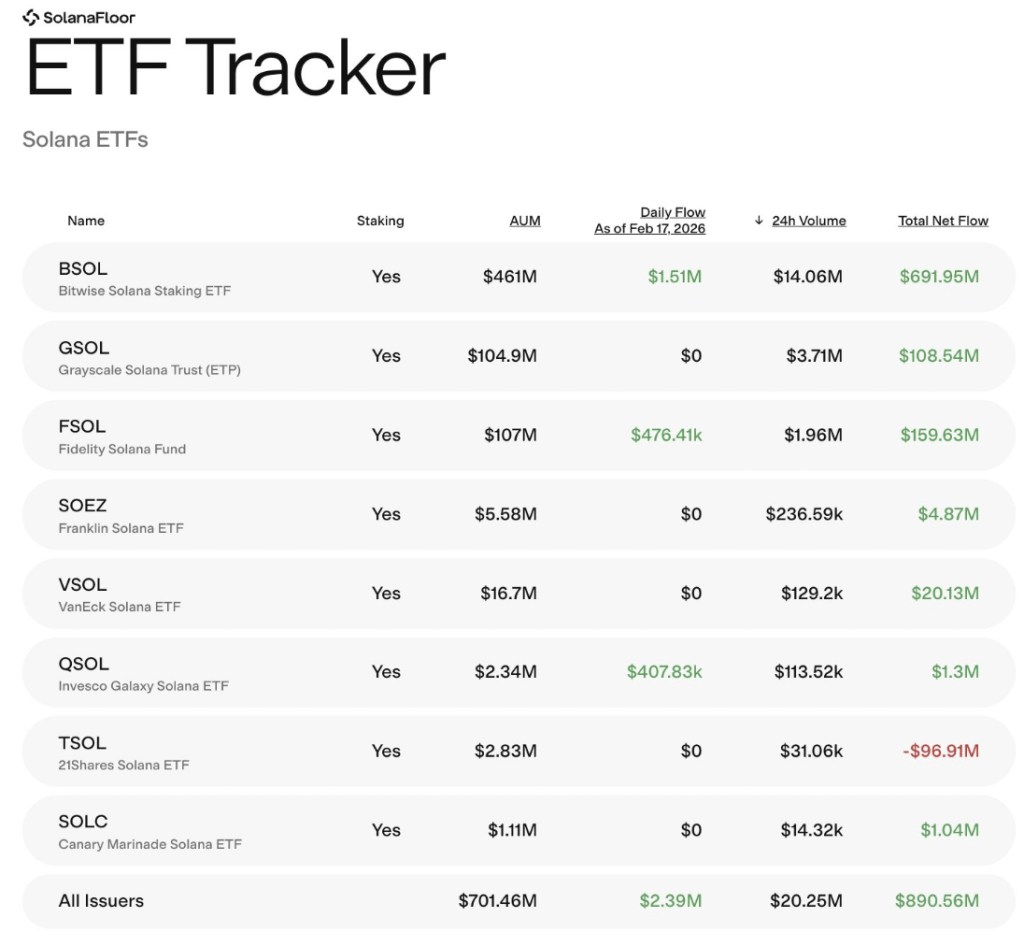

- Solana fell nearly 30% over the past month, yet SOL ETFs recorded $2.39 million in net inflows, diverging from BTC and ETH outflows.

