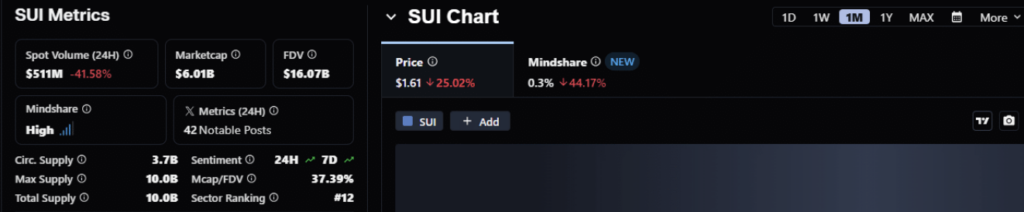

- Sui’s spot volume dropped about 42% to $511M, showing weaker short-term trading momentum even as the long-term structure still leans bullish.

- ZenLedger’s new integration brings automated tax, accounting and audit tools for SUI across 300+ exchanges and 40+ chains, boosting real-world usability.

- TVL remains steady around $923M while Open Interest jumped by $15M to about $747M, signaling cautious but growing interest from larger players.

Sui is kinda drifting through a weird market phase right now, almost like it’s stuck between gears. Its spot trading volume suddenly dipped hard — roughly 42% — landing at about $511 million in the last 24 hours. Not great. And honestly, that drop says a lot about what short-term traders are not doing. They’re pulling back, and the chart’s starting to show those little cracks too.

The daily momentum that was building up just a few days ago? Yeah… it’s fading a bit. But strangely enough, the bigger long-term picture still leans bullish for SUI, even if the near term feels kinda sluggish.

Still, even with the softer activity, the Sui ecosystem just got a pretty meaningful upgrade — the kind that could shift vibes and maybe, just maybe, nudge sentiment back in a better direction.

ZenLedger integration hits at the right moment

So, right on time, Sui announced through its official channels that ZenLedger is now integrating SUI into its platform. And this isn’t a small tweak. We’re talking full-on tax automation, accounting features, audit workflows… the works. It covers 300+ exchanges and over 40 blockchains, making it one of the most complete reporting stacks available to SUI users right now.

For an ecosystem trying to push real-world usability and make trading less of a headache, this kinda upgrade couldn’t land at a better moment. Taxes are always a messy pain in crypto — everyone knows it — so solving even part of that friction makes SUI more appealing for both regular users and bigger institutional players.

Will better utility wake up the activity?

While upgrades like this are great for long-term growth, traders usually react to faster-moving triggers: liquidity spikes, volatility, yield boosts, that sort of stuff. And honestly, SUI’s metrics aren’t exactly exploding at the moment.

Total Value Locked has barely moved, slipping just 1% in the last day to around $923 million. That means capital in the ecosystem is holding steady… but not growing yet. It’s a cautious stance from the market, not a vote of no confidence.

And even flat TVL isn’t a bad thing — the amount locked is still large enough to give long-term holders some comfort that SUI’s DeFi backbone is solid.

On the institutional side though, things look a bit more lively. After the ZenLedger announcement, SUI’s Open Interest jumped by about $15 million within a day. That bump pushed the total OI across all exchanges to roughly $747.78 million, which is a pretty decent sign that bigger players are paying attention.

SUI’s in a wait-and-see zone

So right now, SUI feels like it’s sitting at one of those crossroads where fundamentals are improving but trader participation is cooling off. The ZenLedger integration could help re-ignite activity — fewer headaches usually means more confidence, and more confidence often leads to more trading.

The long-term trend still leans bullish, but in the short run, traders are probably waiting for either a rebound in spot volume or fresh liquidity inflows before they commit to any strong move.

For now… it’s a patience game. A slightly awkward one, but still leaning optimistic.