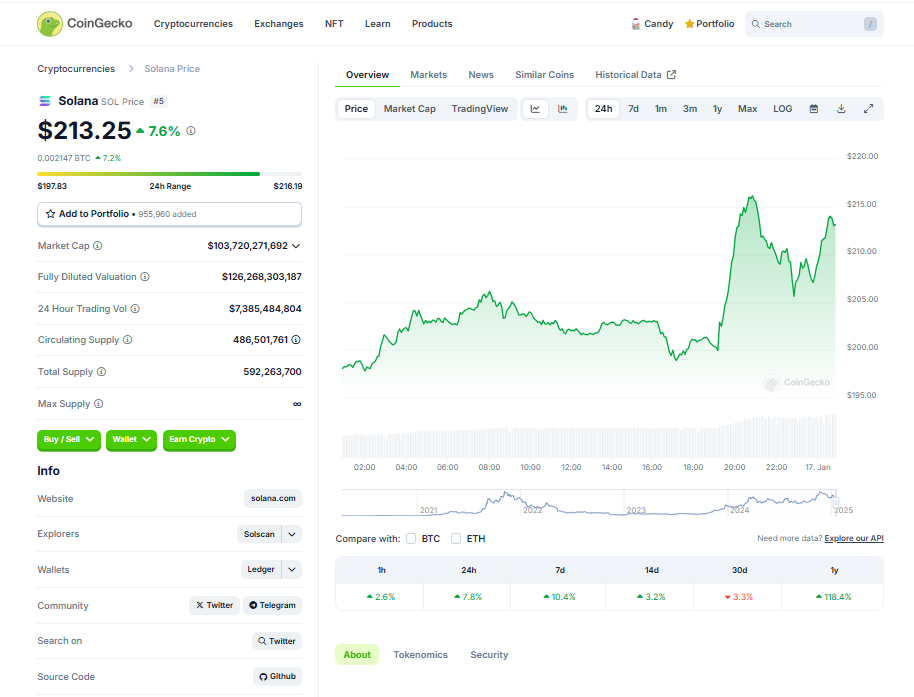

- Solana broke past $200, supported by strong technical signals and steady market momentum.

- Key resistance levels to watch are $205, $212, and $220, with potential for higher targets like $232.

- Solid support near $196 and healthy trading volumes indicate ongoing buyer interest and market stability.

Solana’s recent market performance has been turning heads, and for good reason. It’s made a solid move above the $200 price mark, which is a pretty big deal for this cryptocurrency. This upward trend isn’t just a fluke—it’s backed by strong market momentum and some improving technical signals that are keeping traders optimistic.

Building Momentum: From $175 to $200 and Beyond

The journey to $200 didn’t happen overnight. Buyers started laying the groundwork around $175, creating a solid base to build on. This foundation turned out to be a key factor, helping Solana push past multiple resistance points on its way to the $200 range.

Step by step, Solana overcame obstacles at $180 and $185, with a particularly important breakthrough at $188. That last hurdle acted like a springboard, propelling the price to cross the $200 milestone.

Hitting a Peak: What $206 Tells Us

Recently, Solana’s price hit a high of $206, showing just how strong this upward push has been. Since then, it’s been hanging out in a bit of a cooling-off phase, consolidating near the 23.6% Fibonacci retracement level. For context, this level reflects the price movement between $186 and $206. It’s a natural pause after a solid run-up, and traders are watching closely to see what comes next.

Bullish Signals: Key Technical Indicators in Play

From a technical standpoint, things are looking good for Solana. It’s trading well above the 100-hour simple moving average—a classic bullish signal. There’s even a support trend line forming near $196 on the hourly chart, suggesting that buyers aren’t backing down anytime soon.

Right now, the $205 level is acting as the next challenge for traders. If Solana can push through this, the next targets are at $212 and $220. And beyond that? A clean break past $220 could pave the way for ambitious price points like $232 and even $245. But let’s not get ahead of ourselves—each of these levels comes with its own set of challenges.

Watching for Dips: Support Levels to Note

Every rally has its bumps, and Solana’s no different. If the price takes a dip, traders are keeping an eye on $196 as the first line of defense. Below that, $190 provides a stronger safety net. And if things get really dicey, $185 is the key level to watch—though the current market conditions don’t suggest much downside pressure for now.

Market Health: Liquidity and Volume in Focus

Taking a step back, the broader market data looks encouraging. Liquidity is solid, with balanced order books that support stable price movement. Trading volumes have stayed steady too, which is usually a sign of healthy market engagement.

Even on shorter timeframes, Solana’s price action shows a constructive pattern of higher lows. This structure gives traders a sense of direction and reinforces confidence in the current trend.

The Big Picture: What’s Next for Solana?

Right now, Solana is holding steady around $202, comfortably above key support levels. Exchange data shows a cluster of buy orders near $196, hinting at strong interest from buyers who want to keep prices afloat. It’s a sign that there’s commitment in the market to sustain this momentum.

As trading volumes grow and liquidity conditions improve, Solana is attracting more attention from all corners of the market. The big question now is whether it can keep building on this momentum—or if it’ll take a breather before the next leg up.

Final Thoughts

Solana’s price action tells a story of resilience and growing market confidence. While there’s always the potential for pullbacks, the strong support levels and healthy market conditions suggest that SOL could have more room to climb. For now, traders and investors alike are keeping a close eye on the charts, ready to seize the next opportunity.