- Solana is consolidating around the key $145 support level after a rally from $95 to $157, with resistance forming near $155. The price currently floats around $148.

- Technical signals are mixed: A bearish head-and-shoulders pattern threatens a drop to $137 or lower if $145 breaks, while a bullish cup-and-handle pattern on the weekly chart suggests a possible breakout toward $300 in the long term.

- Next moves depend on $145: Holding above it could lead to a rally toward $165 or $180; dropping below might spark a correction to $137 or even $124. All eyes are on whether bulls can maintain momentum.

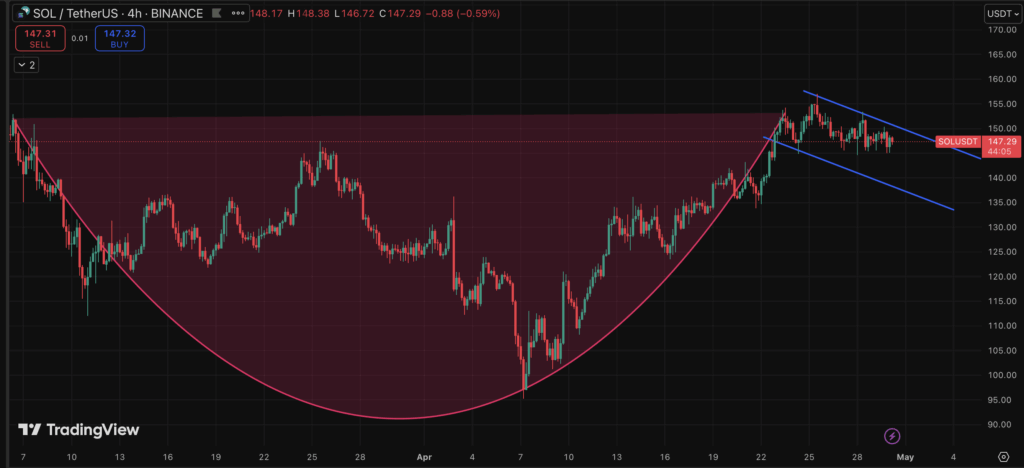

Solana ($SOL) has been holding its ground, more or less, around that all-too-familiar $145 psychological mark. After bouncing back from a dip near $95 (yeah, that low), it pushed up to $157 before running into a wall—yep, resistance at $150ish hasn’t been easy to shake off. Right now, it’s kinda just chilling around $148. There’s some buyer curiosity there, but also a decent dose of caution. Bears? Still circling.

Holding on Tight – but for How Long?

Looking at the 4-hour chart, there’s this lower wick on the latest candle that gives off a bit of a bullish vibe. Nothing huge, but it hints at buyers stepping in. Also, the 50 EMA is lending a bit of support around $145—think of it as a safety net for now. Still, if SOL slips below that, it could drop down to $137, where the next batch of support is waiting.

Bearish Head-and-Shoulders Alert

Here’s the tricky part. That whole $145–$155 range? It’s started shaping into a bearish head-and-shoulders pattern. And that neckline? Yep, it’s sitting right at $145. If SOL breaks below that neckline with conviction, we might be staring down targets like $137—or worse, $124. Not the prettiest picture.

Wait, There’s a Cup-and-Handle Too?

Now, before you get too gloomy, there’s a twist. Zoom out to the weekly chart, and you’ll see something kinda exciting—a cup-and-handle pattern forming. It’s one of those bullish continuation setups, and if it plays out, SOL could rip through the upper resistance and head much, much higher. Analyst Ali Martinez is especially pumped about this one, pointing toward a potential neckline near $300. Yeah, that’s a big jump from here.

We’re probably still in the “handle” phase, which means we’re in the calm-before-the-storm territory. If SOL can break above this setup’s trendline, we might be in for something explosive.

So, What’s Next?

Right now, all eyes are on the $145 level. Stay above it, and we could see a nice push toward $155, maybe even $165—and if things really heat up, $180 isn’t off the table. But if that $145 support gives way, expect a stumble down toward $137 (where the 200 EMA hangs out), and if that cracks, $124 could come into play.

Final Thoughts

Solana’s in a weird place—caught between short-term bearish signals and long-term bullish potential. If it keeps holding the $145 line, those bullish dreams might just come true. But the head-and-shoulders formation? That’s the storm cloud in the distance. It’s gonna come down to volume, sentiment, and whether the bulls can really push through resistance and send SOL flying.

Either way, this consolidation won’t last forever. Something’s brewing… it’s just a matter of which way it breaks.