- Solana faces renewed bearish pressure as it approaches a key support level at $123.

- EMAs hint at a possible Death Cross, which historically preceded deeper declines.

- Realized profit/loss is at its lowest since 2023—previous dips this low led to strong rebounds.

Solana has been grinding lower again, and the decline is pushing the altcoin right back into a critical support level it hasn’t touched in more than seven months. The move isn’t happening quietly either—market weakness is deepening across the board, and SOL is feeling the full weight of it. Unless the tone shifts fast, the chart is hinting at more trouble ahead.

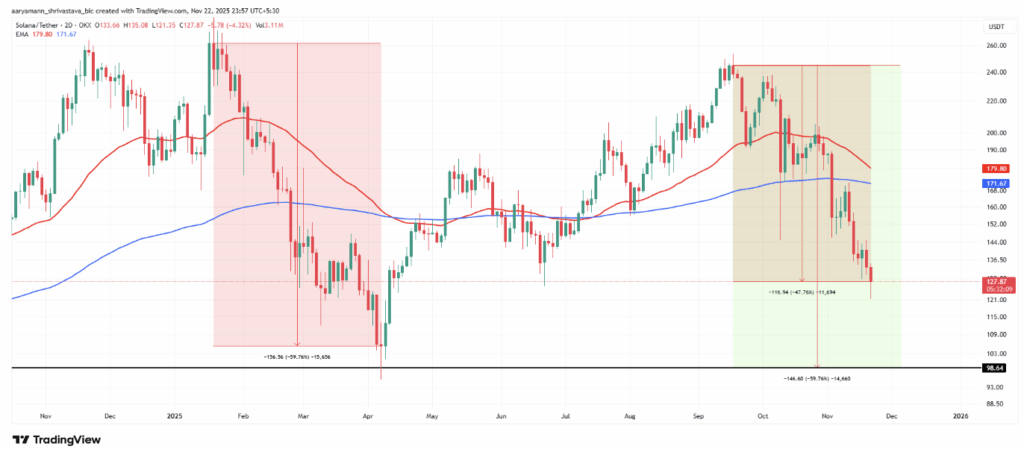

Heavy losses pile up as a possible Death Cross forms

Investors are hurting. Solana’s exponential moving averages are beginning to hint at a potential Death Cross, which forms when a short-term EMA dips below a longer-term one. It’s usually a warning sign of a prolonged downtrend, and Solana has seen similar setups earlier this year.

Back in Q1 and Q2, SOL dropped 59% from the local top before the Death Cross fully formed. The current decline is already down 47% from the peak, and if history repeats itself, SOL could slide toward $98—a level that would confirm deeper bearish pressure.

Sentiment is clearly softening. The market looks tired, and so do the holders.

