- SHIB is up 9.1% daily and 20.3% over two weeks, boosted by Bitcoin’s new ATH at $116K+.

- Breaking past $0.000014 could set SHIB on course for $0.00002—a level not seen since January.

- Fed rate cuts and BTC halving cycles could play a major role in SHIB’s next big move.

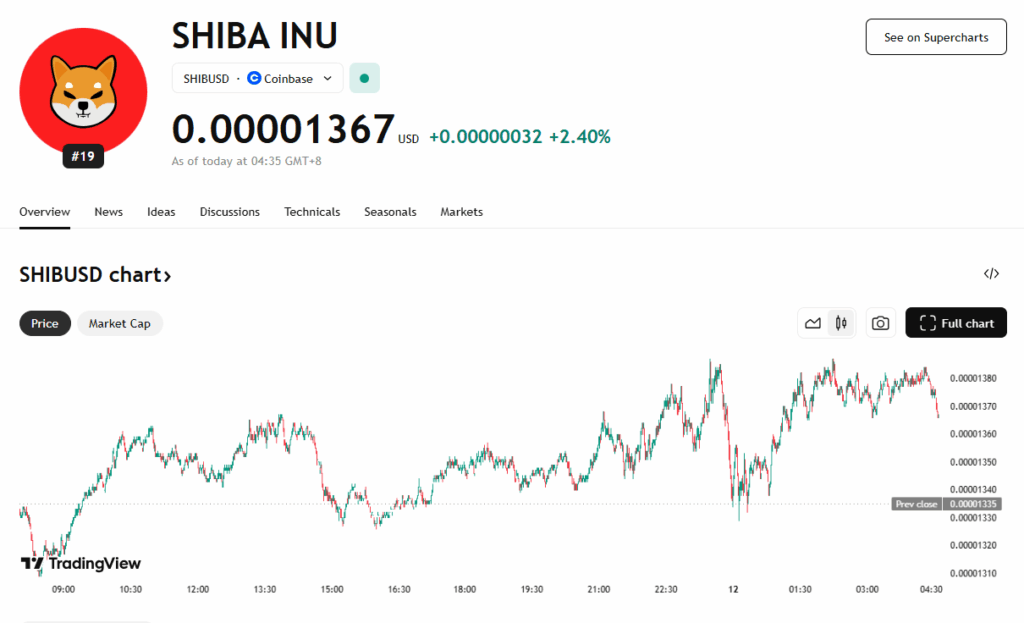

Bitcoin’s explosive climb to a new all-time high of $116,818 on July 11 has triggered a full-blown rally across the crypto market—and Shiba Inu (SHIB) is riding the wave. The popular dog-themed token is up 9.1% today, with weekly gains of 15.5% and a strong 20.3% rise over the last 14 days. Even its monthly numbers are turning green, up 2.6%. But zoom out, and SHIB is still down 17.3% on the year.

So the big question now—can SHIB reclaim the $0.00002 level, and if so, how soon?

Momentum Builds As SHIB Follows Bitcoin’s Lead

SHIB hasn’t touched $0.00002 since January 2025, and it last peaked at $0.00003 back in December 2024. Since then, the token’s price has seen a slow fade—until now. Bitcoin’s breakout appears to have injected new life into SHIB’s trajectory.

Institutional money is once again flowing into crypto. Over 21 companies have announced plans to add a combined $3.5 billion into BTC treasuries, and that kind of buying power has a ripple effect. With Bitcoin leading the charge, altcoins like SHIB often follow suit—and that’s exactly what we’re seeing.

Can SHIB Push Past Resistance?

According to recent data, SHIB may face some friction around the $0.000014 level. That’s a critical resistance zone. If the token can break through cleanly, momentum could carry it back to the elusive $0.00002 mark.

But the road isn’t guaranteed. Much will depend on continued strength from BTC and broader market sentiment. A pullback from Bitcoin or macro market jitters could slow things down fast.

What to Watch: Rate Cuts and Halving Cycles

Looking ahead, two big factors could shape SHIB’s path. First—the Federal Reserve. If rate cuts come through later this year, that could trigger renewed interest in risk-on assets like crypto. That’s a setup SHIB could thrive in.

Second—the looming possibility of a market correction around September or October. Historically, post-halving price action has included sharp but temporary pullbacks. If that pattern repeats, SHIB’s momentum could stall before another leg up.