- Strategy (MSTR) bought 15,355 more Bitcoin last week, spending about $1.42 billion.

- Their Bitcoin stash now totals 553,555 BTC, worth over $52 billion at current prices.

- MSTR funded the purchase by selling stock and saw a 1.5% pre-market share boost.

Strategy (MSTR) just went on another Bitcoin shopping spree — grabbing 15,355 BTC over the past week, according to a fresh filing that dropped Monday. They shelled out around $1.42 billion for the purchase, paying an average price of about $92,737 per coin.

MSTR’s Bitcoin Hoard Keeps Growing

With this latest haul, Strategy’s total Bitcoin holdings have now climbed to 553,555 BTC, valued at a jaw-dropping $52 billion with Bitcoin trading just above $95K right now.

Their average buy-in price across the whole stack? Roughly $64,459 per Bitcoin. (Yeah, they’re sitting on a pretty hefty unrealized gain.)

How’d They Pay for All That BTC?

The filing says Strategy funded the buys using proceeds from two at-the-market (ATM) stock offerings. Between April 21 and April 27, the company sold over $4 million worth of its Class A common stock, plus more than 435,000 shares of its preferred stock series, STRK.

As of now, there’s only about $128.7 million left from the original $21 billion ATM program they kicked off back in October 2024 — that’s just 0.6% still sitting unused.

MSTR Stock Ticks Up as Bitcoin Edges Higher

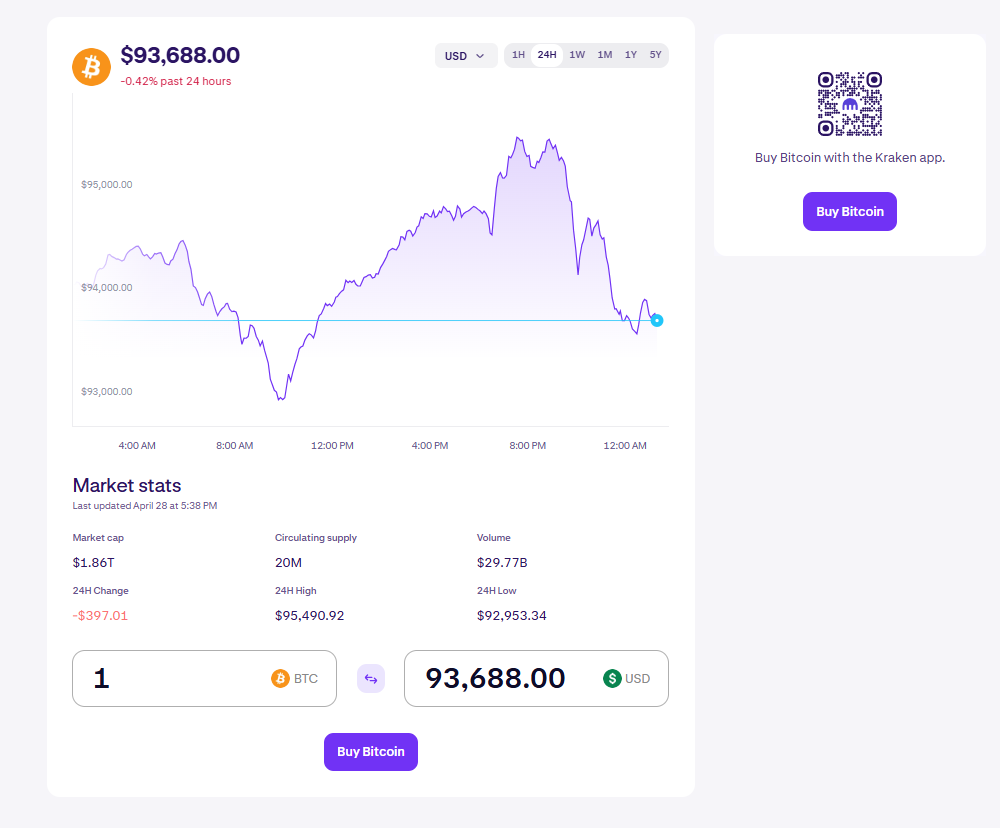

Shares of MSTR rose 1.5% in pre-market trading Monday, riding along with a slight uptick in Bitcoin’s price since Friday afternoon. Looks like the market’s giving a cautious thumbs-up… for now.