Metaverse Sandbox is set to debut a new round of fundraising valued at $4 billion, according to sources familiar with the topic. The firm plans to raise around $400 million through the sale of new and existing shares.

Finding Big Investors for Bigger Development

According to a blog comment from the company, it is in negotiations with potential investors. The value and size of the forthcoming investment round might fluctuate based on market conditions and investor demand in the future.

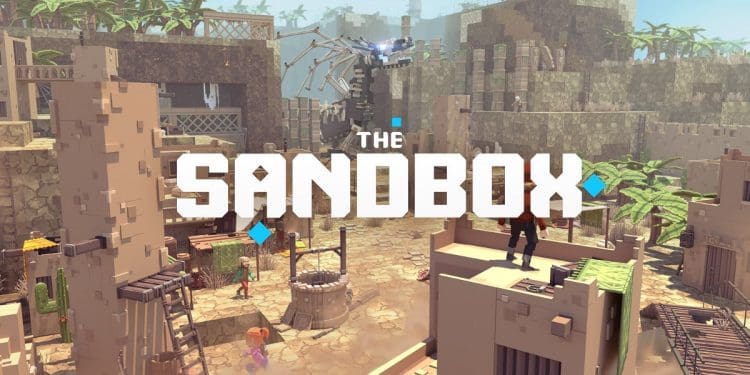

A play-to-earn platform based on the Ethereum blockchain, like Decentraland, allows gamers to purchase, sell, trade, and own virtual assets, usually as NFTs.

In Sandbox, gameplay consists of users exploring the game’s environments and purchasing a piece of LAND. A plot of land on the platform or an Ethereum ERC-721 token is referred to as LAND in the Sandbox.

A Rise to the Top

The Sandbox’s most notable achievement was the release of its two namesake mobile games, which have had over 40 million downloads. The organization subsequently moved into the blockchain industry by creating a platform for user-generated content that included a market where NFTs could be purchased. The project was able to raise $2 million in seed funding from investors such as True Ventures, Algorand, and gumi Cryptos.

The company plans to use the funds to expand its team, continue marketing efforts, and accelerate product development. The Sandbox also has plans to launch an initial coin offering (ICO) in order to fundraise for the project.

An ICO is an unregulated means by which funds are raised for a new cryptocurrency venture. A cryptocurrency investor receives tokens in exchange for investing fiat currency or cryptocurrency.

The firm revealed that it was in talks with potential investors and planned to raise $4 billion in a new round of funding. Sources familiar with the matter stated that the company plans to sell new and existing shares, which would value the firm at around $400 million.

The Sandbox ecosystem now has over 2 million registered members, which they acknowledged with the release of their new build, Alpha Season 2. HSBC, a prestigious bank with operations across the world, is one of its most active users and recently acquired real estate in the Sandbox (LAND) under a collaboration agreement with the project. The Sandbox team will also participate in HSBC’s Blockchain Accelerator Program to help promote the use of blockchain technology across different industries.

Beyond the Gaming Atmosphere

The project has been backed by strong partnerships and a lot of interest from within the gaming industry. Game studios such as Square Enix, The Sandbox Partners, Unity Technologies, and Pixowl have all partnered with The Sandbox. These companies will help to bring their user-generated content (UGC) experiences and games to the blockchain platform.

The value and size of the forthcoming investment round might fluctuate based on market conditions and investor demand in the future.

A play-to-earn platform based on the Ethereum blockchain, like Decentraland, allows gamers to purchase, sell, trade, and own virtual assets, usually as NFTs.

In Sandbox, gameplay consists of users exploring the game’s environments and purchasing a piece of LAND. A plot of land on the platform or an Ethereum ERC-721 token is referred to as LAND in the Sandbox.

The Sandbox’s most notable achievement was the release of its two namesake mobile games, which have had over 40 million downloads. The organization subsequently moved into the blockchain industry by creating a platform for user-generated content that included a market where NFTs could be purchased.

High-Profile Investors Coming In

Adidas and Carrefour SA, among other multinational companies, have purchased sites in the Sandbox.

Warner Bros. also managed to purchase land in the Sandbox for virtual concerts and exclusive events.

Snoop Dogg debuted his first blockchain-created music video. His digital version performed for his new song “House I Built,” which was released earlier this month – all shot inside the Metaverse.