- Stellar (XLM) broke out of a long bearish channel, surging 8.5% in 24 hours with a 25% spike in trading volume, signaling strong renewed interest from traders and investors.

- On-chain data shows 65% of top Binance traders holding long positions, while millions of dollars in bullish bets have been placed near key support and resistance levels, backed by significant exchange outflows hinting at accumulation.

- Technical analysis points to a potential 30% rally toward $0.375, as long as XLM holds above critical support at $0.275, with a warning that dropping below $0.26 could invalidate the bullish setup.

Stellar (XLM) has finally busted outta its long, painful bearish stretch — one that started way back in November 2024. During that rough ride, XLM’s price dropped by about 65%, carving out a pretty clear bearish channel on the charts.

But now? That breakout has not just stopped the bleeding, it’s actually lit the fuse for what could be a big upside run. At the time of writing, XLM was trading close to $0.284, after jumping up about 8.5% in just the last 24 hours.

Even better, trading volume spiked 25% during the same window — a clear sign that traders and investors are pouring back in.

Pretty obvious that this breakout and the bullish price action have caught a lot of eyes.

Traders Are Leaning Hard Into Bullish Bets

Peeking at the on-chain data, it’s clear: most traders are betting that XLM’s gonna keep pushing higher.

Right now, Binance’s XLMUSDT Long/Short Ratio is sitting at 1.89 — pretty dang bullish. Digging deeper, 65.37%of top traders on Binance are holding long positions, while only 34.63% are daring to short it.

That’s a big split. Confidence in the rally is definitely strong among the heavy hitters.

Millions Poured Into Bullish Positions Near Key Levels

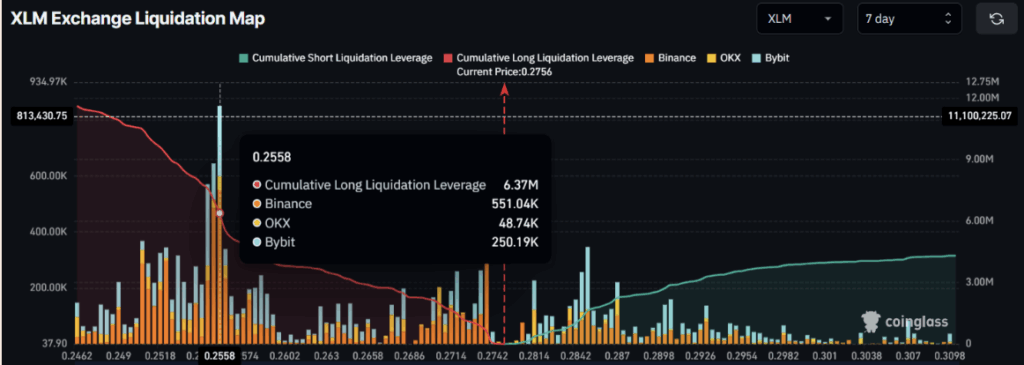

According to Coinglass’s XLM Exchange Liquidation Map, there’s been a lot of high-stakes positioning happening around important price points.

- Near $0.2558 (support), traders built up about $6.37 million worth of long positions.

- Around $0.285 (resistance), about $1.63 million in shorts have stacked up.

Both those zones are now flirting with liquidation pressure, which could fuel even more volatile moves soon.

At the same time, exchange data shows about $1.19 million worth of XLM has flowed out of exchanges in the past 24 hours — and when coins leave exchanges, it usually means accumulation. Translation: buyers are getting serious.

Technicals Are Flashing Green Lights

AMBCrypto’s latest technical analysis backs up the bullish vibes. On the daily timeframe, XLM has officially broken out of that long descending channel and actually closed a daily candle above a key level — a big deal for confirming the breakout.

If Stellar can keep its head above the $0.275 mark, the path looks clear for a possible 30% rally, pushing the price toward $0.375 in the near future.

Small warning though: if XLM slips below $0.26, the bullish case could fall apart pretty fast. So yeah… still a little tightrope walk happening here.

Bottom Line: Momentum’s Building for Stellar

Right now, the stars seem to be aligning for Stellar (pun totally intended). Between the breakout, surging volume, aggressive long positions, and bullish technicals, XLM’s setup is looking pretty solid — at least for now.

If the token can keep holding key support levels, this could just be the start of a much bigger move up.