- Over $17M in SUI has moved off exchanges in the past week, signaling steady accumulation by longer-term holders.

- Traders are leaning heavily long, with leveraged bullish positions far outweighing shorts near key levels.

- A daily close above $1.75 could unlock a move toward $2.20, supported by strong trend momentum.

Fresh derivatives data is starting to tell a story that the SUI price chart alone doesn’t fully capture. According to CoinGlass, more than $17.17 million worth of SUI has been pulled off exchanges over the past week. That kind of outflow usually isn’t random. It tends to show accumulation, especially when it happens during choppy market conditions like these.

In simple terms, a growing number of holders appear to be moving SUI into wallets instead of leaving it on exchanges. That behavior often lines up with investors positioning early, not chasing momentum later.

Where Traders Are Focused Right Now

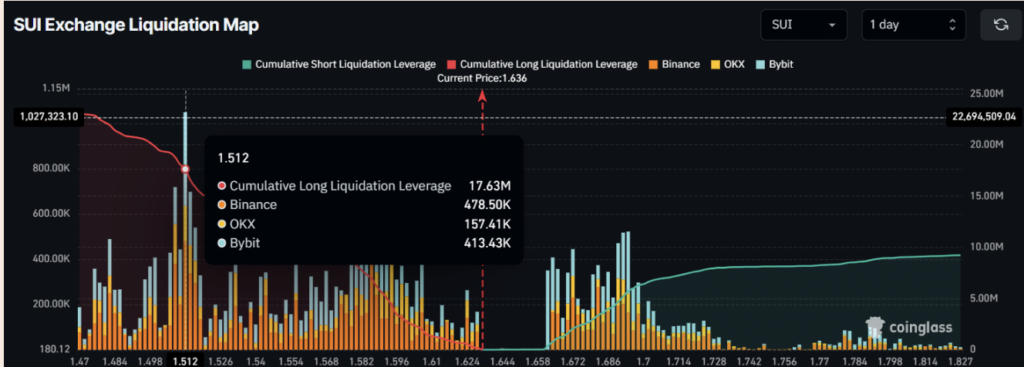

Zooming into derivatives, the liquidation map highlights two key zones that matter most in the short term. On the downside, $1.512 stands out as the main level where long liquidations would cluster. On the upside, $1.694 marks the zone where short pressure could kick in.

Bullish sentiment around SUI has been heating up, and not quietly either. The token has benefited from steady accumulation, rising long bets, and a broader recovery across the crypto market. At press time, SUI trades near $1.64, up 6.35% on the day.

That said, participation has cooled slightly. CoinMarketCap data shows 24-hour trading volume dropped 22%, falling to around $831 million. Even with price pushing higher, lower volume suggests traders are staying cautious, likely waiting for clearer direction.

ETF Inclusion Adds a New Source of Demand

One of the biggest catalysts behind SUI’s recent strength is its addition to the Bitwise 10 Crypto Index ETF (BITW). The fund began trading on NYSE Arca on December 10, 2025, and its latest allocation shows 0.24% exposure to SUI, roughly $2.4 million at launch.

That might sound small, but ETF flows tend to be sticky. Once included, assets benefit from ongoing rebalancing and passive inflows, which can quietly support demand over time.

Traders Lean Long as Accumulation Continues

Derivatives positioning adds another layer. CoinGlass data shows a clear skew toward long positions, with the market looking slightly over-leveraged in the short term. Around the $1.512 to $1.694 range, traders have built roughly $17.63 million in leveraged longs, compared to just $5.72 million in shorts.

That imbalance points to strong intraday bullish conviction. It also explains why price has remained relatively firm despite lower spot volume.

At the same time, longer-term holders appear confident. The $17.17 million weekly exchange outflow reinforces the idea that buyers aren’t just trading — they’re holding.

Price Structure and What Comes Next

From a technical perspective, SUI’s recent push has brought it back above a key support zone near $1.60. As long as that level holds, the structure remains constructive.

Based on historical behavior, a clean daily close above $1.75 could open the door to another leg higher. If that breakout sticks, a move toward $2.20 — roughly a 26% upside — comes into view.

Momentum indicators support that idea. The ADX sits at 26.68, above the key 25 level, signaling that the current trend has strength behind it.

For now, SUI sits in an interesting spot. Accumulation is rising, traders are leaning bullish, and institutional exposure has arrived via ETFs. Volume has cooled, yes — but that hesitation may be exactly what allows the next move to build quietly before it shows up on everyone’s chart.