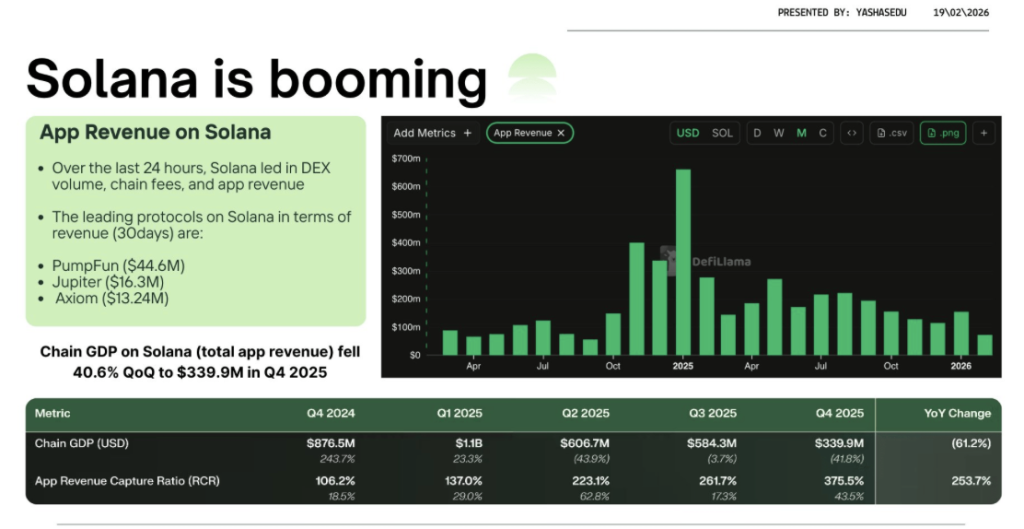

- Despite price weakness, Solana leads Layer 1 peers in 24-hour DApp revenue, signaling strong network usage and developer activity.

- A rising revenue capture ratio shows improving capital efficiency, reinforcing institutional confidence in SOL’s long-term outlook.

Institutional money doesn’t usually chase weakness without a reason. And yet, that’s exactly what seems to be happening with Solana. While SOL has pulled back nearly 30% over the past month and shows little technical evidence of a clean bullish reversal, institutional flows are quietly leaning the other way.

At the time of writing, Solana ETFs recorded $2.39 million in net inflows, extending a six-day streak. Meanwhile, Bitcoin and Ethereum ETFs have continued to bleed capital. That divergence alone raises eyebrows.

Price Weakness, But Capital Conviction

Technically, SOL still looks heavy. The chart hasn’t printed a convincing higher high. Momentum remains subdued. In most cycles, that kind of setup keeps institutions cautious.

But fundamentals are telling a slightly different story.

Among Layer 1 blockchains, Solana has been leading in 24-hour DApp revenue, generating roughly $3.43 million at press time. That’s not a vanity metric. It signals real usage — users interacting, developers deploying, fees being paid. Even in a softer price environment.

So you get this unusual split: price drifting lower, yet institutional flows strengthening. It’s not typical behavior. Smart money, at least in this case, appears more focused on network efficiency than short-term charts.

The Revenue Story Beneath the Surface

In risk-off conditions, most chains struggle. Volatility cools activity. Lower activity reduces transaction fees. Lower fees compress revenue. It’s a fairly predictable chain reaction.

Solana, though, seems to be bending that pattern.

Its app revenue capture ratio — essentially how much DApps earn relative to network fees paid — jumped from 262% to 375% last quarter. That means for every $1 spent in fees, applications are generating about $3.75 in revenue. That’s a sharp improvement in capital efficiency.

This matters more than many realize.

Institutional investors often prioritize efficiency metrics over raw activity spikes. A network that can generate stronger returns per dollar of activity becomes structurally more attractive, especially in uncertain markets. Efficiency sustains ecosystems. Hype doesn’t.

Capital Efficiency as a Competitive Edge

Even though SOL remains one of the weaker large-cap assets in terms of recent price action, its fundamentals aren’t deteriorating in the same way. In fact, they’re tightening up. Becoming leaner.

That efficiency shift sends a signal to developers as well. It says: even in volatility, the network can deliver yield on effort. Builders notice that. So do funds.

The result is a subtle but important divergence. While broader market fear and uncertainty dampen sentiment, Solana continues attracting institutional capital and maintaining top-tier DApp revenue. It’s not explosive. It’s not euphoric. But it’s steady.

And sometimes, steady conviction during weakness says more than price strength during hype.