- SOL fell to its lowest level since June 23, showing strong bearish pressure and weakening momentum.

- Futures OI sits near $6.47B, and TVL dipped 4.7%, signaling stress even with high activity.

- Reclaiming $130 is critical—above it targets $134–$138, below it risks a return to $123–$120.

Solana hasn’t looked this shaky in months. After sliding to its lowest level since June 23, the chart is flashing clear signs of stress—heavy selling pressure, fading buyer strength, and indicators leaning deeper into bearish territory across multiple timeframes. Unless sentiment flips fast, the risk of more downside keeps growing.

According to CoinGecko, SOL is trading around $125.32, oddly up about 8% on the day, even though the broader picture still feels weak. Price bounced between $122.66 and $135.27, with spot volume hitting a massive $10.2 billion. Traders aren’t backing off… they’re just getting more cautious.

Leverage builds up as futures activity heats up

Coinglass data shows Solana’s open interest sitting near $6.47 billion, with $29.3 billion in futures trading volume in the past 24 hours. That’s a crowded market—lots of leveraged positions, lots of people betting both directions. Heavy OI during a downtrend usually means volatility isn’t done yet.

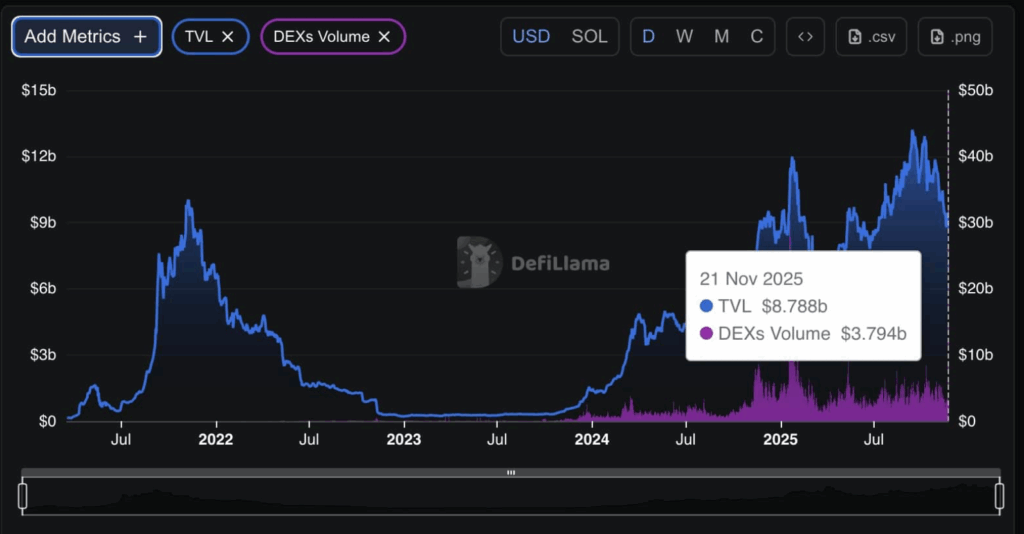

Meanwhile, DeFi Llama reports Solana’s TVL at $8.78B, down 4.7% in a single day. DEXs still pushed about $3.32Bin 24-hour volume, so activity is healthy… but the TVL dip hints at rotation, some profit-taking, and maybe nerves creeping in.

Put together: spot rebound + high derivatives flow + steady DeFi usage = active market.

But that TVL slip? That’s the small warning light blinking on the dashboard.

Solana Price Prediction: What if SOL can’t reclaim $130?

SOL is sitting right at a critical point after a sharp intraday drop sliced through the mid-$120s. Analyst Crypto Tony’s 4-hour chart shows SOL trying to recover, pushing back toward the $128–$130 region—now acting as fresh resistance.

A move above $130 would shift short-term sentiment. But another rejection? That keeps the pressure straight to the downside.

Recent sessions have carved out the classic lower-high, lower-low stair-step pattern, which is basically the signature of bearish momentum. The break below $130 triggered a fast flush, wiping out hours of sideways chop in a single candle. Long lower wicks around $123 show buyers stepped in—but the bounce so far is tiny compared to the speed of the drop.

Crypto Tony summed it up perfectly:

“$130 reclaim is bullish. Rejection and drop is a short position.”

Right now, SOL is pressing against a former support that has flipped into resistance. If buyers manage a solid close above $130, the door opens toward $134–$138. But if SOL fails again, the downtrend stays fully in control—$123 becomes the next retest, and below that sits the $120 support zone.

A market still under stress

The repeated rejections, heavy leverage, shrinking TVL, and lower-high structure all paint the same picture: Solana’s market is stressed, and buyers need a clean reclaim above $130 to shift the tone. Until that happens, every bounce risks turning into another short setup for traders.

If SOL can’t reclaim the level soon, expect more chop… maybe even another leg down.