- Stellar is showing early signs of stabilization after weeks of price weakness

- A TD Sequential buy signal suggests selling pressure may be fading

- Momentum indicators hint at a potential short-term recovery, though confirmation is still needed

Stellar is beginning to show small but noticeable signs of stabilization after several weeks of downward pressure. While the broader trend remains fragile, a mix of technical signals suggests bearish momentum may be fading. Adding to that view is the appearance of a TD Sequential buy signal, alongside momentum indicators that hint at early upside strength trying to form.

At the time of writing, XLM is trading near $0.20, with a 24-hour trading volume of about $143.65 million and a market capitalization around $6.78 billion. The token is up roughly 2.49% over the past day, though it remains down about 2.8% on the week, a reminder that recovery is still tentative, not confirmed.

TD Sequential Buy Signal Puts XLM Back on Radar

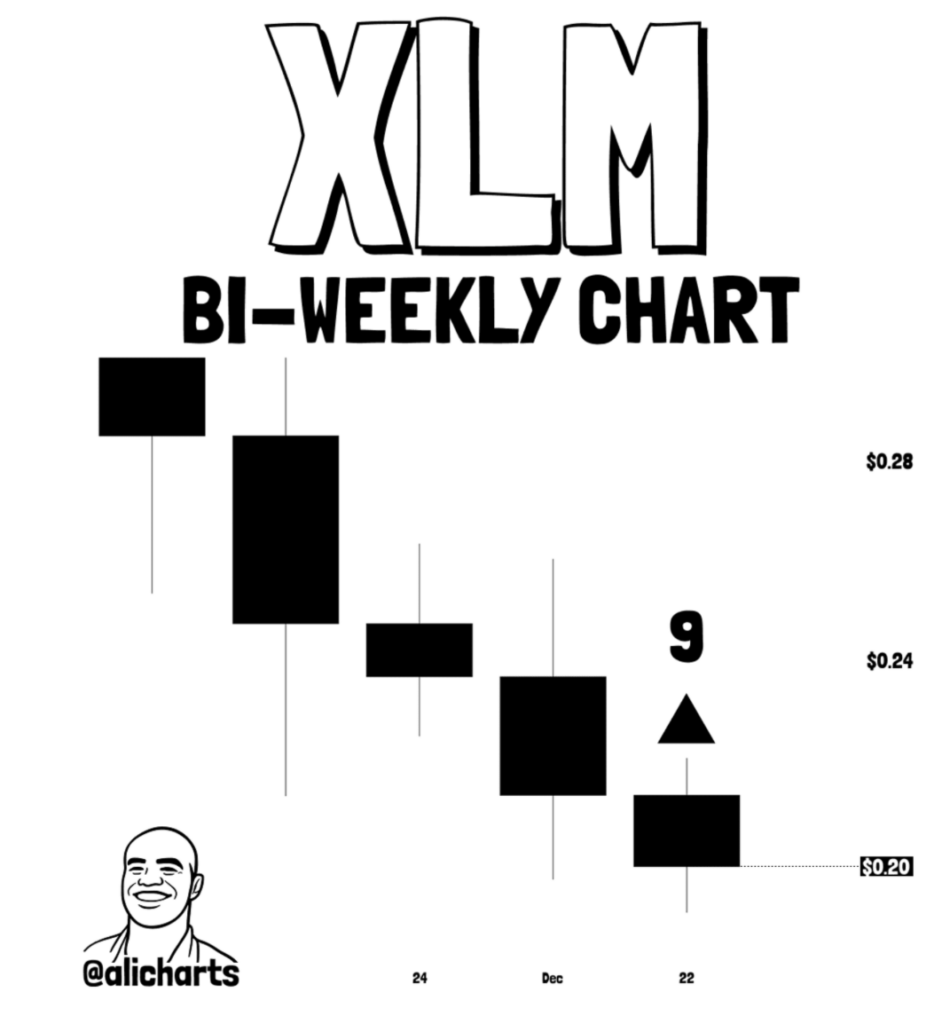

Crypto analyst Ali recently pointed out that Stellar has triggered a fresh TD Sequential buy signal, a tool often used to identify exhaustion points in a trend. The signal appeared after a prolonged decline, suggesting selling pressure may be losing strength. Historically, this indicator has often preceded short-term relief rallies, though results aren’t guaranteed every time.

From a broader technical perspective, the signal implies XLM may be emerging from its recent downtrend. Confirmation is still needed, and without follow-through, the setup remains vulnerable. But if momentum continues to build, Stellar could attempt a push toward higher resistance levels that previously capped price action.

Momentum Indicators Hint at a Possible Recovery Phase

Looking at recent price behavior, XLM declined steadily from mid-November through late December, printing lower highs and lower lows. After bottoming near the $0.198 area, the token staged a modest rebound, closing around $0.215 with a bullish reversal candle. Since then, price has been consolidating between $0.21 and $0.22, reflecting cautious market sentiment rather than aggressive buying.

Momentum indicators are beginning to align with this stabilization narrative. The MACD histogram has flipped into positive territory, signaling that bearish momentum is slowing, even though the MACD lines themselves remain below zero. RSI is hovering near 44, moving up from oversold conditions toward neutral, which often marks the early stages of a relief or recovery phase.

What Comes Next for Stellar

While these signals don’t confirm a full trend reversal, they do suggest that downside pressure is easing. For Stellar to build a stronger recovery case, buyers will need to defend current levels and push price above nearby resistance with conviction. Until then, XLM remains in a wait-and-see zone, where patience matters as much as positioning.