- BIS innovation hub will be launching Pyxtrial, a stablecoin monitoring project.

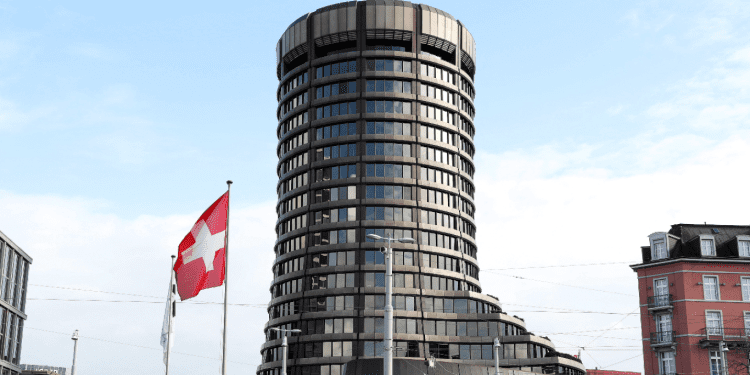

- The Switzerland-based bank revealed its groundbreaking plans for 2023, citing global central banks’ awareness as its reason.

- BIS believes that CBDCs in payment systems are an important aspect of exploration.

The Bank for International Settlements (BIS) announced its plans for 2023 in a report via its Innovation Hub.

The report stated that the “bank for central banks” will be delving more into experimenting and developing CBDCs (Central Bank Digital Currencies) through its research and development unit and launching a new project to oversee stablecoins.

On February 7, the Switzerland-based bank published an article reporting that its Innovation Hub will focus on CBDCs to boost payment systems. The goal of the BIS (Bank for International Settlements) is to shape the future of financial regulation and supervision.

In the report, the BIS explains that one of its projects this year includes ‘Project Pyxtrial,’ which will be an experiment launched by the Hub’s London Centre to enable the systemic supervision of stablecoins.

What is Project Pyxtrial?

According to the Bank for International Settlements, the project Pyxtrial aims to create a platform to monitor stablecoin’s balance sheets.

“Most central banks lack tools to monitor stablecoins and avert asset-liability mismatches systematically,” the report reads.

The project Pyxtrial will be used to investigate multiple technological tools that will assist regulators and supervisors in developing policy frameworks centered on integrated data.

Launched in 2019, the Bank for International Settlements’ Innovation Hub (BISIH) has collaborated with Central Banks worldwide to accomplish 5 CBDC projects with 21 ongoing projects.

The Innovation Hub aims to increase the integration of its international network with additional cross-center projects, including Mariana —a project that connects the upcoming Eurosystem centers and Singapore Swiss.

BIS Comment on Experimenting with CBDCs

The BIS explained that CBDCs or digital currencies and payment system improvements are essential to exploration as they accounted for 15 of the 26 active projects in the last few years.

The Switzerland-based bank for central banks emphasized that the reason for cross-border payments systems was reflected in the interests and priorities of the G20 countries.

Moving on with the knowledge obtained from wholesale CBDC projects, the Innovation Hub plans to experiment with retail central bank digital currencies such as “the technology architecture of two-tiered distribution model called ‘Aurum.’“

Additionally, the BIS mentioned that its ongoing experiments reveal how wholesale and retail CBDCs and the interconnection of domestic payment systems can provide affordable, transparent, and faster cross-border payments.

The BIS announced that it was also focusing on projects to shape the future of supervision, regulation, and finance. An example of these projects includes:

- Cryptocurrencies and decentralized finance.

- The development of tools for overseeing financial markets in real-time.

- Other regulatory purposes.

BISIH boasted of its cyber security portfolio expanding with multiple projects targeted at “exploring the cyber resilience of CBDCs.”

Conclusion

The BISIH promised to take its advancement to the next level by working on other significant initiatives, such as the “BIS Innovation Network.” With its recent announcement, the BIS Innovation Hub has admitted that it would not be left behind in developing CBDCs.