- Tom Lee predicts Ethereum could reach $62,000 based on Bitcoin-relative valuation

- He believes tokenization will drive Ethereum’s next major breakout phase

- Analysts see improving technical momentum, but warn of downside risks

Bitmine chairman and Fundstrat co-founder Tom Lee sparked fresh debate across crypto markets this week after predicting Ethereum could surge as high as $62,000 in the coming months. Lee made the comments during a keynote address at Binance Blockchain Week, where he framed Ethereum as the core infrastructure behind the next major financial shift.

Known for his long-term bullish stance on digital assets, Lee argued that Ethereum is entering a historic moment similar to a major turning point in traditional finance.

Ethereum’s “1971 Moment” According to Tom Lee

Speaking on stage, Lee compared Ethereum’s current setup to 1971, the year the U.S. abandoned the gold standard, triggering a fundamental shift in global finance.

“Ethereum this year is having its 1971 moment,” Lee said.

He believes 2025 marks the beginning of large-scale tokenization across financial markets, driven by blockchain-based settlement rails rather than legacy systems.

“In 2025, we’re tokenizing everything. It’s not just the dollar. It’s stocks, bonds, real estate, and Wall Street is again going to take advantage of that and create products onto a smart contract platform,” he said.

Lee noted that Ethereum has traded in a relatively tight range for nearly five years, but now appears to be breaking out, prompting his firm to increase exposure to ETH.

“Ethereum at $3,000 is grossly undervalued,” he added.

How Lee Gets to a $62,000 ETH Price

Lee explained that his price target is based on Ethereum’s historical relationship with Bitcoin. If ETH simply returns to its long-term average ratio against BTC, Lee believes Ethereum could reach roughly $12,000.

But the more aggressive scenario comes if Ethereum captures a larger share of Bitcoin’s market value.

“If it gets to 0.25 relative to Bitcoin, that’s $62,000,” Lee said.

The prediction assumes Ethereum plays a dominant role in tokenized assets, institutional finance, and smart contract-based infrastructure as adoption accelerates.

Bitcoin Still Headed to $250,000, Lee Says

Alongside his Ethereum call, Lee doubled down on his bullish Bitcoin outlook. He reiterated earlier comments suggesting BTC could reach $250,000 within months, despite recent market weakness.

“I think Bitcoin is going to get to $250,000 within a few months,” Lee said, calling Bitcoin and Ethereum the two most important crypto platforms in the ecosystem.

His view aligns with comments made earlier this year by Cardano founder Charles Hoskinson, who said Bitcoin could hit $250,000 in 2026 if large corporations begin adding crypto exposure to their balance sheets.

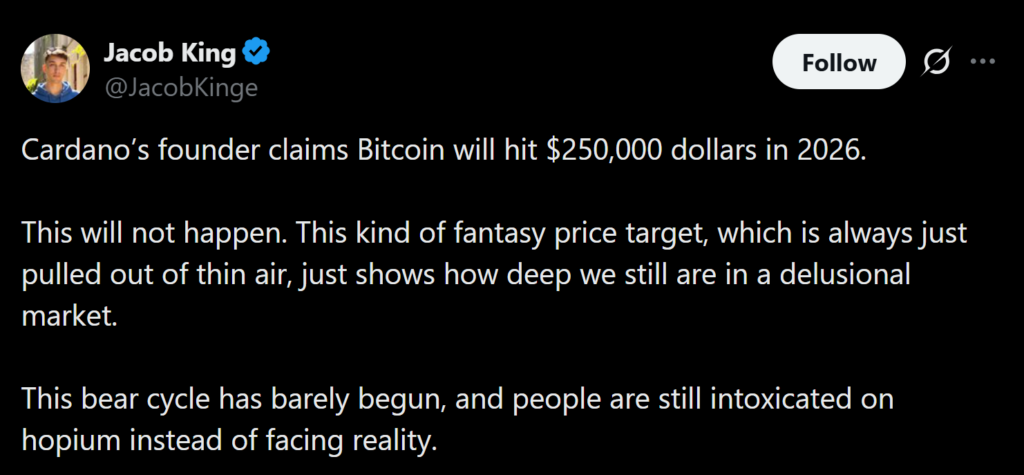

Still, critics remain unconvinced. Crypto commentator Jacob King dismissed such projections as unrealistic, arguing that markets are underestimating the depth of the current bear cycle.

Technical Analysts See Upside, With Conditions

While Lee’s price targets stirred controversy, some analysts point to improving technical signals for Ethereum, though risks remain.

CCN market analyst Victor Olanrewaju noted that ETH recently broke above the upper trendline of a falling wedge pattern on the daily chart, a setup often associated with bullish reversals.

“If this trend continues, ETH could breach resistance at $3,541,” he said, adding that a move above that level could open a path toward $3,876.

However, Olanrewaju cautioned that the breakout must hold. A failure to maintain momentum could quickly invalidate the bullish structure.