- Solana-based memecoins like Dogwifhat, Bonk, Myro, and Popcat have rallied double-digits in the last 24 hours despite the crypto downturn.

- The 7-day average of daily active addresses on Solana spiked to a multi-year high this week, signaling growing network usage.

- Altcoins like Solana’s SOL and Binance’s BNB have sustained gains, while Bitcoin saw a slight 3% retracement in the last 24 hours.

Solana has sustained its rally over the past 24 hours, defying a downturn in the wider cryptocurrency market. The altcoin’s native token, SOL, has gained over 5% in the last day, while the overall crypto market cap has dropped more than 2%.

Solana-Based Memecoins Drive Market Activity

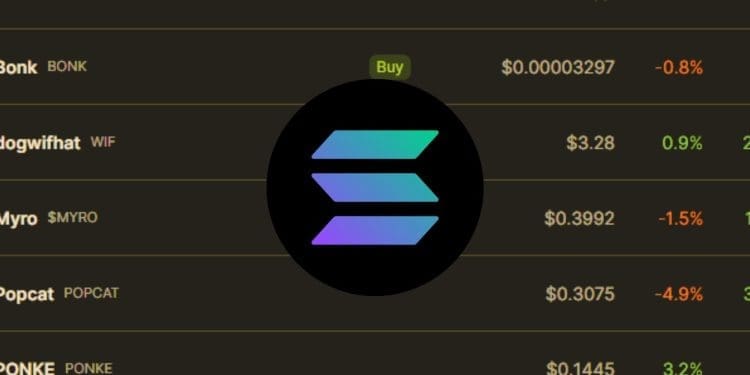

Much of the trading activity on Solana is focused on the network’s memecoins. Top memecoins by market cap on Solana like Dogwifhat, Bonk, Myro, and Popcat have all posted impressive double-digit gains in the last 24 hours. According to experts, meme coins are flourishing on Solana due to their fun nature and easy accessibility.

Daily Active Solana Addresses Spike to Multi-Year High

In a sign of growing network usage, the 7-day moving average of daily active addresses on Solana has reached its highest level in years. The number of unique addresses signing transactions on Solana jumped from around 660,000 to over 1 million from Tuesday to Wednesday this week.

BNB Bucks Downtrend with Daily Gains

Binance’s BNB token is another altcoin sustaining gains amidst the broader crypto pullback. BNB has posted a more modest 1% increase in the last 24 hours. Analysts have observed significant overnight rotations of capital from bitcoin and ether into large-cap altcoins like BNB and SOL.

Bitcoin Sees Slight Retracement

Compared to Solana’s rally, bitcoin has pulled back slightly after gaining earlier this week. The largest cryptocurrency by market cap has dropped 3% in the last 24 hours and was trading around $70,825 at the time of writing. Meanwhile, bitcoin’s 7-day average trading volume across major exchanges has fallen over 18% from its recent multi-month highs.