- A “smart trader” boosted ETH long position to $131M, signaling confidence in a breakout.

- ETH must break $4,100 resistance to confirm bullish continuation toward $4,750.

- Exchange reserves hit multi-year lows, hinting at a supply squeeze and long-term accumulation.

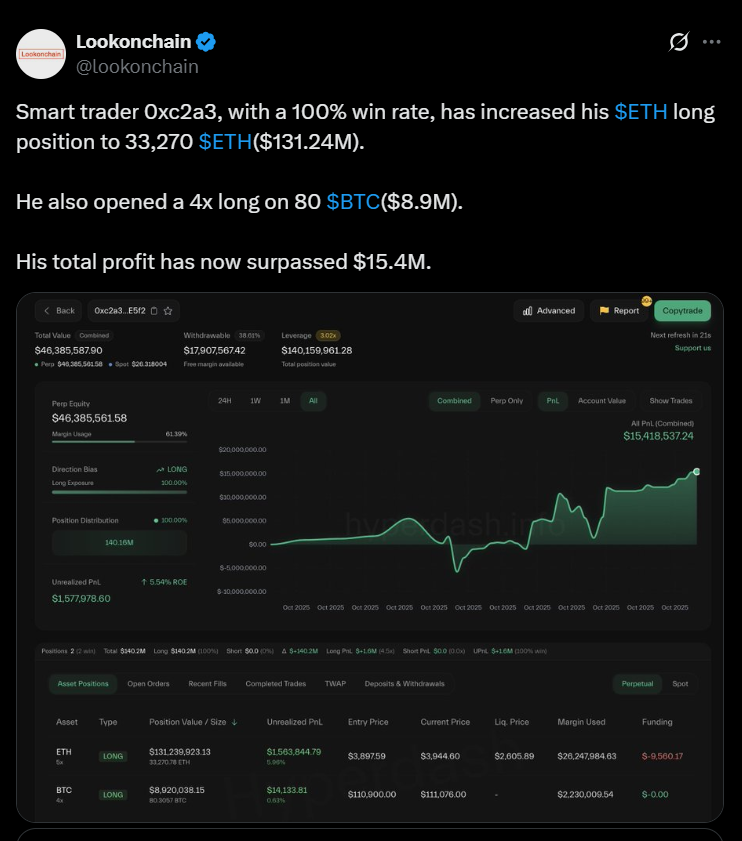

Ethereum (ETH) surged back toward the $4,000 mark on Friday as on-chain analysts tracked a “smart trader” who increased their long position to 33,270 ETH — worth about $131 million. The move reignited optimism among traders that ETH could break out of its multi-week consolidation zone.

Data from Cointelegraph Markets Pro and TradingView showed ETH/USD hitting an intraday high of $4,025, before stabilizing near $3,940. The trader behind the $131M long has a 100% win rate over the past two weeks, reportedly pocketing $16 million in profits, according to user Discover on X. This bet coincides with whale accumulation activity, as addresses holding 10,000–100,000 ETH have begun adding to their positions.

Traders Eye $4,100 and $4,750 Targets

Analysts say ETH needs to reclaim $4,100 to confirm a breakout from its recent “flush” and set up for a stronger rally. Trader Daan Crypto Trades noted that clearing this level could flip market structure into a “big deviation,” opening room for sustained upside momentum.

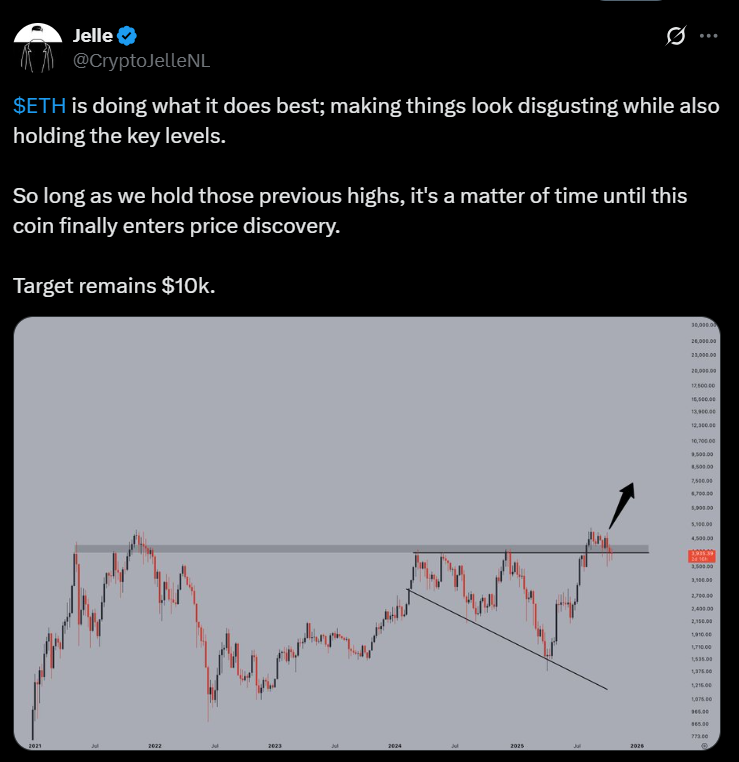

Meanwhile, Crypto Zee projects a gradual climb through $4,250 resistance, targeting a $4,750 demand zone, while Jelle reiterated that ETH remains on track toward a potential $10,000 cycle high if it maintains support above previous highs.

Supply Squeeze Builds as Exchange Reserves Fall

A bullish supply story is also unfolding beneath the surface. Data from CryptoQuant shows ETH reserves on exchanges have fallen to their lowest levels in years, suggesting investors are increasingly moving holdings into long-term storage or DeFi protocols.

Analyst Master of Crypto commented, “People are holding, not selling. When this happens, prices usually explode.” Combined with whale accumulation and a favorable macro backdrop — including 94% odds of another Federal Reserve rate cut — Ethereum’s setup looks primed for a renewed push above $4K.