFi to the mainstream by addressing gaps such as oversight and regulation. Because traditional financial institutions are legally required to operate within a strict regulatory framework, AllianceBlock allows them to access opportunities within DeFi.

The platform enables both centralized institutions and retail investors to interact with DeFi in a regulated manner directly, thereby simplifying how users can transfer capital between traditional finance and DeFi protocols.

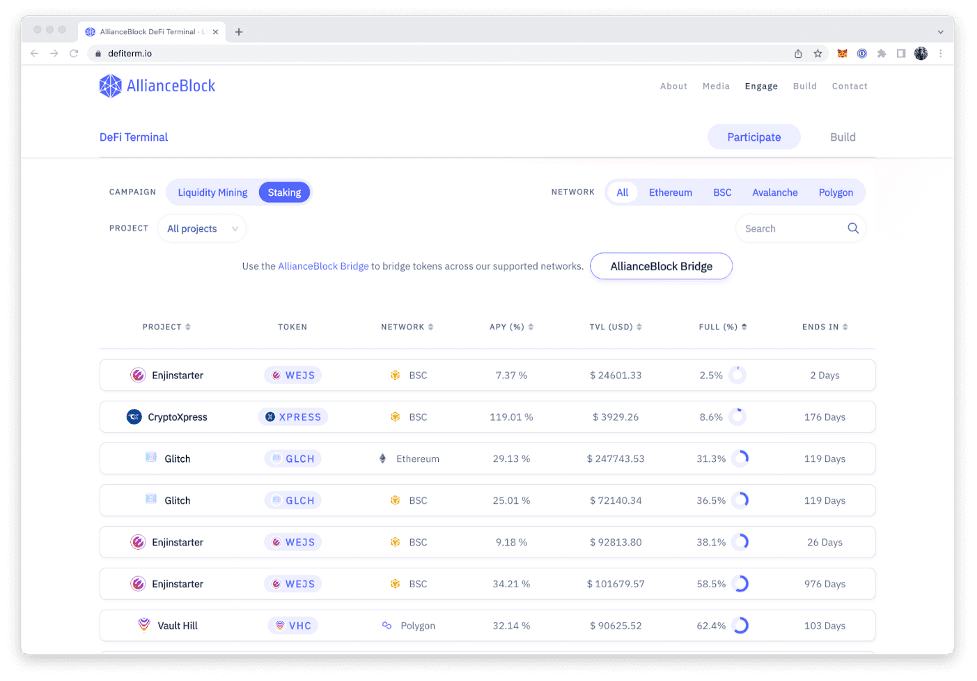

DeFi Terminal is among the most popular products by AllianceBlock. It is a service that simplifies how developers, builders, and retail users participate in the DeFi space through an integrated liquidity mining and staking platform. The product also enables staking, such that users can lock their assets within smart contracts for network transaction verification and rewards earning.

Aave

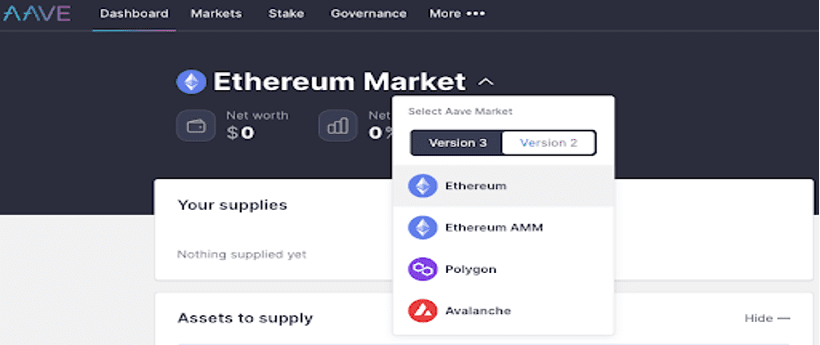

Launched in 2018, Aave and has grown to become one of the most famous DeFi platforms in the industry. Aave is a top-rated decentralized finance platform, enabling users to lend or borrow various digital assets in an entirely peer-to-peer (P2P) fashion. They avail essential financial services to everyone without the involvement of intermediaries. This is achieved through smart contract structures.

