- U.S. stocks plunged Thursday after the White House revealed China tariffs had jumped to 145%, sparking investor panic.

- Trump’s 90-day pause on tariffs for most countries gave brief relief, but China’s exclusion rattled markets and triggered retaliation.

- Despite U.S. losses, global markets in Asia and Europe rallied on hopes of eased trade tensions and paused EU tariffs.

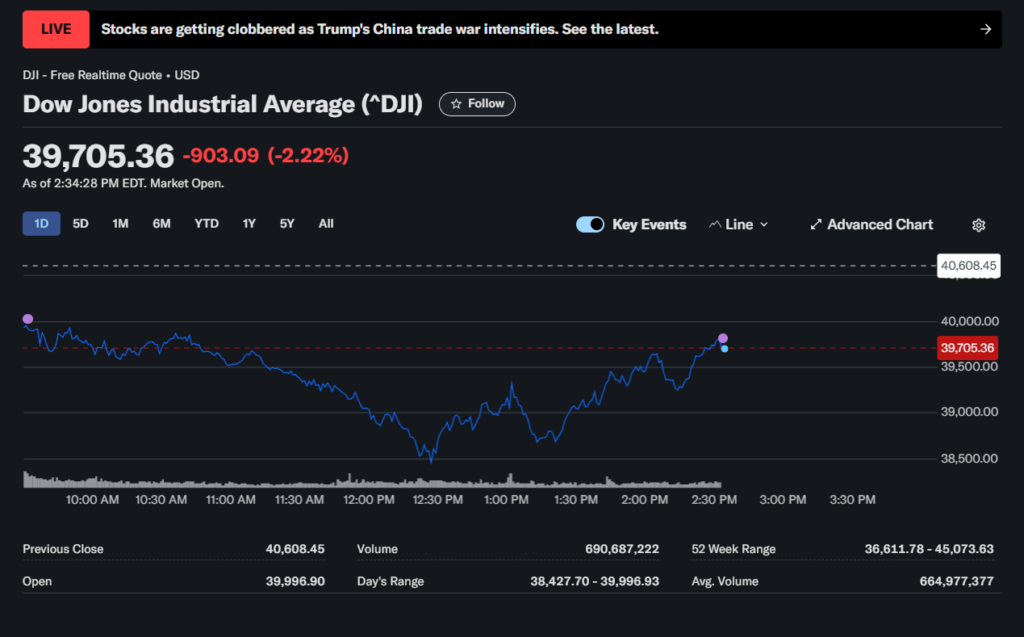

U.S. stocks took a sharp nosedive Thursday, erasing nearly half of the previous day’s wild rally. Investors were left reeling after the White House revealed tariffs on Chinese goods had actually been pushed to a whopping 145%—higher than the 125% most were bracing for.

That news didn’t sit well with Wall Street. By mid-afternoon, the Dow Jones tanked 1,790 points (that’s 4.4%), the S&P 500 lost 5.2%, and the Nasdaq crumbled 6.2%.

It wasn’t just the indexes—big-name stocks got slammed too. Nike plunged 10% as investors worried about supply chain disruptions. Tesla dropped 9%, and chipmaker Nvidia fell 8%. Meanwhile, a few stayed afloat—AT&T and Verizon inched up around 0.5%.

The market’s stumble came just hours after Trump had tried to cool tensions by hitting pause on most of the new tariffs—for everyone except China. The 90-day suspension helped spark a monster rally Wednesday, but those gains didn’t last long.

China, unsurprisingly, fired back. Officials in Beijing accused the U.S. of “weaponizing tariffs,” and even threatened to block Hollywood films as part of its retaliation. Foreign Ministry spokesman Lin Jian called the move an act of “selfish pressure.”

A Tale of Two Markets

It was a stark contrast from just a day earlier when the Nasdaq posted a record 12.1% single-day surge, and the Dow soared nearly 8%—a five-year high. But the mood flipped fast as the real numbers behind the tariff hike trickled out.

Interestingly, Asian markets didn’t seem too rattled—at least not right away. Japan’s Nikkei closed up 9.1%, South Korea’s Kospi added 6.6%, and Taiwan’s Taiex jumped a whopping 9.3%. Even China’s markets managed gains: the Hang Seng rose 2%, the Shanghai Composite ticked up 1.1%, and the Shenzhen Index climbed 2.2%.

In Europe, investors were riding high on news that the EU would pause its retaliation for 90 days, mirroring Trump’s move. That sent the STOXX 600 up more than 7%, with strong gains across the board—from London to Madrid.

A Messy Trade Fight, Far From Over

Trump defended his tariff hike on China in typical fashion—through a Truth Social post, where he blasted Beijing for showing “a lack of respect.” He insisted the 145% rate was necessary, even as some economists warned the move could derail the recovery and spark inflation.

Meanwhile, the White House kept quiet on how long the pause on tariffs for other nations would last—or what happens when that 90-day clock runs out.

All in all, markets are swinging hard, investors are nervous, and global trade relations are looking shakier by the day.