- Bitcoin falling below $65K has pushed Strategy’s BTC holdings under cost basis, increasing pressure

- Strategy’s financing model has stalled as the equity premium fades and no new raise was announced

- Investors are now watching for capital plans as critics warn of a corporate crypto “death spiral”

Bitcoin sliding under $65,000 is worsening the stress spreading across the digital asset market, and few public companies are as exposed as Michael Saylor’s Strategy Inc. In its earnings release on Thursday, the company reported a staggering $12.4 billion net loss for the fourth quarter, driven almost entirely by mark-to-market losses tied to its massive Bitcoin holdings. And the situation got worse this week, as fresh volatility pushed Strategy’s BTC stash below its cumulative cost basis for the first time since 2023, wiping out much of Bitcoin’s post-election rally.

That shift matters because Strategy’s entire identity has become a financial experiment built around one asset. When Bitcoin is rising, the model looks unstoppable, almost genius. When Bitcoin is falling, the same structure starts to look like a trap, and markets are now asking if the unwind has already started.

The premium machine stalls as capital markets tighten

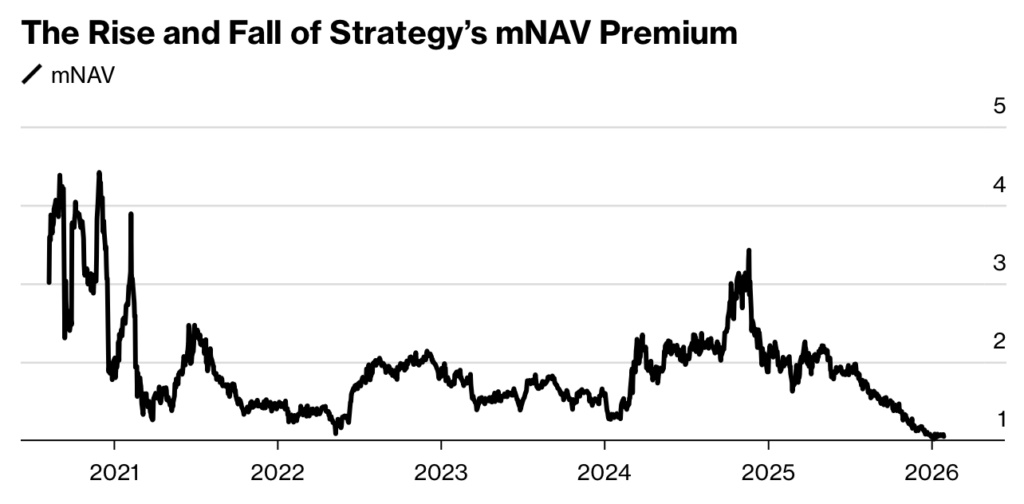

For years, Strategy found a way to defy gravity. The company’s shares often traded at a massive premium to the value of its Bitcoin holdings, letting it issue stock, raise capital, buy more Bitcoin, and repeat the cycle. It was a feedback loop, and it worked, until it didn’t.

That premium has now faded, and the company didn’t announce a new equity raise or debt issuance. More importantly, Strategy didn’t introduce a fresh financing vehicle or new narrative to keep purchases going, which is a major departure from the playbook it has followed since 2020. In past sell-offs, investors were used to Saylor responding with more bravado and more buying. This time, the tone feels defensive, and the silence is loud.

Saylor has said the company faces no margin calls and still holds $2.25 billion in cash, enough to cover interest and distributions for more than two years. But with Bitcoin sitting below Strategy’s reported cost basis of $76,052, the pressure is building anyway. Not because liquidation is imminent, but because the market is starting to question how sustainable the strategy is without fresh capital.

Strategy admits profits aren’t coming anytime soon

Strategy also reiterated that it does not expect to generate earnings and profits in the current year, or in the foreseeable future. That’s not exactly shocking, but saying it out loud changes the framing. It also means that, for now, any distributions paid to holders of the firm’s perpetual preferred shares are expected to be tax free, at least under current conditions.

During a post-results presentation, CEO Phong Le tried to reassure investors with a blunt message. He said anyone who bought Bitcoin or MSTR in the last year was likely experiencing their first downturn, and his advice was to hold on. The comment didn’t land well, and the livestream’s comment section reportedly filled with angry responses from anonymous posters, a pretty clear sign that investor patience is wearing thin.

Analysts are now focused less on the Bitcoin thesis itself and more on Strategy’s next move. As Benchmark’s Mark Palmer noted, the market wants clarity on how Strategy plans to raise capital to keep fueling Bitcoin purchases in a much tougher environment. He suggested the firm may now lean on its STRC perpetual preferred stock as a driver for that effort, but that’s still more expectation than certainty.

The size of the bet makes Strategy a lightning rod

Strategy currently holds more than 713,000 Bitcoin, valued around $46 billion based on the company’s own figures. In late January, it even added another $75.3 million worth of BTC, signaling that the accumulation narrative hasn’t been abandoned, at least officially. But the margin for error is shrinking, and critics are returning fast.

This week, Michael Burry reignited scrutiny by warning that Bitcoin’s drop could trigger a “death spiral” among corporate holders, leaving firms like Strategy billions underwater. His remarks revived long-running criticism from high-profile skeptics, including short sellers like Jim Chanos, who have argued for years that Strategy is built on speculative leverage tied to a non-earning asset.

For much of the last four years, Strategy functioned as a high-beta Bitcoin proxy, and investors treated it like a leveraged way to play BTC upside. Between 2020 and 2024, the stock surged more than 3,500%, outperforming major indexes and becoming a magnet for both speculators and critics. But the environment has changed. Spot Bitcoin ETFs have made BTC exposure cheaper and cleaner, weakening Strategy’s niche, and as liquidity fades, the same investors who once chased upside are now pulling back.

Why this downturn feels different for MSTR

Saylor has also been managing expectations more openly. During the presentation, he dismissed quantum computing fears as “FUD,” but that wasn’t the real headline. The real shift is how Strategy is now framing itself. By emphasizing that profitability isn’t coming soon, Saylor is essentially asking investors to stop judging the company like a software business or a trading vehicle.

Instead, he is repositioning Strategy as something closer to a long-duration Bitcoin trust, where quarterly earnings matter less than Bitcoin’s long-term trajectory. The problem is that investors may not want that deal anymore. The stock is already down nearly 80% from its record high in November 2024, and in a market like this, narratives don’t protect you the way they do in a bull run.