- Solana saw $311M in institutional inflows, tripling its previous record.

- ARK Invest is staking SOL via a strategic partnership, tightening supply.

- Price is challenging $194 resistance; a clean break could ignite a rally to $235, though a short-term correction is still possible.

Solana’s been heating up again, and this time, it’s not just retail hype. Big money’s pouring in—$311 million last week alone—and ARK Invest just rolled out a new institutional staking play. The price? Teetering right at a key resistance range between $190 and $194. If SOL can smash through that zone, well… things could get interesting real fast.

Underneath all the price candles and tweets, there’s something deeper going on—real structural momentum, with institutions quietly laying down bets.

ARK Invest Dives Into Solana Staking, and That’s No Small Deal

So here’s the kicker—ARK Invest, Cathie Wood’s $20B powerhouse, just tapped SOL Strategies to manage staking for its Digital Asset Revolutions Fund. Sounds boring, right? Not quite.

This move’s huge for Solana. It’s one thing when retail apes pile in. It’s another when institutions start staking. That means supply gets tighter. And with ARK’s stamp of approval, expect eyeballs—lots of them—to start zooming in.

When big players start staking their tokens instead of flipping ’em, that usually points to long-term conviction. And that’s exactly the vibe right now.

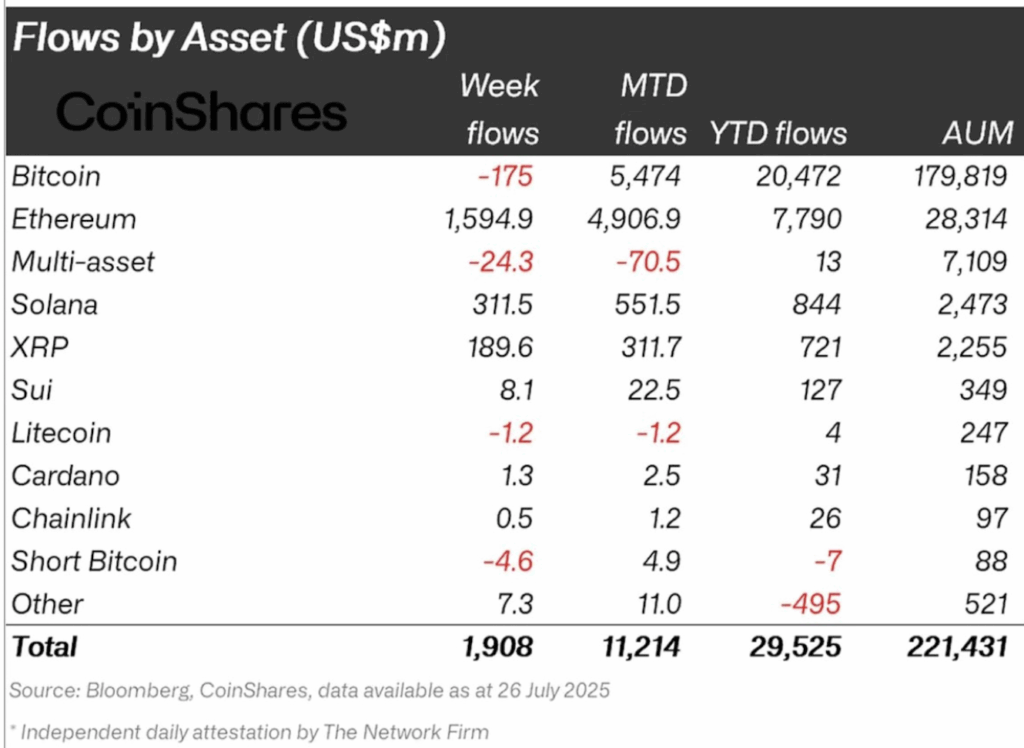

$311 Million in Weekly Inflows? Yeah, That Happened

Solana just posted a monster inflow week—$311 million across ETFs, ETPs, you name it. That’s not just a record—it’s triple the last high. CoinShares data says it loud: institutions are circling, and they’re not being quiet about it.

Other coins? Bitcoin saw outflows. SOL? It’s swimming in capital. So far this month, it’s pulled in over half a billion bucks. Not too shabby.