Currently, the Aave platform supports up to 26 cryptocurrency assets. These assets, inclusive of popular assets like Ethereum, Chainlink, USD Coin, and Aave (LEND), can be placed in exchange for significant profits. With over 30 pools for Ethereum-based assets and different markets on other networks, Aave gives DeFi users a wide array of choices.

The platform also features lending pools for real-world assets like freight invoices and real estate. These features are available courtesy of Aave’s partnership with Centrifuge. A DeFi protocol that allows businesses to tokenize some assets and, afterward, be traded freely, the same as bonds.

Despite meriting as one of the most trustworthy DeFi protocols in the world today, Aave continues to find ways to develop its offerings. At the start of the year, the Aave DAO voted to approve a proposal for launching GHO, a new yield-generating stablecoin. With this launch, GHO would become the native stablecoin on Aave pegged to the USD, backed by multiple digital assets.

The platform looks to use GHO to make stablecoin borrowing more competitive and generate extra revenue by transferring 100% of the interest on GHO loans to its DAO.

Aave price action has been bullish, as the cryptocurrency has soared above $75 to trade at $77.48 at press time, according to data from CoinGecko. Aave opened the trading day on Wednesday in the green, rising above the $77.46 level. This move has invalidated the previous bearish setup, putting the digital asset on a recovery path in the short term.

Orbs

Although Orbs is a relatively early project, it has consistently demonstrated a commitment to climbing the blockchain innovation ladder. Orbs platform features a unique hybrid architecture that has made it a game changer in the DeFi sector. It is strategically positioned to introduce a frontier building block in the crypto environment.

Orbs network was established in 2017 as a company before developing a mainnet launched by its network of Guardians in March 2019. At inception, the value proposition was a public blockchain infrastructure explicitly structured for enterprises.

“The platform set to bring the full value of permissionless infrastructure to enterprise business.”

While Orbs is set to serve large-scale enterprise applications, the team behind the network envisions massive opportunities in the burgeoning of its vision. To this end, the company has adapted to the shifts and opportunities presented by the fast-paced crypto market, thus DeFi, NFT, GameFi, and other emerging blockchain-based sectors.

Orbs Network operates as a decentralized backend, enabling new capabilities for decentralized finance. It works in collaboration with existing layer-1 blockchains such as Ethereum and Layer-2 networks like polygon, creating a tiered infrastructure stack for Decentralized Finance. This enables Dapps to use the network’s enhanced execution services to develop more advanced DeFi apps.

Orbs CEO Naadav Shemesh announced a new decentralized Time-Weighted Average Price protocol. This can support new order types for decentralized exchanges (DEXs), and Automated Market Makers (AMM).

“We are always looking at CeFi as a template for new protocols that can enhance our stakeholders’ experience, and TWAP (Time-Weighted Average Price) was no exception.”

ORBS price on CoinGecko was $0.03501 at the time of this writing, down by 0.3% over the last 24 hours. From a technical outlook, the value of Orbs is predicted to rise by 8.79% to hit $ 0.037577 by October 10, 2022. Although the current technical setup shows that the current sentiment is bearish, it is essential to note that cryptocurrencies have generally performed well in October. Therefore, as the price of Bitcoin is expected to rise, altcoins such as Orbs may follow suit.

Cake DeFi

Founded in 2019 and headquartered in Singapore, Cake DeFi is a decentralized platform striving to make crypto and DeFi services accessible to everyone. The platform complies with all regulatory requirements of the Monetary Authority of Singapore (MAS) and plans to educate and help investors with transparent value-adding crypto-based products and services.