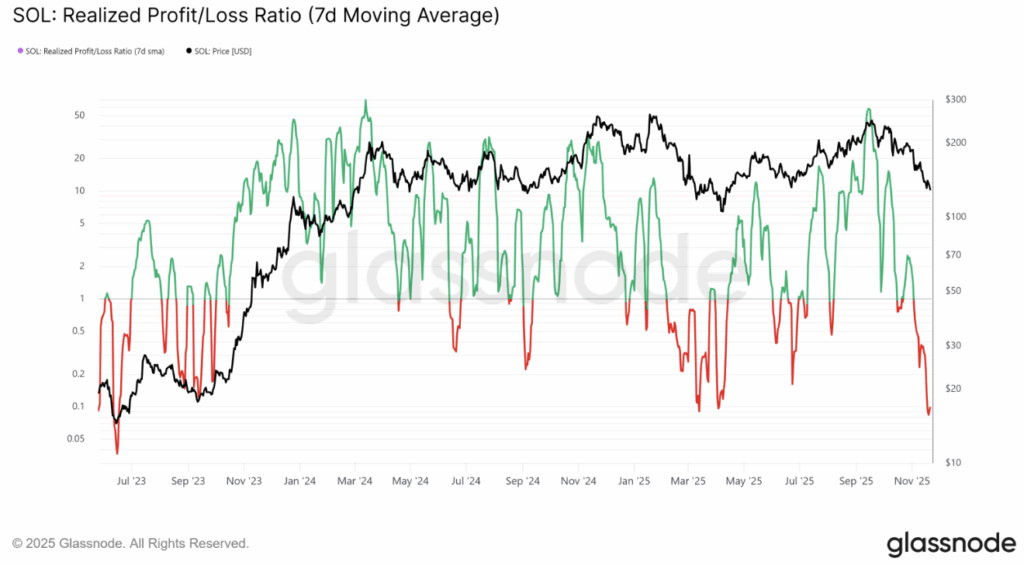

Realized losses hit their lowest point in over a year

Solana’s net realized profit/loss ratio just fell to its lowest level since June 2023. That means holders have been locking in some serious realized losses during this downturn. This metric often signals fear, capitulation, or just a broad reevaluation of risk.

But oddly enough, there’s a silver lining here.

Whenever the ratio dipped below 0.1—as it has now—the market historically rebounded. This happened in March, April, and September of 2023, each time marking the start of a recovery as selling pressure began to cool off.

If that pattern repeats, SOL might not be as doomed as the lower timeframes suggest. Sometimes the market has to flush out enough pain before it can bounce.

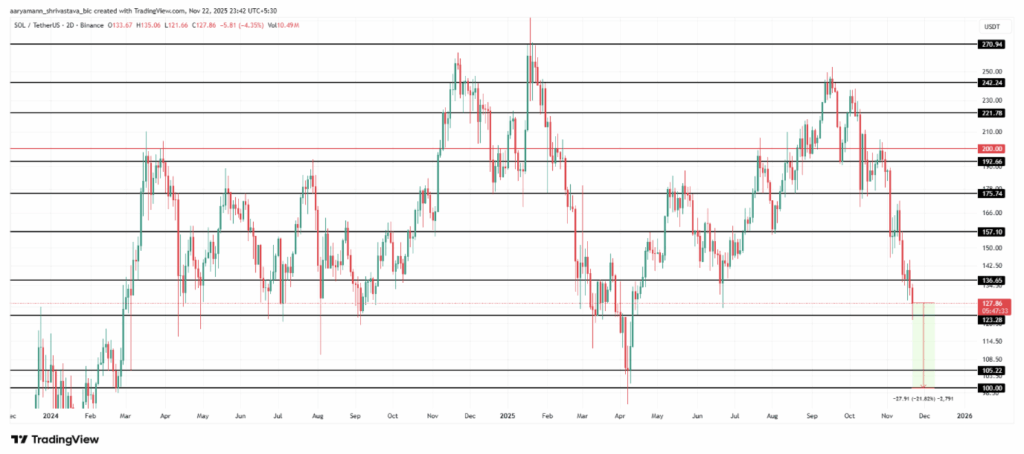

SOL holds $127… but barely

Right now Solana trades around $127, clinging just above the $123 support zone. The chart is basically waiting for the broader market to stop bleeding. If confidence returns, SOL could hold this level and rebound.

But the risk side still dominates the picture.

If the Death Cross confirms and weakness persists:

- A break below $123 opens the door to $105

- A deeper slide toward $100 becomes possible

- That would mark roughly a 21.8% drop from current levels and revisit price territory last seen in March

It’s not the prettiest scenario, but it’s increasingly realistic if the market keeps sinking.

What could save the trend?

If realized losses begin to stabilize—something already hinted at by the profit/loss ratio—Solana could bounce off $123and attempt a move back toward $136. Clearing that level would shift the short-term outlook and open a path toward $157, effectively invalidating the bearish structure and giving bulls something real to work with.

For now, SOL sits in a fragile pocket: one strong bounce away from recovery, or one bad candle from another big leg down.