- SOL dipped 10% after a rejection at $185, now hovering around $167 with eyes on $142 support.

- Despite the drop, Solana’s DEX volume and fees surpassed Ethereum’s, showing strong ecosystem activity.

- Upcoming token unlocks and MEV issues may weigh on SOL’s momentum despite bullish fundamentals.

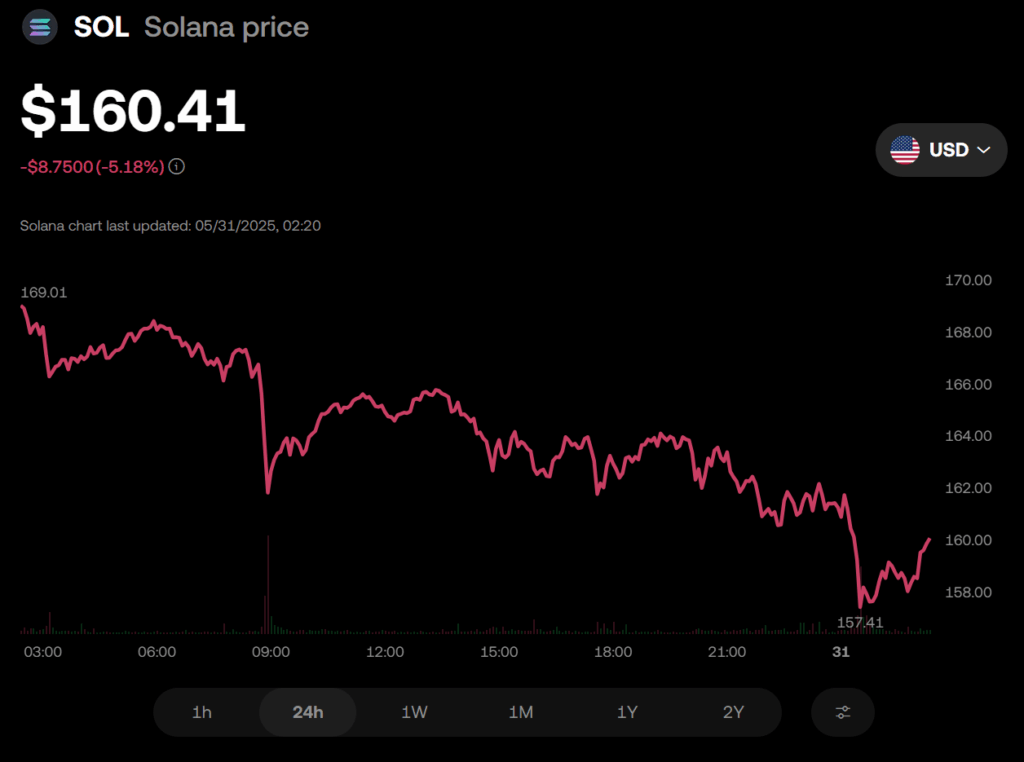

Solana (SOL) took a sharp dip, losing about 10% after getting rejected at the $185 mark on May 23. It’s now hanging out around $167 — the lowest we’ve seen in over a week. Traders are already wondering: is this just a quick reset or could SOL slide back to $142 support?

Despite the pullback, there’s still a silver lining. Solana’s holding strong as the second-largest blockchain in terms of total value locked (TVL), with $11B locked up — that’s a 14% bump from last month. Ethereum still rules the roost though, with its deep layer-2 infrastructure making it tough to catch.

Fees, Volumes, and a Web3 Edge

What’s helping Solana stay relevant? Well, DEX activity on Solana is going wild. In just the last month, it hit $94.8B — a whole lot more than Ethereum’s $64.8B. And when you look at fees, SOL actually pulled in more ($48.7M) than ETH ($36.9M), even with Ethereum’s much larger deposit base.

On top of that, Solana’s pushing hard with mobile-friendly Web3 apps. Bulls say this smooth experience could help keep momentum going. But bears are quick to point out Ethereum’s layer-2s are catching fire too — $59.2B in DEX activity — though it hasn’t translated into bigger fee revenue just yet.

Token Unlocks and Yield Woes

Still, not everything’s sunshine. Between June and August, 3.55 million SOL are set to unlock — that’s about $600M worth. And a big chunk of that came from the FTX/Alameda estate, bought at roughly $64 per token. That looming supply could be a serious headwind.

Sure, staking yields for SOL are higher than ETH — 8% vs. 3% — but inflation’s a factor. With Solana’s supply growing at 5.2% annually, net returns are getting squeezed. You might even find better passive returns staking stablecoins in DeFi, depending on where you park your funds.

MEV Concerns and Memecoin Fade

Another red flag? MEV. Solana’s high-speed setup makes it a playground for validators looking to boost profits by messing with transaction order. Stuff like front-running and sandwich attacks hurts regular users — and even Solana insiders are calling it the network’s “biggest problem.”

Then there’s memecoin fatigue. Some of the wildest tokens on Solana — TRUMP, FARTCOIN, POPCAT, and PENGU — all dropped hard over the past week. If memecoin interest keeps sliding, DEX activity could slow even more, adding pressure to SOL’s price action.

All in all, Solana’s still flexing its strength in volume and deposits. But with unlocks on the horizon and risks like MEV and cooling memecoin hype, a run back to $200 might have to wait.