- Sui surged over 21% to $1.61 after Coinbase officially enabled trading for New York residents, expanding SUI’s reach into one of the most regulated U.S. markets.

- Technical indicators show early bullish signs, with the MACD approaching a positive cross and RSI rebounding from oversold levels.

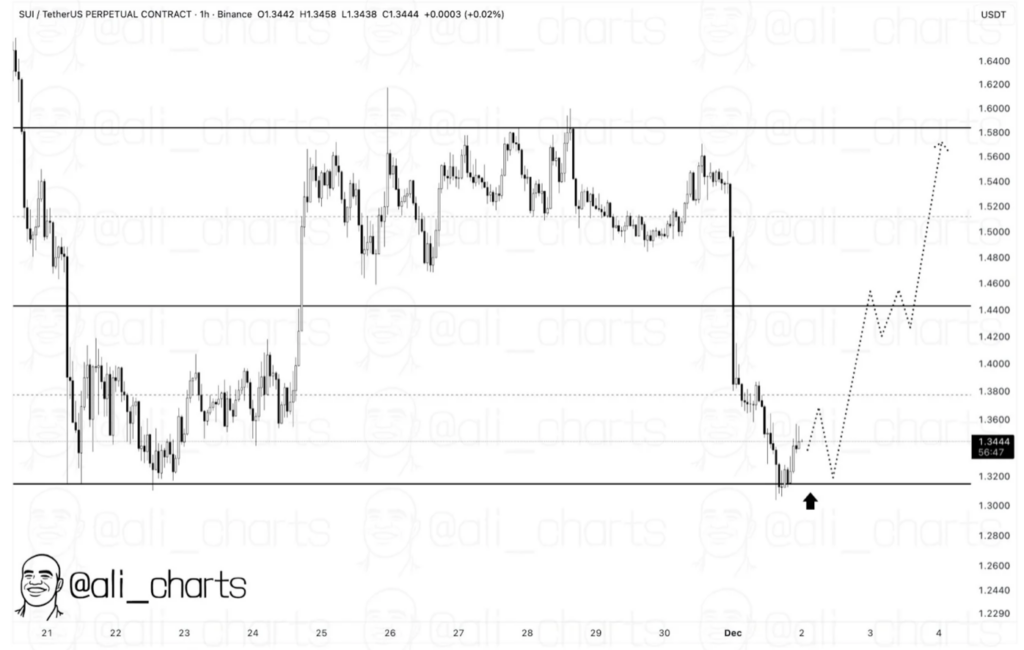

- Analysts highlight a major support zone that could send SUI above $1.60 and potentially spark renewed institutional and retail interest if buyers hold the line.

Sui (SUI) has been running hot over the past day, almost catching a second wind as market conditions flipped in its favor. The token is sitting around $1.61 right now after a pretty sharp 21% jump in just 24 hours—one of those sudden moves that feels like it came out of nowhere, but also kind of didn’t. Momentum has been building underneath for a bit.

One big catalyst slipped in quietly: Coinbase Markets confirmed that SUI is now officially available to New York residents. That means users across Coinbase.com and its mobile apps in one of the toughest, most highly regulated states in the U.S. can finally buy, sell, and trade SUI freely. It’s a big milestone—not just legally but symbolically—as the project inches deeper into the mainstream.

Sui’s identity as a fast, developer-friendly layer-1 chain already gives it a unique appeal, but now with access opening up to New York’s compliance-heavy environment, adoption could spread faster. Coinbase’s strict regulatory framework gives SUI a stamp of legitimacy that many smaller blockchains never get. And for Sui, it’s another sign that the U.S. market is starting to take the project more seriously.

Technical Outlook: Signs of a Bounce Are Forming

The chart shows that SUI hasn’t exactly had an easy run since mid-October. Price kept sliding beneath the 20-period moving average and even dipped under the lower Bollinger Band, hinting at how oversold things became. But late November brought a quick snapback—from around $1.12 up to above $1.59—showing that buyers were willing to step in aggressively once SUI hit that lower limit.

Momentum is starting to shift too. The MACD line is creeping toward a bullish cross, and the histogram has flipped positive, which is usually one of those early signals traders watch for. Meanwhile, the RSI, which was deep into oversold territory below 30, has crawled back to roughly 35, showing that selling pressure is finally cooling off. Still, a full trend shift will only be confirmed once SUI breaks above the mid Bollinger Band near $1.90. Until then, this is more a recovery attempt than a full-on reversal.

Strong Support Zone Could Trigger a Move Above $1.60

Crypto analyst Ali pointed out that SUI is sitting right on a major support level that could define its short-term direction. Holding this area is crucial; losing it would likely open the door to further selling and break whatever optimism the market has rebuilt over the past few days. Traders tend to watch levels like this closely because they often become psychological turning points.

If SUI manages to maintain its footing here, analysts say it could stage a quick push back toward the $1.60 region—or even slightly above—strengthening the case for a broader comeback. A clean break through this zone wouldn’t just boost technical indicators; it could also pull in more retail and institutional interest, especially now that SUI is tradable in New York. That kind of psychological lift often creates a ripple effect across the chart.

For now, the token sits at an important crossroads. Support is holding, momentum is shifting, and sentiment is warming—but the next move depends on whether buyers can defend this zone long enough for the trend to flip.