- Solana broke above $210 while surpassing Ethereum in DEX volumes for 10 consecutive months.

- Wormhole bridge data shows $222M inflows to Solana, outpacing Ethereum’s $183M.

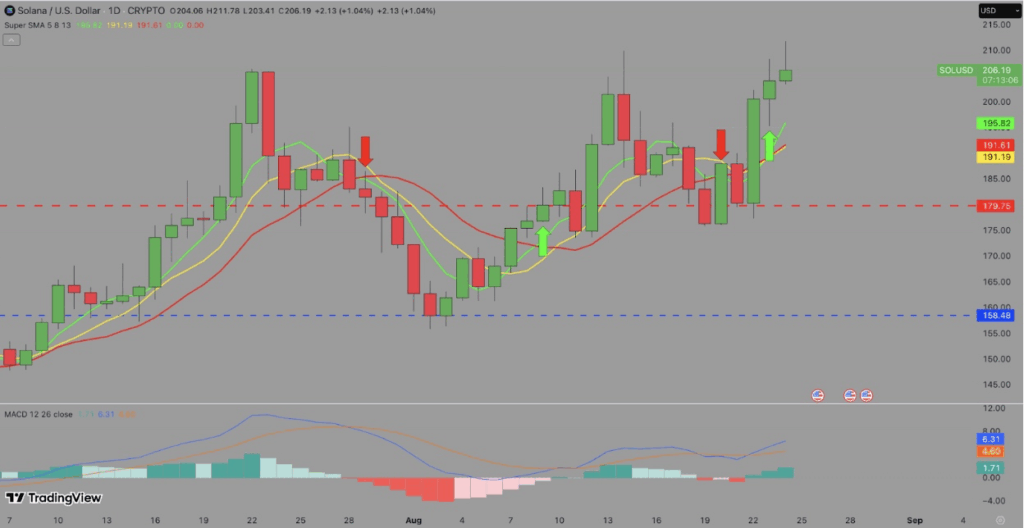

- SOL targets $215–$240 if $200 support holds, with $191 and $179 as key downside levels.

Solana just pushed past $210 again, clocking its highest level since February, while much of the market cooled off over the weekend. Bitcoin, Ethereum, and XRP all gave back some gains, but Solana’s rally kept grinding higher. What’s fueling it? Not just Fed rate-cut hype—on-chain numbers show something bigger at play. Solana has now beaten Ethereum in decentralized exchange (DEX) volumes for 10 months straight, handling over $124 billion in trades in July alone, a 42% lead over ETH.

Liquidity Shifts Into Solana

Data from Wormhole bridge highlights why this streak isn’t just a fluke. Solana captured 42.71% of all cross-chain transfers in the last 30 days, edging out Ethereum’s 42.53%. Capital flows are following too—$222 million came into Solana through bridged inflows, compared to Ethereum’s $183 million. That’s not a small gap, and it suggests Solana is increasingly the preferred liquidity hub for DeFi transactions. In other words, it’s not just speculation; real demand is helping carry SOL higher while other majors stall.

Technical Outlook: Holding the $200 Line

Price-wise, SOL is consolidating above $205 with the 20-day SMA sitting near $191 as a safety net. The MACD is flashing bullish momentum and RSI remains steady, supporting the case for continuation. Immediate resistance sits at $215, which lines up with March highs. A clean breakout there could set up tests at $228 and even $240 if momentum holds. The key, however, is defending the $200 level. If that breaks, downside pressure could drag SOL back to $191, with a deeper slip targeting $179.

What’s Next for SOL?

Right now, Solana’s edge in DEX activity and growing liquidity flows are acting as strong tailwinds. The fact that active users keep fueling demand in DeFi transactions adds to the bullish case. But as always, it comes with a caution—if broader crypto momentum stays weak, sustaining demand above $200 could prove tricky. Still, as long as Solana holds that support, the setup remains one of the more compelling bullish stories in the market.