- Ethereum is testing multi-month support on the ETH/BTC pair while multiple analysts expect ETH to outperform Bitcoin from this zone.

- Exchange balances for ETH have dropped to an all-time low near 8.84% of supply, signaling a historic supply squeeze driven by staking, restaking and L2 usage.

- Key price zones between roughly $2,482 and $2,616 act as strong support, with upside targets stretching toward $3,336 and potentially into the $4,800–$4,800+ region if momentum returns.

Ethereum’s price action grabbed a lot of attention on Dec. 5, mostly because several technical signals suddenly lined up at the same time. Traders noticed what analysts were calling one of the tightest supply squeezes Ethereum has ever seen on centralized exchanges—something that doesn’t happen quietly. Add that to a few emerging chart setups, and it felt like the market was quietly laying the groundwork for a bigger move.

All of this happened while crypto markets were still trying to catch their breath from Bitcoin’s messy volatility and the wider macro noise that’s kept traders on edge. Even so, analyst Michaël van de Poppe pointed out that Ethereum had carved out a clean higher-timeframe support level. He called it the first solid step toward a broader reversal, and hinted that ETH could finally begin outperforming BTC again—a theme he’s been watching for months.

ETH/BTC Tests Multi-Month Support Zone

The ETH/BTC pair hovered around 0.03440 satoshis, sitting right above a major support region that’s held almost the entire year. The structure even looks like a potential double-bottom forming—price tapped the same range once earlier, then returned for a second hit without breaking down. That zone between roughly 0.026 and 0.034 satoshis has acted like a magnet all through 2024 and into 2025.

If this level holds, van de Poppe sees room for ETH to climb toward 0.055 BTC—a move that would mean a roughly 60% gain relative to Bitcoin. On the daily chart, ETH is still trapped under a descending trendline dating back to mid-2024, but price is consolidating right underneath that resistance. Traders like these kinds of compressions because once price decides which way to break, the move tends to hit fast.

Exchange Balances Hit Record Lows

Milk Road highlighted something even more dramatic happening behind the scenes: Ethereum’s exchange supply hit an all-time low of just 8.84% on Dec. 5. That’s an insanely tight supply environment. For comparison, Bitcoin still sits around 14.8% supply on exchanges—nearly double.

The shrinking ETH supply reflects something deeper than just investor mood. Tokens are flowing into staking contracts, restaking protocols, layer-twos, data availability layers, collateral loops, and long-term custody setups. These flows aren’t “price hype” flows—they’re structural. They remove ETH from circulation, sometimes permanently.

What’s interesting is that sentiment across the market felt pretty heavy in early December, yet exchange outflows didn’t slow down at all. Supply kept tightening even while traders argued over macro headlines.

Historically, when exchange balances fall this sharply and stay low, the next strong rally often comes out of nowhere—because once buyers need liquidity, there’s barely any left.

Technical Targets From $3,336 to $4,885

Trader Crypto Caesar mapped out the key levels he’s watching. His ETH/USDT chart shows price in the $3,000 region testing support at $2,616. Resistance overhead sits much higher, stretching into the $4,789–$4,885 zone, which lines up with the 2024 weekly high.

Caesar also pointed out that ETH broke out of a long-term descending channel earlier in mid-2024. That breakout created the foundation for the current consolidation. Now price is compressing within a cleaner range, waiting for either a clean break upward—or a deeper retest of support.

The support range between $2,482 and $2,616 has produced multiple strong rallies before. If ETH continues to respect this zone, the next leg could aim toward the mid-$4,000s.

Will Ethereum Deliver Sustained Gains?

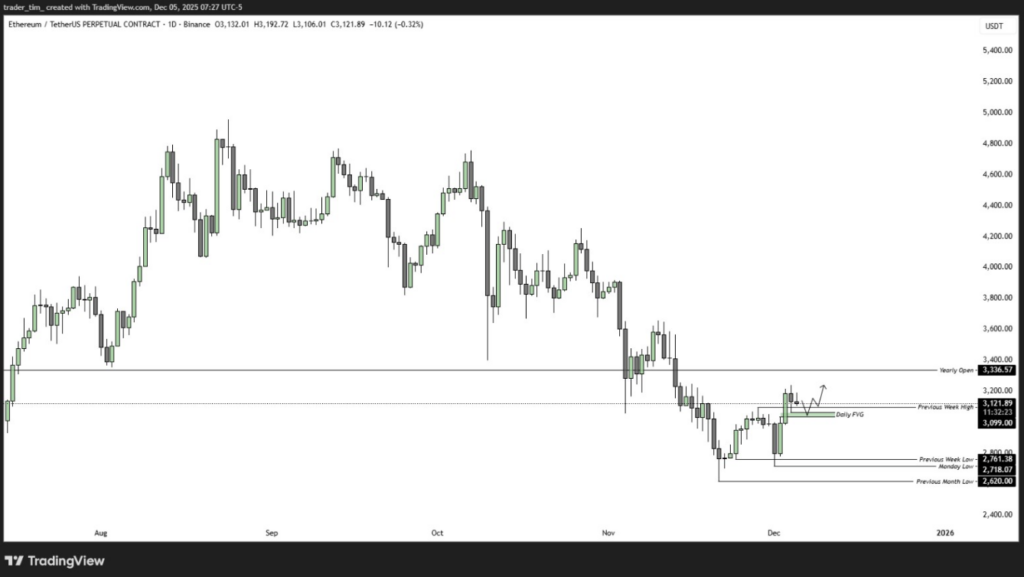

Short-term trader Tim added his perspective: even though Bitcoin’s chart still looks fragile, Ethereum is showing relative strength. In fact, he said ETH is the only pair he’s considering for long positions right now.

On his four-hour chart for ETH perps, price was trading near $3,067—just above last week’s low at $2,761 and the monthly open near $2,943. He highlighted a daily fair-value gap from $2,943 to $3,064 that historically attracted algorithmic buying. That’s his preferred entry zone.

Targets? The previous week’s high at $3,099 and the yearly open at $3,336.

Tim admitted the setup feels “uncomfortable” because Bitcoin looks weak—but emphasized that ETH’s daily structure remains intact and the risk-reward is still better than most large-caps.

Ethereum’s Supply Squeeze Could Become a Long-Term Tailwind

ETH is currently consolidating above major support while exchange supply hits record lows. Analysts across multiple timeframes see constructive structures forming, even though market sentiment hasn’t fully recovered yet.

Whether this combination turns into a sustained rally depends mostly on Bitcoin stabilizing and broader risk appetite returning. But with ETH being locked away in staking, restaking, L2 ecosystems, and long-term storage, the structural supply constraints seem unlikely to disappear—even if sentiment swings around in the short term.

When the market eventually shifts, Ethereum may not have much liquid supply left to meet demand.