- A single court ruling will decide the fate of roughly $150B in U.S. tariffs.

- Striking them down would act like quiet stimulus through cost relief.

- Upholding them locks in higher costs and ongoing policy friction.

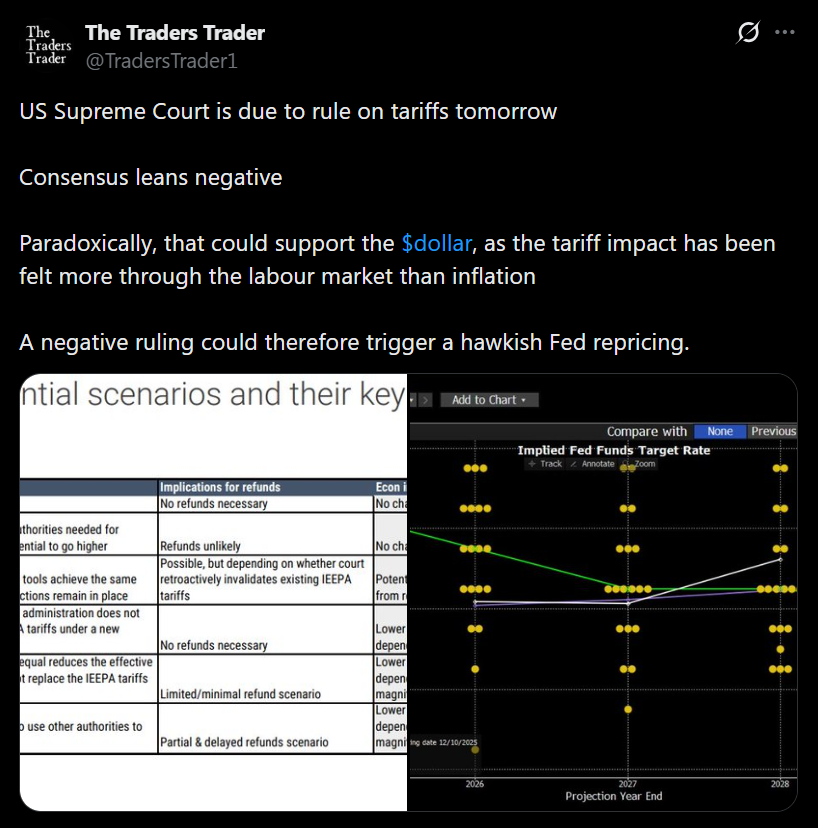

Tomorrow’s court ruling on U.S. tariffs isn’t just a procedural headline or a debate about presidential authority. It’s a real economic switch. Roughly $150 billion in tariffs are tied to this decision, and whether they stay embedded in the system or get unwound will ripple straight through margins, prices, and capital flows. Markets have learned to live with these costs, but they have not truly priced in what happens if they disappear overnight.

If the Tariffs Are Struck Down

A strike-down would act like a pressure release valve. Importers would see immediate relief, and expectations around refunds would move quickly into focus. Input costs fall without Congress passing a stimulus bill and without the Fed touching rates. That’s why markets could treat this as quiet, uncoordinated stimulus. Not flashy, not announced, but tangible. Risk assets would likely react first, with equities and cyclicals catching a bid as margins reset higher.

If the Tariffs Stand

If the court upholds the tariffs, the message is less dramatic but still meaningful. The cost structure stays intact. Supply chains remain distorted. Inflation pressure doesn’t ease. That outcome probably wouldn’t shock markets, but it would reinforce the idea that policy friction is not temporary. Businesses can adapt, but adaptation is defensive. It preserves margins, it doesn’t expand them.

Why Markets Care More Than Politics

Markets don’t care about ideology. They care about outcomes. This ruling redraws assumptions around pricing power, cost pass-through, and capital allocation in a single stroke. That’s why it matters more than most legal decisions. One ruling quietly changes the math across industries.

The Real Stakes

This isn’t about who wins in court or how the ruling is framed politically. It’s about whether $150 billion stays trapped inside the system or starts leaking back out into the economy. Either outcome will move markets. Pretending it’s just legal noise would be the real mistake.