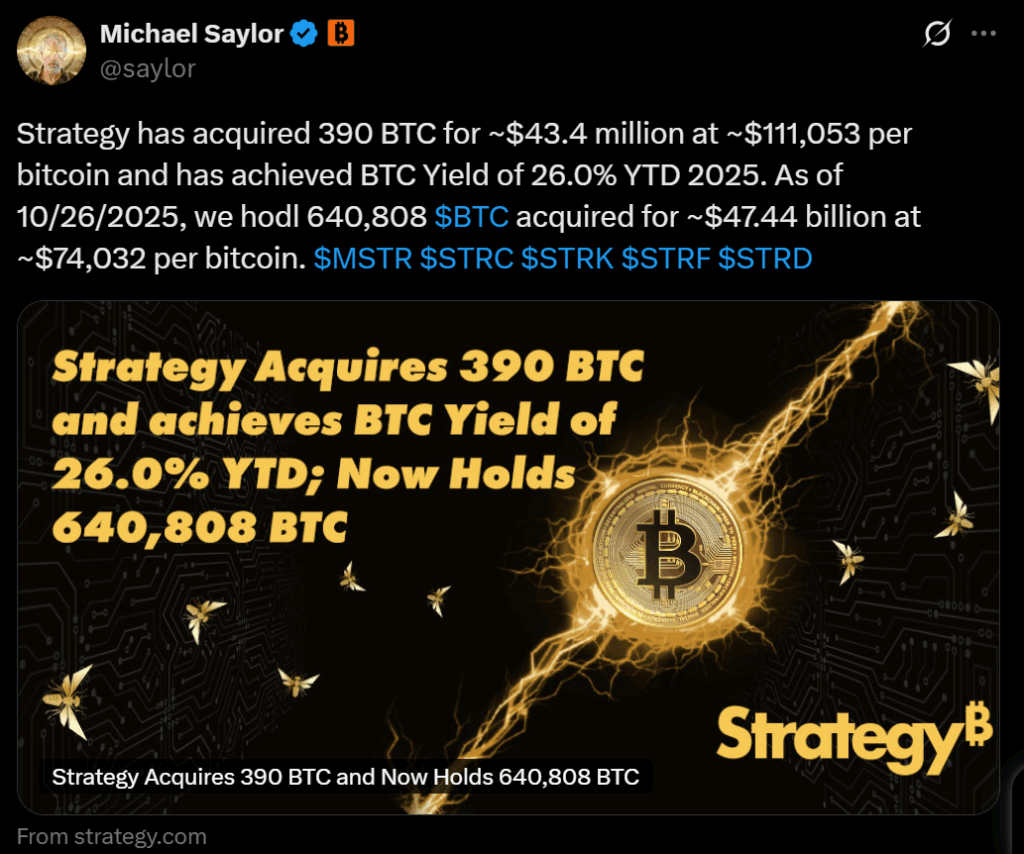

• Strategy added 390 BTC ($43.4M) at an average price of $111,117 per coin.

• The firm now holds 640,808 BTC worth $74B — 3% of Bitcoin’s supply.

• Funded via perpetual preferred stock sales, Strategy’s treasury goal remains 5% of total BTC supply.

Strategy, the world’s largest Bitcoin treasury company, has added another 390 BTC to its reserves between Oct. 20 and Oct. 26, spending about $43.4 million at an average price of $111,117 per coin. The acquisition was disclosed in an SEC filing on Monday, confirming that the firm’s total holdings now stand at 640,808 BTC — worth roughly $74 billion at current market prices around $115,000 per bitcoin. The purchase was funded through proceeds from the sale of Strategy’s perpetual preferred stock programs.

Aiming to Control 5% of Bitcoin’s Supply

The company’s 640,808 BTC represents about 3% of Bitcoin’s entire 21 million supply, positioning Strategy as the single largest corporate holder of the cryptocurrency. With a total acquisition cost of around $47.4 billion and paper gains of more than $26 billion, the firm continues its march toward its long-term goal of owning 5% of all Bitcoin in circulation. The latest buy follows a smaller 168 BTC addition just last week, signaling Strategy’s ongoing dollar-cost-averaging approach despite market fluctuations.

Funded Through Expanding Preferred Stock Programs

The purchases were financed by proceeds from the sale of Strategy’s perpetual preferred stock offerings — including its STRK, STRF, STRC, and STRD series. The company’s “42/42” capital plan, now upsized to “84/84,” targets an $84 billion total capital raise through equity and convertible notes by 2027. Recent filings show over $20 billion in STRK shares and $4 billion in STRD shares still available for issuance. Each preferred series carries distinct dividend terms and conversion rights, allowing Strategy to balance yield, liquidity, and risk across its financing mix.

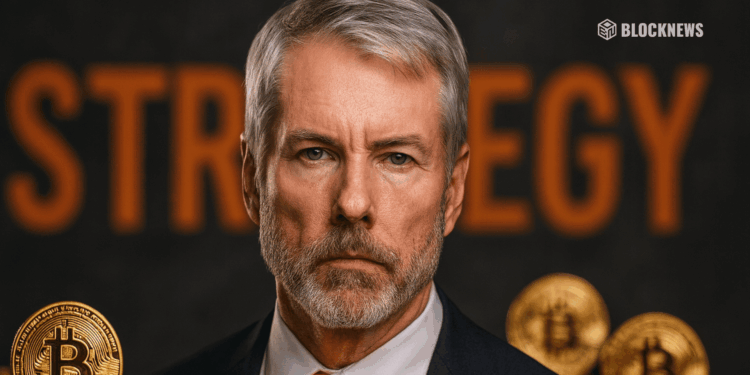

Strategy’s Market Position and Vision

Despite share price volatility — with the stock down 37% since summer peaks — Strategy remains the dominant player in corporate Bitcoin accumulation. Other major holders like MARA, Twenty One, and Metaplanet trail far behind. Executive chairman Michael Saylor maintains that the firm’s capital structure can endure a 90% drawdown in Bitcoin prices for several years, citing diversified funding sources and long-term conviction. In his own words, “It’s orange dot day” — a playful nod to the company’s latest accumulation milestone and an emblem of its unwavering Bitcoin strategy.