- Silver surged over 2% to break above $67 for the first time ever.

- Softer U.S. inflation has boosted expectations for Fed rate cuts.

- Gold and platinum also moved higher, while palladium lagged.

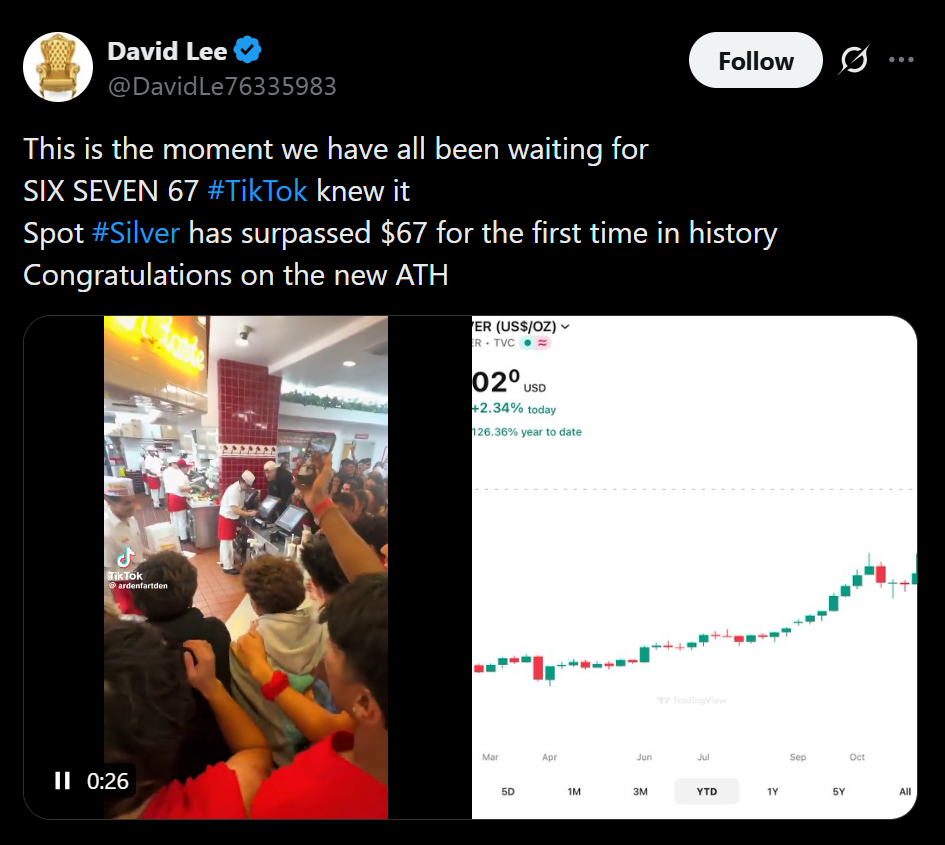

Precious metals pushed higher on Friday, led by a powerful move in silver that sent prices above the $67 mark for the first time ever. The rally capped off an impressive month, with silver up roughly 30% on a monthly basis. The strength across metals appears closely tied to renewed optimism around Federal Reserve rate cuts following softer U.S. inflation data.

Inflation Data Reignites Rate Cut Expectations

Investor sentiment shifted after new economic data showed U.S. inflation cooling further. Annual inflation came in at 2.7% in November, down from 3% in September and below analyst expectations. The print has strengthened the view that inflationary pressures may be easing fast enough to give the Fed more room to cut interest rates, a backdrop that typically benefits hard assets like precious metals.

Silver Leads as Metals Move Higher

Silver briefly touched $67.24 per ounce before settling slightly lower, still up a strong 2.42% at around $67.15 by late morning trading. Gold followed with more modest gains, rising 0.34% to trade near $4,349.56 per ounce. Platinum also joined the rally, climbing 2.13% to $1,975.67, while palladium was the lone laggard, slipping 0.57% to about $1,675.48.

Why Metals Are Back in Focus

Lower interest rate expectations tend to reduce the opportunity cost of holding non-yielding assets, making metals more attractive. Combined with lingering macro uncertainty and strong momentum, silver’s breakout has drawn fresh attention from both traders and long-term investors. If rate cut optimism continues to build, precious metals could remain firmly in the spotlight.