- Solana is struggling to reclaim $89 as negative funding and long liquidations keep pressure on price

- Open interest collapsed roughly 75%, signaling a major exit from leveraged bullish positioning

- Weekly Solana DApp revenue fell 25%, reinforcing weaker network demand and staking incentives

Solana just can’t seem to get back above $89. Every attempt to reclaim that level has been met with fading momentum and, more importantly, rapid closures of bullish derivative bets. That shift alone has increased the probability of a breakdown below the $80 support zone, which is now the line everyone is watching.

Funding rate data from Coinglass shows something interesting — and not in a good way for bulls. Short sellers have been paying a premium for more than a week, meaning funding has stayed negative. That tells us traders are leaning heavily bearish, and they’re willing to pay to hold those positions. When that persists, it’s rarely random.

Open Interest Collapse Signals Long Exodus

The bigger warning sign might be open interest. According to CoinGlass, open interest has fallen from roughly $13.5 billion down to about $3.4 billion. That’s a 75% drop. It’s not just a small shakeout — it’s a clear exodus of leveraged longs leaving the table.

When open interest drains that aggressively, it usually reflects forced liquidations or traders voluntarily closing risk. Either way, it removes fuel for upside moves. Without fresh long positioning, rallies tend to stall before they really begin.

And this derivatives unwind isn’t happening in isolation. It’s coinciding with weakening on-chain fundamentals, which adds another layer of pressure.

DApp Revenue Falls to Multi-Month Lows

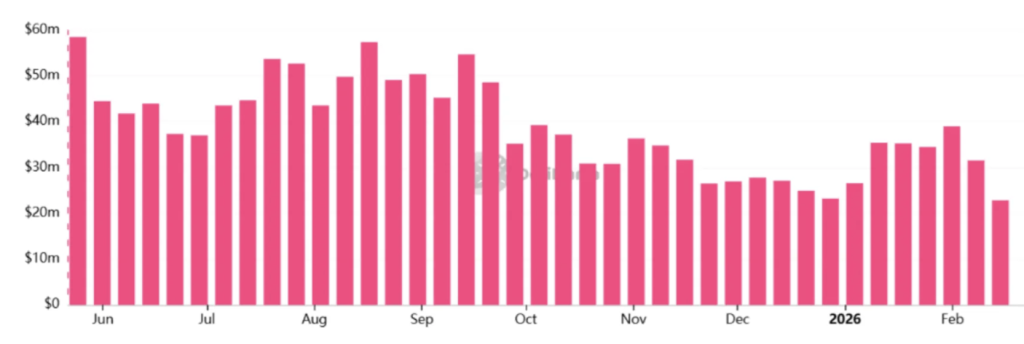

According to DefiLlama, Solana DApps generated about $22.8 million in weekly revenue, down 25% from the previous week’s $30.4 million. That puts network revenue at its lowest level since October 2024. It’s not catastrophic, but it is a noticeable slowdown.

Lower revenue directly affects validator incentives and staking yields. If network demand cools, staking rewards feel it. And if staking becomes less attractive, long-term holding incentives weaken. That dynamic doesn’t show up instantly in price, but it builds pressure over time.

There’s also the uncomfortable reality that much of Solana’s recent revenue strength came from memecoin launchpad activity.

Memecoin Dependence Still Weighs on the Network

A large chunk of SOL’s DApp revenue has been tied to memecoin-driven trading cycles. That kind of revenue can spike quickly, but it can fade just as fast. It’s different from infrastructure-heavy revenue streams like lending protocols, block building, or sustained DeFi demand.

Compared to Ethereum, Solana still generates less revenue from deeper infrastructure protocols. That translates to lower institutional positioning and less Total Value Locked overall. It doesn’t mean Solana lacks utility, but it does mean its revenue base can look more retail-driven and cyclical.

When memecoin momentum cools, network revenue tends to follow. And right now, that slowdown is visible.

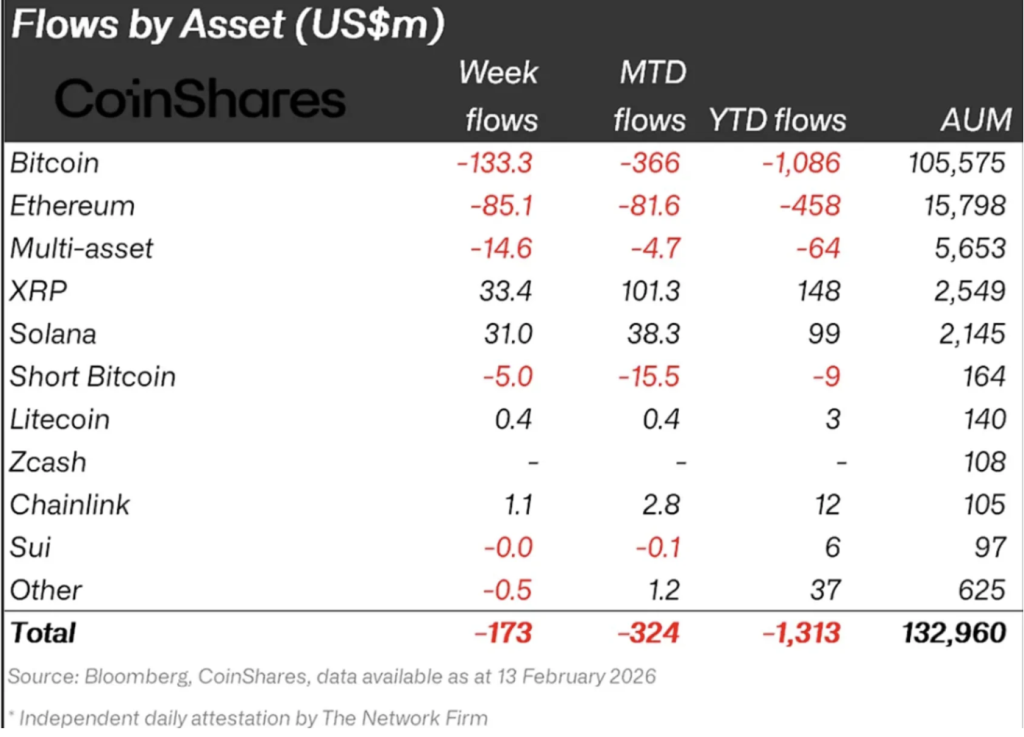

ETF Gap Highlights Institutional Skepticism

Institutional demand also tells part of the story. CoinShares data shows Solana-based ETPs hold around $2.1 billion in assets under management. Meanwhile, Ethereum ETPs hold over $16 billion. That gap is hard to ignore.

The difference suggests institutions are still more confident in Ethereum’s revenue sustainability and broader use case. Limited ETF inflows mean SOL lacks the same structural support that helps absorb selling pressure during downturns. In bear phases, strong ETP inflows can cushion price drops. For Solana, that cushion looks thinner.

Derivatives Structure Still Favors Downside

Negative funding combined with falling open interest paints a clear picture: short conviction is strong, and new bullish positions are limited. Solana has also underperformed the broader crypto market over the past month, reinforcing the idea that sellers are still in control.

The key zone now sits between $78 and $80. If SOL can hold that range convincingly, it may stabilize and attempt a recovery. But if that support cracks, it could trigger another wave of liquidations and extend the current bearish structure.

Why This Matters

When network revenue declines and derivatives lean heavily bearish at the same time, demand weakens while pressure builds. That combination increases the odds of a sustained move below $80, especially if broader market conditions remain fragile.

Solana isn’t broken. But right now, the data suggests it’s under pressure — and until funding flips or revenue stabilizes, rallies may struggle to stick.