Momentum like this puts a lot of weight behind price action. Even if it doesn’t explode today, pressure’s building.

Eyes on $235 as Solana Punches the Ceiling

Right now, SOL’s duking it out with the $190–$194 resistance zone. This is where sellers tend to show up. But so far, buyers are hanging tough. According to CW8900, the next real resistance sits up at $210… and then the big kahuna at $235.

If SOL can hold above $194 and stop getting swatted down intraday, it might run quick. The structure looks tight. Volume’s building. And the last few dips? They got eaten fast.

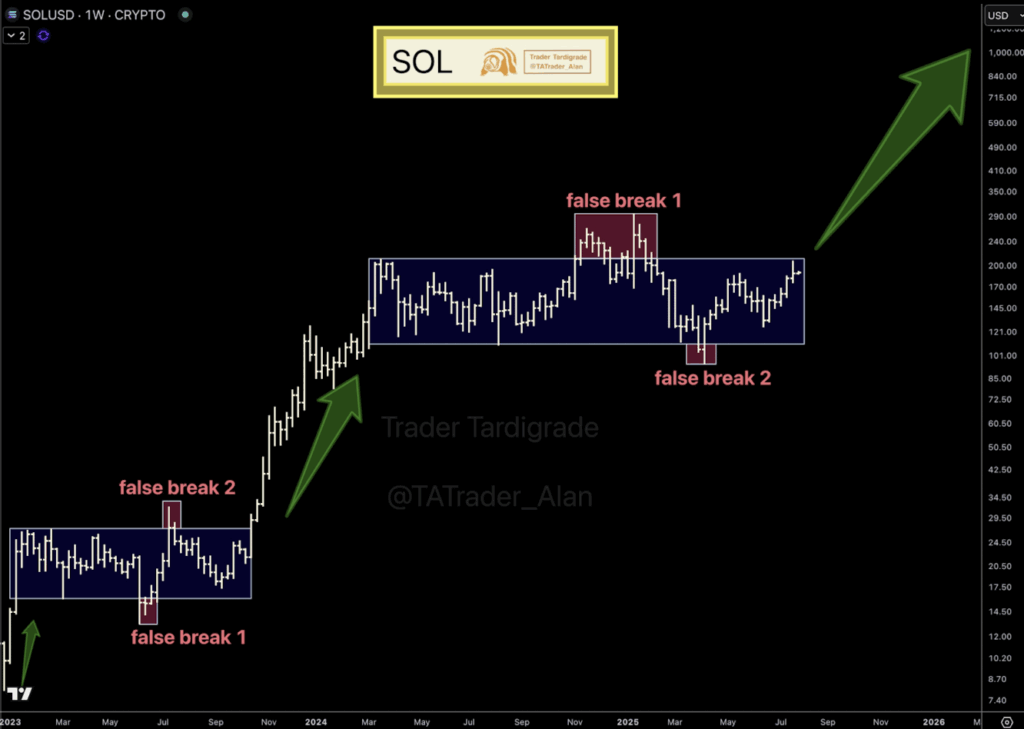

Breakout Brewing? Fractals Say Maybe

Looking at the weekly chart, trader Tardigrade pointed out what looks like a long, slow coiling pattern—accumulation territory. Price has faked both up and down a couple times, setting clear horizontal boundaries. But now? It’s pressing up against the top again.

If that boundary breaks—and that’s a big if—it could open up a run toward $260 and maybe even beyond. We’re talking about price discovery territory again.

The Bearish Curveball: ABC Correction?

Still, not everyone’s shouting breakout just yet. OxonTrading flagged a potential ABC correction forming on the 4-hour chart. Basically, if wave (C) plays out, we might see a pullback to the $172–$174 range before bulls step back in.

That wouldn’t break the uptrend—just reset the board a bit. And honestly, those are healthy sometimes. Flush out leverage. Cool off RSI. Let things breathe.

So… Boom or Breather?

Here’s the bottom line: Solana’s right on the edge. Between ARK’s staking splash and record-setting inflows, there’s serious bullish energy building. If $194 gives way, things could rip fast toward $210, then $235.

But don’t count out a quick dip either. If the ABC pattern plays out, we could be in for a small correction before the next leg up. Either way, SOL’s moving—and this next move could be a big one.