- Sui rebounds after chaos: Despite a massive DEX exploit and sharp liquidations, SUI held above $3.30, showing strong support backed by dev activity and rising DEX volume.

- On-chain strength remains solid: TVL bounced back to $1.68B, stablecoins stayed above $1B, and the community swiftly recovered $162M in frozen funds after a 90% approval vote.

- Traders eye next leg up: With smart money signals flashing and bullish sentiment returning, SUI could push toward $4.10—if it breaks past the $3.60–$3.75 resistance zone.

After getting rocked by liquidations and a DEX exploit, Sui (SUI) is finding its footing again. Price has been hovering just above $3.30, holding a key technical level while the network quietly regains strength. Developer activity’s still going strong, and with some big macro stuff in play—like a potential Fed pivot later this year—traders are watching for that $4.10 mark. A few are even tossing around $4.50 as a stretch target, assuming momentum sticks.

Ecosystem Rebuilds After the Cetus Shake-Up

Even after the $223M Cetus DEX exploit, the Sui community didn’t waste time responding. Over 90% voted to recover $162M in frozen assets, now sitting in a multisig wallet waiting for distribution. Despite the chaos, TVL dropped but then bounced from $1.54B to $1.68B. That’s not a small move. Stablecoin supply stayed firm above $1B—so liquidity didn’t dry up, which is a good sign. Daily DEX volume is also back on the upswing, from $178M to nearly $272M. Devs are still building, users are still around, and the network’s not skipping a beat.

SUI Price Holds Fib Support, Traders Eye Breakout Zones

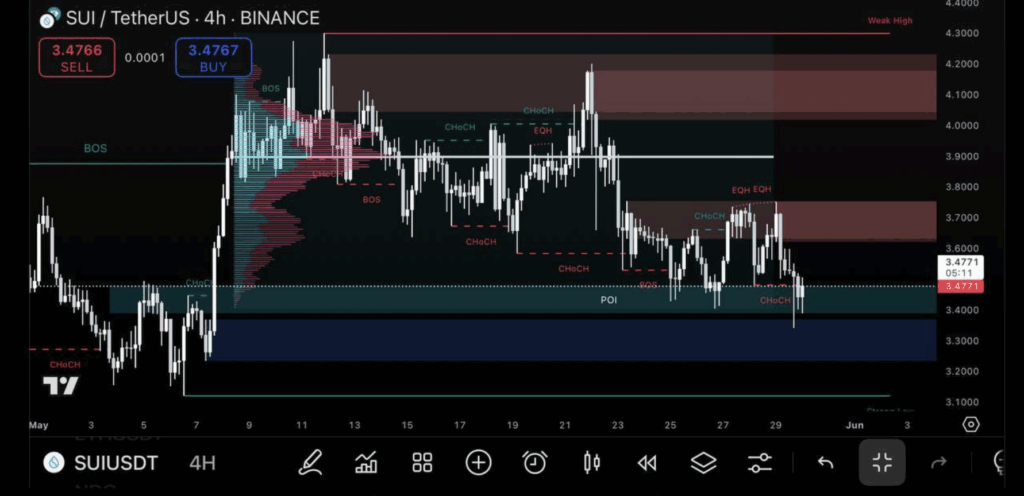

Right now, SUI’s chillin’ at $3.44—right on the classic 0.382 Fib level. Buyers have been holding down the $3.30 to $3.45 range pretty tightly, and if it holds, that could mean another leg up. First checkpoints? Around $3.75, maybe $4.10 if momentum clicks. Analyst Kamil thinks we’re in an accumulation zone—smart money moves like BOS (Break of Structure) and CHoCH (Change of Character) suggest bullish intent. Still, short-term resistance might pop up around $3.80–$3.90 where liquidity traps tend to happen.

Market Shakeouts Clear the Board—Now What?

That $16M liquidation wave wiped out a bunch of longs fast. Open interest dropped nearly 15%, so the leverage got flushed. But bigger picture? Traders on Binance and OKX are still leaning long, hard. The long/short ratio is 2.11 by volume for top Binance traders—people are still betting on upside. Funding rates have turned positive again, and some shorts got wrecked recently. If SUI breaks past $3.60 with good volume, that $4.10 target might come into view faster than expected. If not, buyers will probably look at reloading around $2.91 or $2.33—major Fib levels.

Fed Watch and Déjà Vu from 2017

Macro-wise, things feel a bit like 2017 again—big spikes, big drops, everyone trying to guess the next move. Global markets are still jittery, and traders are watching the Fed’s next steps. Some say we might see a shift by late Q4, which could open the doors for a crypto rally. Until then, SUI has to hold its base—anywhere between $3.10 and $3.30 might be a springboard. If that floor holds and volume picks up, SUI could be prepping for a fresh leg up, with $4.10 still in sight. Maybe even higher, if stars align.