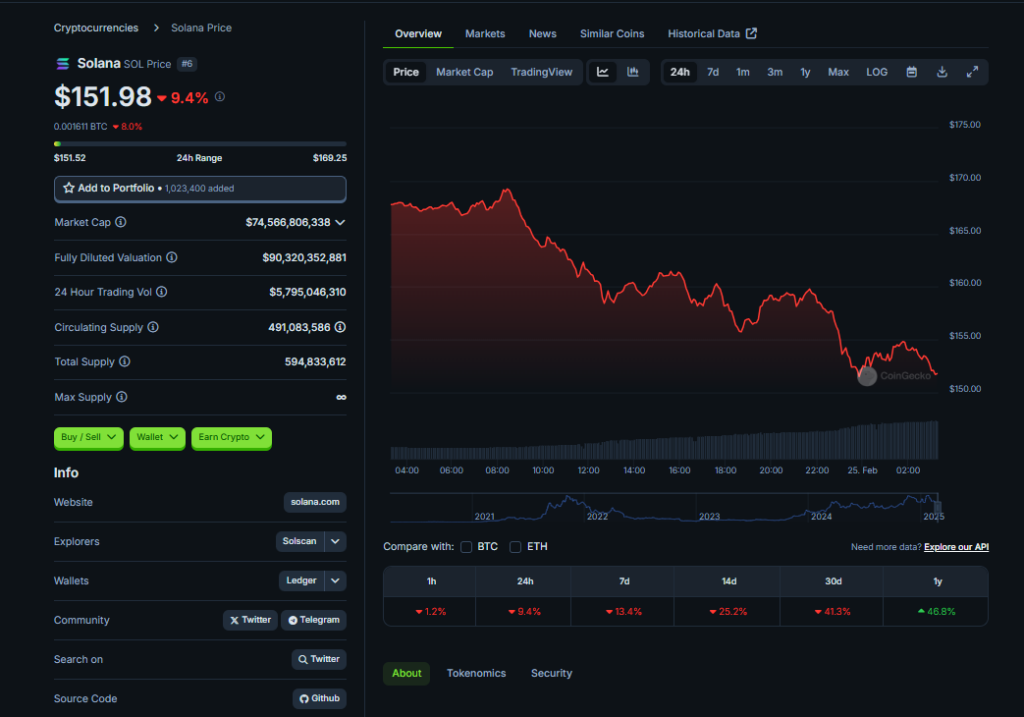

- Solana dropped below $160 for the first time since November 2024, facing strong bearish pressure.

- Binance and Wintermute have offloaded millions in SOL, increasing selling pressure ahead of a $2 billion token unlock.

- If SOL fails to hold $150, a drop to the $138-$139 support zone looks increasingly likely.

Solana just dipped under $160 for the first time since November 2024, caught in a steep downtrend with no clear signs of recovery yet.

The token has been under pressure for weeks, with on-chain metrics slipping, DEX activity declining for the fifth straight week, and overall network engagement weakening. Meanwhile, investor sentiment is shifting toward Ethereum and other assets—leaving SOL struggling to find its footing.

Binance & Wintermute Dumping SOL?

One of the biggest factors fueling this sell-off appears to be Binance unloading SOL heavily.

- Solana has been bearish for five consecutive weeks, just as $2 billion worth of SOL is set to unlock.

- Wintermute, a major liquidity provider, pulled $38 million worth of SOL from Binance—likely prepping for a sell-off.

- If this trend continues, panic selling could accelerate, driving prices even lower.

The market’s next major test? Whether SOL can hold the $150 level—because if it breaks, the slide toward $138-$139 becomes much more likely.

Technical Indicators Flashing Red

The daily chart is showing heavy bearish signals, with key supports breaking down.

- SOL lost crucial support at $158 after a brief consolidation.

- The Gaussian channel has flipped bearish, signaling a need for a strong recovery to reverse the trend.

- Chaikin Money Flow (CMF) dropped below 0, breaking a steady pattern that had held since December.

With bearish strength growing, bulls will need serious momentum to prevent further downside. If $150 doesn’t hold, the next major support lies around $138-$139—a level that could determine Solana’s trajectory in the weeks ahead.