The infrastructure is tailored to support three critical elements of the crypto space- staking, lending, and liquidity mining.

“We founded Cake DeFi to create an easy and intuitive platform for decentralized financial services for crypto beginners and seasoned investors. Therefore, Cake DeFi makes decentralized financial products accessible to all ages; even your mother can do it!”

These enable investors to deposit assets in exchange for earning rewards. Cake DeFi operates as a custodial portal that offers a wide range of unique features targeted at widening the usability range of crypto. Cake DeFi employs a robust DeFi Chain blockchain in backing its main functionalities within the decentralized space. This facilitates crypto trading efficiently.

Cake DeFi’s native currency is DFI. DFI tokens are reward forms distributed on the Cake DeFi platform, which makes processing transactions highly convenient for users. The DeFi Chain is a fork of the Bitcoin blockchain, bearing no connection with Ethereum, unlike the many upcoming blockchain ventures in the market today.

Unlike Bitcoin, Cake DeFi runs as an autonomous network using the Proof-of-Stake (PoS) algorithm to deliver better results.

The most famous product of Cake DeFi is EARN, a singular-sided liquidity mining service for investors looking to earn passive rewards while shielding themselves against the traditional volatility of the crypto market. EARN aims to give risk-averse investors a way to transparently make a generous investment yield while keeping the risks to an absolute minimum.

Citing Cake DeFi’s co-founder and CEO, Dr. Julian Hosp:

“EARN will allow users to get unbeatable returns on Bitcoin, which they can transparently track on the blockchain.”

Hosp believes the volatility protection feature will protect them against impermanent loss, especially in market volatility. When writing this article, Cake DeFi’s EARN token price was $0.01711 on CoinGecko.

Uniswap

Uniswap stands among the industry’s largest and most popular decentralized exchanges, operating as an essential tool for most investors in the DeFi space. Primarily, the platform provides a means for traders to exchange crypto tokens conveniently and securely while enjoying lower fees than centralized exchanges.

Users also earn passive income by depositing tokens into liquidity pools. The network employs an AMM model based on smart contracts that set prices and execute trades, thus complete decentralization and no intermediaries.

The DeFi project facilitates trading thanks to its use of liquidity pools. The pools are user-contributed funds locked within intelligent contracts and used in reducing users’ trades like buying and selling crypto pairs.

The platform collected a small fee from every transaction and distributed it among the pool’s liquidity providers (LPs). In doing so, the process benefits traders and liquidity providers.

Among the reasons for Uniswap’s success and popularity in the DeFi space include its slick and simple user interface across the web and mobile apps. Connecting to a crypto wallet is also easy. Secondly, it has a high total value locked (TVL) thanks to its expansive user base. At the time of writing the article, Uniswap was ranked 5th in terms of TVL, which stood at $5.23 billion, according to data from DefiLlama. With higher TVL comes more liquidity making it highly unlikely for users to experience any challenges when swapping different tokens.

Finally, Uniswap supports multiple cryptocurrency wallets like MetaMask, Trust Wallet, Coinbase Wallet, and Ambire Wallet, among others. The DeFi platform is straightforward to use and can cater to everyone. This explains why the platform remains among the most trusted DeFi apps in the industry.

The native token for the Uniswap platform is UNI, currently trading at $6.56 and has a daily trading volume of 168 million dollars on CoinGecko. The market cap is now $5 billion after recovering more than 90% from its low in June, which means that token holders that accumulated Uniswap in June are enjoying good returns.

Conclusion

The DeFi market is highly dynamic and competitive, with all players pushing to keep up with the latest technology. As such, projects that exhibit persistence and flexibility in adapting to new market conditions will prevail, while those that do not are at risk of being left behind. DeFi presents the perfect platform for businesses looking to be decentralized without intermediaries or brokers. Nonetheless, the above projects are likely to have a fantastic time in the future because they present as the most advanced with a potentially bright future compared to other projects.