- SHIB rallied 10.35% in 24 hours as altcoins strengthened and Bitcoin dominance declined.

- On-chain metrics show reduced distribution since December, with rising mean coin age signaling accumulation behavior.

- Low dormancy and heavy holder losses suggest profit-taking pressure is limited, though this remains a bounce, not a confirmed recovery.

Shiba Inu just posted a sharp move higher, rallying 10.35% in the last 24 hours as the altcoin market started waking up again. Over the past three days, the broader tone has shifted, with Bitcoin dominance slipping and capital rotating outward. That rotation matters, because SHIB (and most memecoins) tends to breathe better when BTC stops hogging all the attention.

In the same stretch, the total altcoin market cap climbed 7.59%, rising from $683.58 billion to $735.46 billion. And while SHIB grabbed headlines, the memecoin sector’s real leader on the day wasn’t Dogecoin, it was Pepe. PEPE ripped 27.7% in a single session, showing surprising strength and basically reminding the market that memes still trade like memes, fast and loud.

SHIB’s Bounce Wasn’t Random, It Was Sitting on a Setup

A week ago, AMBCrypto had flagged that a SHIB bounce was likely, mainly due to imbalances on the daily chart. These “fair value gaps” tend to act like unfinished business in price action. Markets don’t always fill them immediately, but when liquidity returns, they often get revisited.

Now that bounce is starting to play out, and the structure suggests there could be more upside in the short term. But here’s the catch: a price bounce isn’t automatically a recovery. It can just be a bounce. The difference comes down to what’s happening underneath, and that’s where the on-chain data becomes useful.

On-Chain Data Points to Accumulation, Not Panic Selling

Santiment metrics show that SHIB’s behavior has changed noticeably since December. Back then, the age consumed metric spiked hard, signaling that long-dormant coins were suddenly moving. That’s usually not a good sign, because it often means older holders are distributing into fear or exiting during volatility.

At the same time, mean coin age dropped sharply, which reinforced the same message: both long-term and short-term SHIB holders were moving coins, and likely selling. It looked like panic, and the chain data reflected it.

Since then, even though SHIB’s price has continued falling, the mean coin age has been trending upward again. That’s a subtle shift, but it matters. It suggests coins are becoming dormant again, meaning holders are slowing down, not rushing to exchanges.

Age consumed still shows a few small spikes here and there, but nothing like the December surge. And that’s the key point. The big wave of distribution appears to have passed, at least for now. Instead, the chain data is leaning more toward accumulation behavior.

Losses Are Still Heavy, Which Can Actually Reduce Sell Pressure

Another interesting piece comes from the MVRV ratio. The average 3-month holder of SHIB is still sitting at a significant unrealized loss. And oddly enough, that’s not always bearish in the short term.

When holders are deep underwater, the immediate threat of profit-taking is lower, because there’s no profit to take. That also reduces the risk of break-even selling in the near term. So while losses aren’t “good,” they can temporarily create a cleaner runway for a rally, since fewer people are rushing to cash out at the first green candle.

Dormancy Data Supports the Same Story

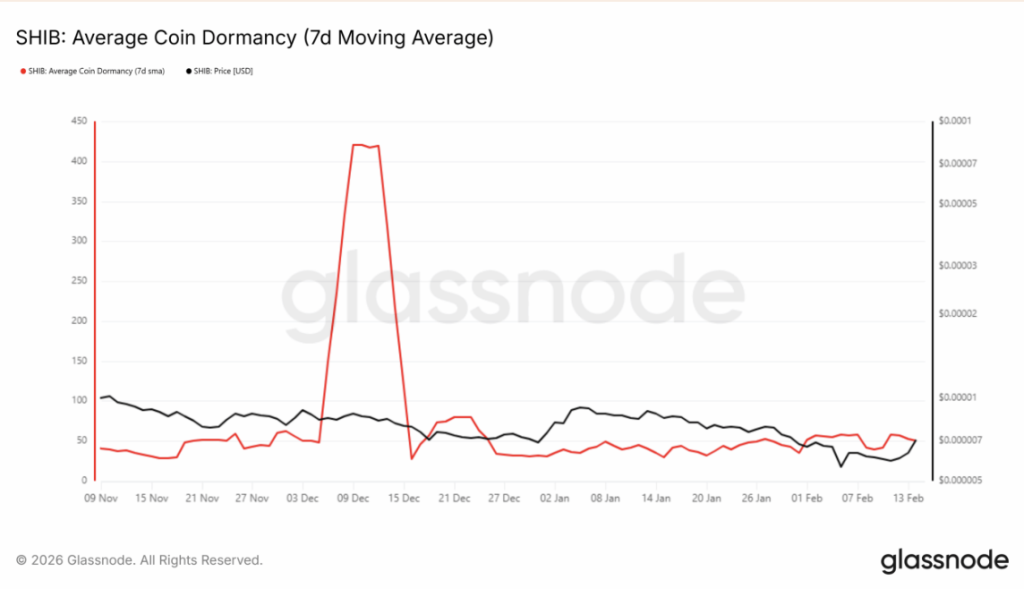

Glassnode’s 7-day moving average of the dormancy metric backs up the accumulation view. Dormancy is calculated using coin days destroyed, which is often used to track distribution trends. When dormancy is low, it suggests older, long-held coins are not moving.

And right now, dormancy levels remain low.

That’s another signal that long-term holders aren’t in a hurry to sell. It doesn’t guarantee a breakout, but it does suggest a major selling wave is not currently underway.

A Bounce Isn’t a Full Recovery (Yet)

Even with these supportive on-chain signals, it’s still too early to call this a full SHIB recovery. The metrics show accumulation and reduced distribution pressure, which is constructive. But the memecoin market is still driven heavily by sentiment, liquidity, and rotation flows.

If altcoins continue gaining share and Bitcoin dominance keeps slipping, SHIB could extend this bounce further. If the market flips risk-off again, memecoins are usually the first to get slapped back down.

For now, the story is simple: SHIB is bouncing, and the chain data suggests the rally isn’t being immediately sold into. That’s a good start. But it’s still a start, not a finish.